Kinnevik Results Presentation Deck

Intro

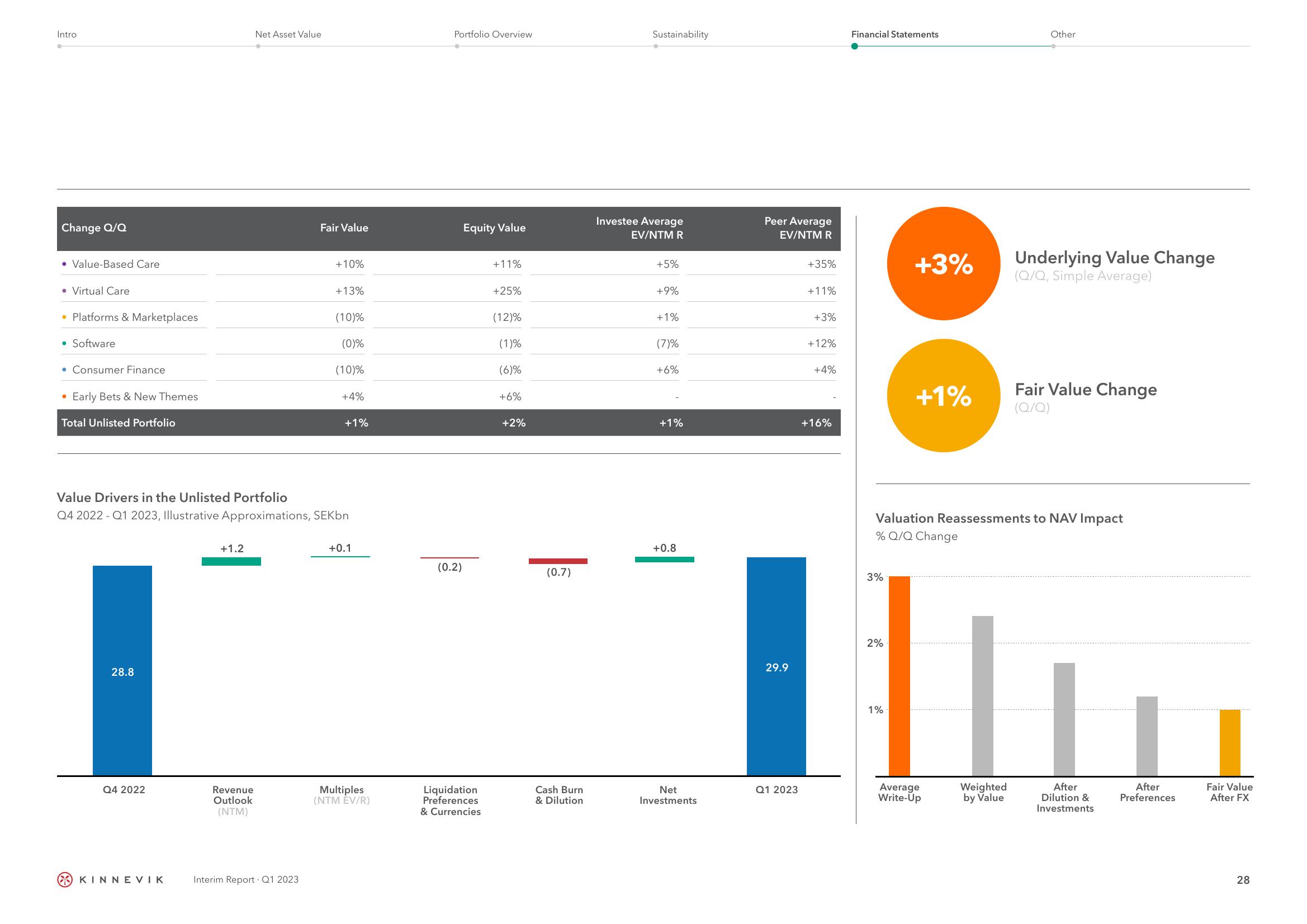

Change Q/Q

• Value-Based Care

• Virtual Care

• Platforms & Marketplaces

• Software

• Consumer Finance

• Early Bets & New Themes

Total Unlisted Portfolio

28.8

Q4 2022

KINNEVIK

+1.2

Net Asset Value

Revenue

Outlook

(NTM)

Fair Value

Value Drivers in the Unlisted Portfolio

Q4 2022-Q1 2023, Illustrative Approximations, SEKbn

Interim Report Q1 2023

+10%

+13%

(10)%

(0)%

(10)%

+4%

+1%

+0.1

Multiples

(NTM EV/R)

Portfolio Overview

(0.2)

Equity Value

Liquidation

Preferences

& Currencies

+11%

+25%

(12)%

(1)%

(6)%

+6%

+2%

(0.7)

Cash Burn

& Dilution

Sustainability

Investee Average

EV/NTM R

+5%

+9%

+1%

(7)%

+6%

+1%

+0.8

Net

Investments

Peer Average

EV/NTM R

29.9

Q1 2023

+35%

+11%

+3%

+12%

+4%

+16%

Financial Statements

3%

2%

+3%

1%

+1%

Valuation Reassessments to NAV Impact

% Q/Q Change

Average

Write-Up

Other

Weighted

by Value

Underlying Value Change

(Q/Q, Simple Average)

Fair Value Change

(Q/Q)

After

Dilution &

Investments

After

Preferences

Fair Value

After FX

28View entire presentation