Bed Bath & Beyond Results Presentation Deck

APPENDIX

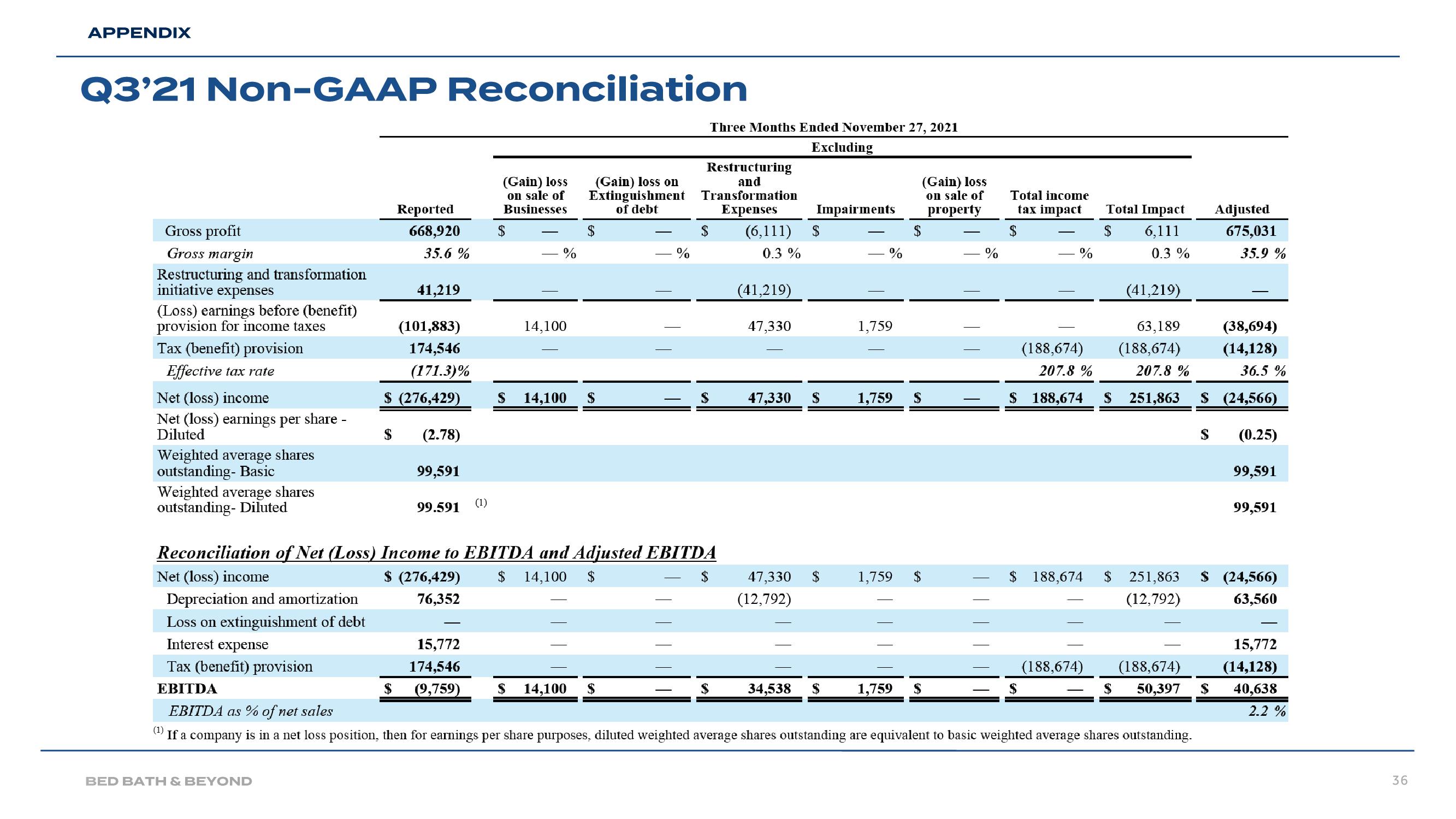

Q3'21 Non-GAAP Reconciliation

Gross profit

Gross margin

Restructuring and transformation

initiative expenses

(Loss) earnings before (benefit)

provision for income taxes

Tax (benefit) provision

Effective tax rate

Net (loss) income

Net (loss) earnings per share -

Diluted

Weighted average shares

outstanding- Basic

Weighted average shares

outstanding- Diluted

Net (loss) income

Depreciation and amortization

Loss on extinguishment of debt

Interest expense

Tax (benefit) provision

EBITDA

(1)

If a company

$

BED BATH & BEYOND

Reported

668,920

35.6 %

$ (276,429)

$

41,219

(101,883)

174,546

(171.3)%

(2.78)

99,591

99.591 (1)

(Gain) loss

on sale of

Businesses

15,772

174,546

(9,759)

$

%

14,100

(Gain) loss on

Extinguishment

of debt

$

Reconciliation of Net (Loss) Income to EBITDA and Adjusted EBITDA

$ (276,429) $ 14,100 $

$

76,352

$ 14,100 $

%

$ 14,100 S

$

Three Months Ended November 27, 2021

Restructuring

and

Transformation

Expenses

(6,111) $

0.3 %

$

$

(41,219)

Excluding

47,330

Impairments

47,330 $

47,330 $

(12,792)

34,538 $

%

1,759

$

(Gain) loss

on sale of

property

1,759 $

1,759

1,759 $

S

%

Total income

tax impact

$

Total Impact

$

6,111

0.3 %

(41,219)

63,189

(188,674) (188,674)

207.8 %

207.8 %

$ 188,674 $ 251,863

%

$ 188,674

$

(188,674)

$ 251,863

(12,792)

EBITDA as % of net sales

is in a net loss position, then for earnings per share purposes, diluted weighted average shares outstanding are equivalent to basic weighted average shares outstanding.

$

Adjusted

(188,674)

$ 50,397 $

675,031

35.9 %

36.5%

$ (24,566)

(38,694)

(14,128)

(0.25)

99,591

99,591

$ (24,566)

63,560

15,772

(14,128)

40,638

2.2 %

36View entire presentation