Deutsche Bank Fixed Income Presentation Deck

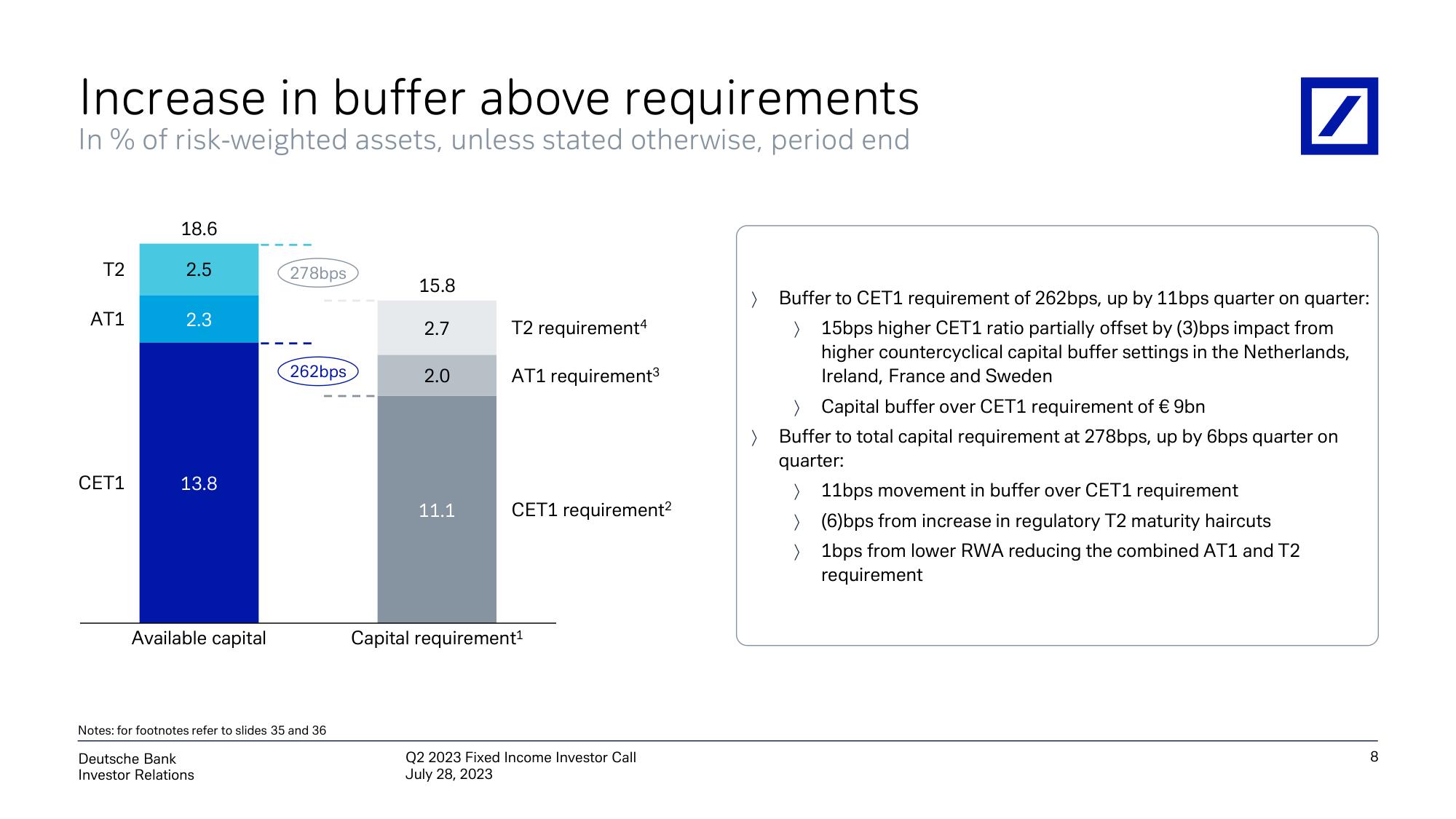

Increase in buffer above requirements

In % of risk-weighted assets, unless stated otherwise, period end

T2

AT1

CET1

18.6

2.5

2.3

13.8

Available capital

278bps

262bps

Notes: for footnotes refer to slides 35 and 36

Deutsche Bank

Investor Relations

15.8

2.7

2.0

11.1

T2 requirement4

AT1 requirement³

CET1 requirement²

Capital requirement¹

Q2 2023 Fixed Income Investor Call

July 28, 2023

/

> Buffer to CET1 requirement of 262bps, up by 11bps quarter on quarter:

> 15bps higher CET1 ratio partially offset by (3)bps impact from

higher countercyclical capital buffer settings in the Netherlands,

Ireland, France and Sweden

> Capital buffer over CET1 requirement of € 9bn

> Buffer to total capital requirement at 278bps, up by 6bps quarter on

quarter:

> 11bps movement in buffer over CET1 requirement

> (6)bps from increase in regulatory T2 maturity haircuts

1bps from lower RWA reducing the combined AT1 and T2

requirement

>

8View entire presentation