CorpAcq SPAC Presentation Deck

10

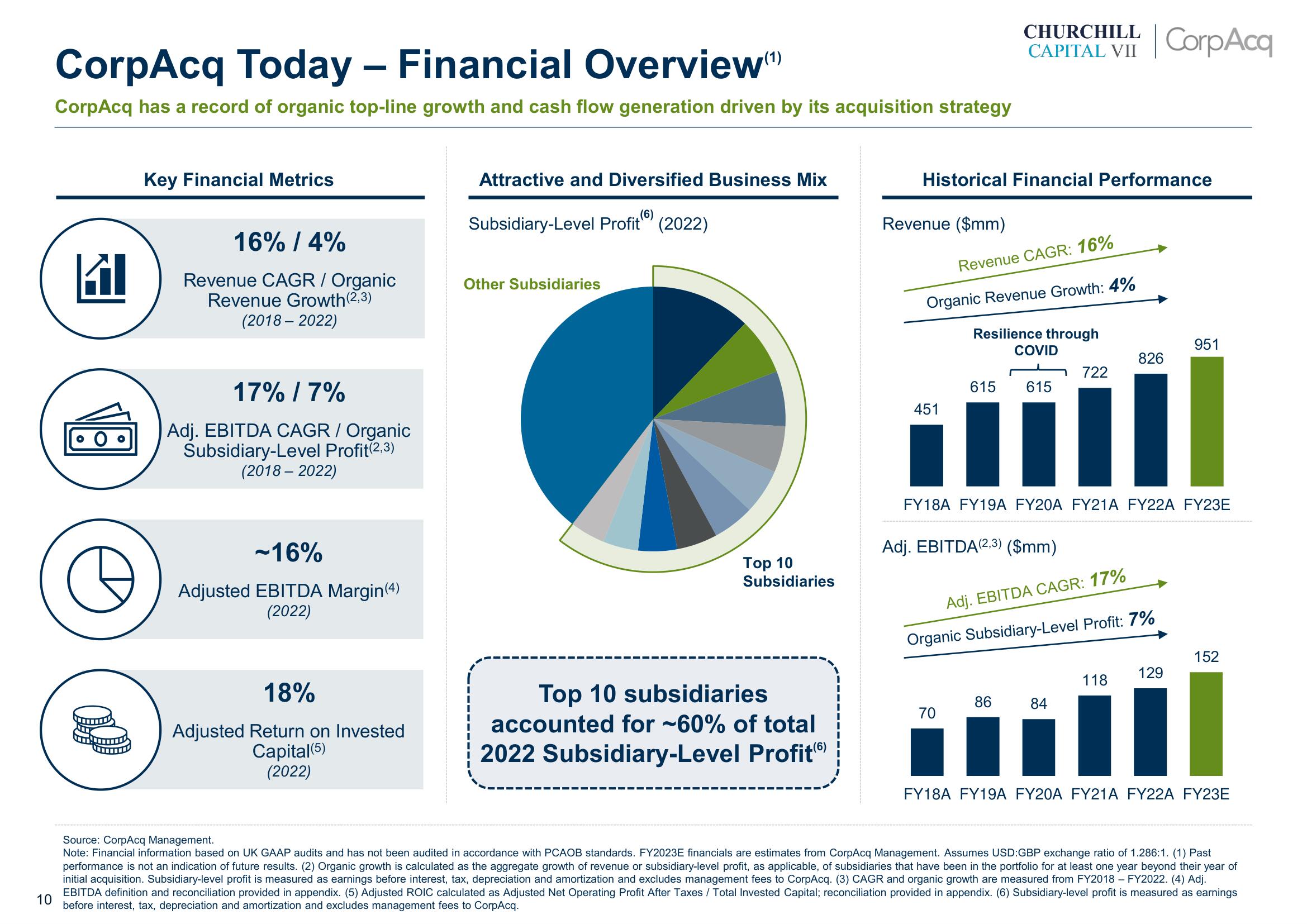

CorpAcq Today - Financial Overview

CorpAcq has a record of organic top-line growth and cash flow generation driven by its acquisition strategy

KI

Q

Key Financial Metrics

16% / 4%

Revenue CAGR / Organic

Revenue Growth (2,3)

(2018-2022)

17% / 7%

Adj. EBITDA CAGR / Organic

Subsidiary-Level Profit(2,3)

(2018 - 2022)

-16%

Adjusted EBITDA Margin(4)

(2022)

18%

Adjusted Return on Invested

Capital (5)

(2022)

Attractive and Diversified Business Mix

(6)

Subsidiary-Level Profit (2022)

Other Subsidiaries

Top 10

Subsidiaries

Top 10 subsidiaries

accounted for ~60% of total

2022 Subsidiary-Level Profit)

Historical Financial Performance

Revenue ($mm)

Organic Revenue Growth: 4%

Resilience through

451

CHURCHILL

CAPITAL VII CorpAcq

Revenue CAGR: 16%

615

70

COVID

Adj. EBITDA (2,3) ($mm)

615

11

FY18A FY19A FY20A FY21A FY22A FY23E

86

722

826

Adj. EBITDA CAGR: 17%

Organic Subsidiary-Level Profit: 7%

951

129

118

152

84

i

FY18A FY19A FY20A FY21A FY22A FY23E

Source: CorpAcq Management.

Note: Financial information based on UK GAAP audits and has not been audited in accordance with PCAOB standards. FY2023E financials are estimates from CorpAcq Management. Assumes USD:GBP exchange ratio of 1.286:1. (1) Past

performance is not an indication of future results. (2) Organic growth is calculated as the aggregate growth of revenue or subsidiary-level profit, as applicable, of subsidiaries that have been in the portfolio for at least one year beyond their year of

initial acquisition. Subsidiary-level profit is measured as earnings before interest, tax, depreciation and amortization and excludes management fees to CorpAcq. (3) CAGR and organic growth are measured from FY2018 - FY2022. (4) Adj.

EBITDA definition and reconciliation provided in appendix. (5) Adjusted ROIC calculated as Adjusted Net Operating Profit After Taxes / Total Invested Capital; reconciliation provided in appendix. (6) Subsidiary-level profit is measured as earnings

before interest, tax, depreciation and amortization and excludes management fees to CorpAcq.View entire presentation