Bank of America Investment Banking Pitch Book

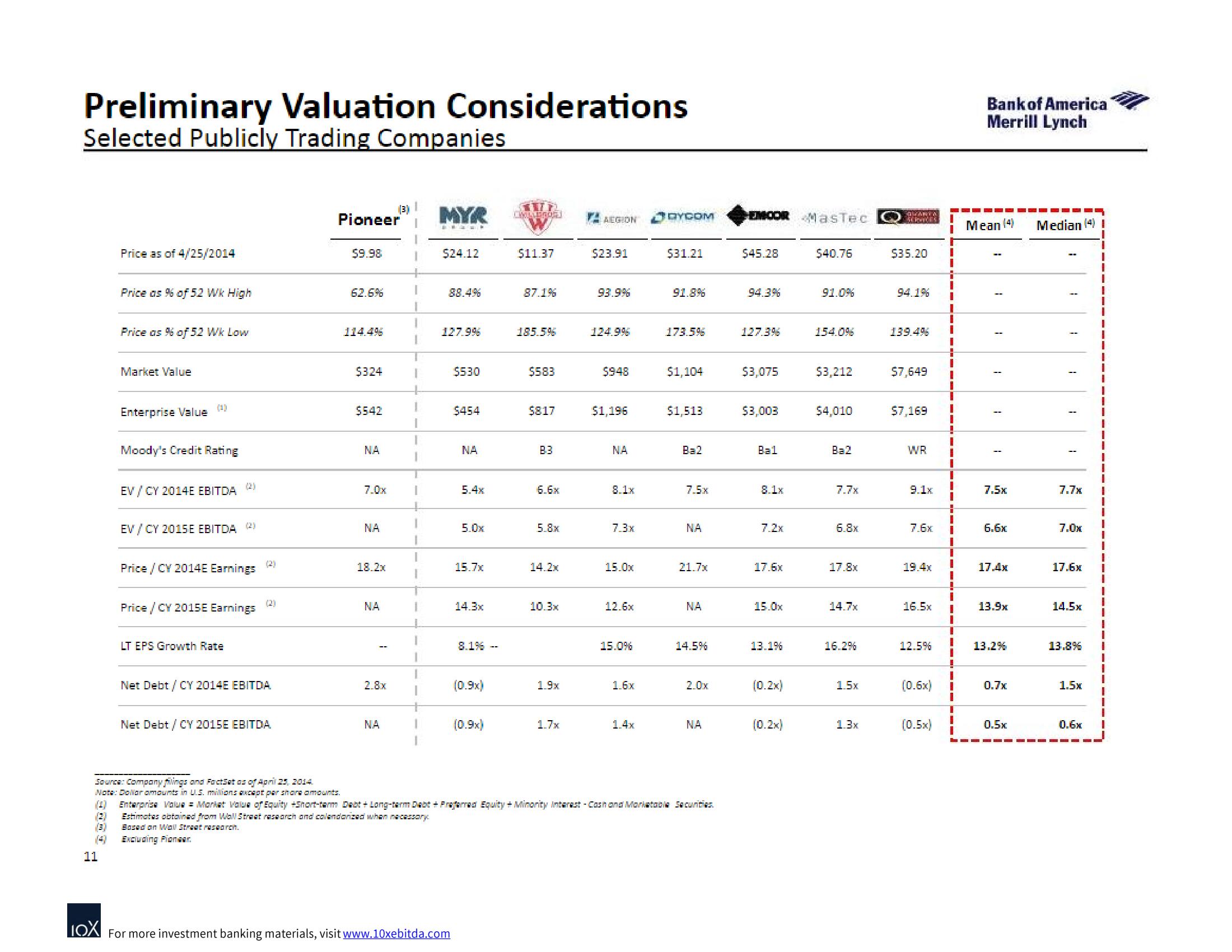

Preliminary Valuation Considerations

Selected Publicly Trading Companies

(3)

(3)

Price as of 4/25/2014

11

Price as % of 52 Wk High

Price as % of 5.2 Wk Low

Market Value

Enterprise Value

Moody's Credit Rating

EV/CY 2014E EBITDA

EV/CY 2015E EBITDA (2)

Price / CY 2014E Earnings

Price / CY 2015E Earnings

LT EPS Growth Rate

(2)

(2)

Net Debt / CY 2014E EBITDA

Net Debt / CY 2015E EBITDA

Source: Company filings and FactSet as of April 25, 2014.

Note: Dollar amounts in U.S. milions capt per share amounts.

Pioneer

$9.98

62.6%

114.4%

$324

$542

ΝΑ

7.0x

NA

18.2x

NA

2.8x

(3) 1

1

NA

MYK

CHAU

$24.12

88.4%

127.9%

$530

LOX For more investment banking materials, visit www.10xebitda.com

$454

NA

5.4x

5.0x

15.7x

14.3x

8.1% --

(0.9x)

(0.9x)

U

CMILGROE

$11.37

87.1%

185.5%

$583

$817

83

5.8x

14.2x

10.3x

1.9x

1.7x

KO

AEGIONY.COM

$23.91

93.9%

124.9%

$948

$1,196

NA

8.1x

7.3x

15.0x

12.6x

15.0%

1.6x

1.4x

$31.21

91.8%

173.5%

$1,104

$1,513

Ba2

7.5x

NA

21.7x

ΝΑ

14.5%

2.0x

ΝΑ

Enterprise Value = Market Value of Equity +Short-term Dabt +Long-term Debt + Preferred Equity + Minority Interest-Cash and Morlatable Securities.

Estimates obtained from Wall Straat rasearch and calendarized when necessary

Based on Wall Streat research.

Excluding Pioneer.

EMCOR MasTec

$45.28

94.3%

127.3%

$3,075

$3,003

Bal

8.1x

7.2x

17.6x

15.0x

13.1%

(0.2x)

(0.2x)

$40.76

91.0%

154.0%

$3,212

$4,010

Ba2

7.7x

6.8x

17.8x

14.7x

16.2%

1.5x

1.3x

OLANTA

dentis

$35.20

94.1%

139.4%

$7,649

$7,169

WR

9.1

7.6x

19.4x

16.5x

12.5%

1

(0.5x)

1

1

H

1

1

1

1

I

1

1

1

I

1

1

1

H

I

1

1

1

1

H

1

I

1

1

I

!

1

I

I

I

1

4

1

(0.6x) 1

1

11

I

1

P

Bank of America

Merrill Lynch

Mean (4)

1

1

6.6x

17.4x

13.9x

13.2%

0.7x

0.5x

Median (4) I

1

1

1

7.0x

17.6x

14.Ex

13.8%

7.7x 1

1

1

1.5x

1

0.6x

T

1

1

1

I

1

1

1

1

1

1

1

1

I

I

|

1

1

1

I

1

1

1

1View entire presentation