Sonder Investor Presentation Deck

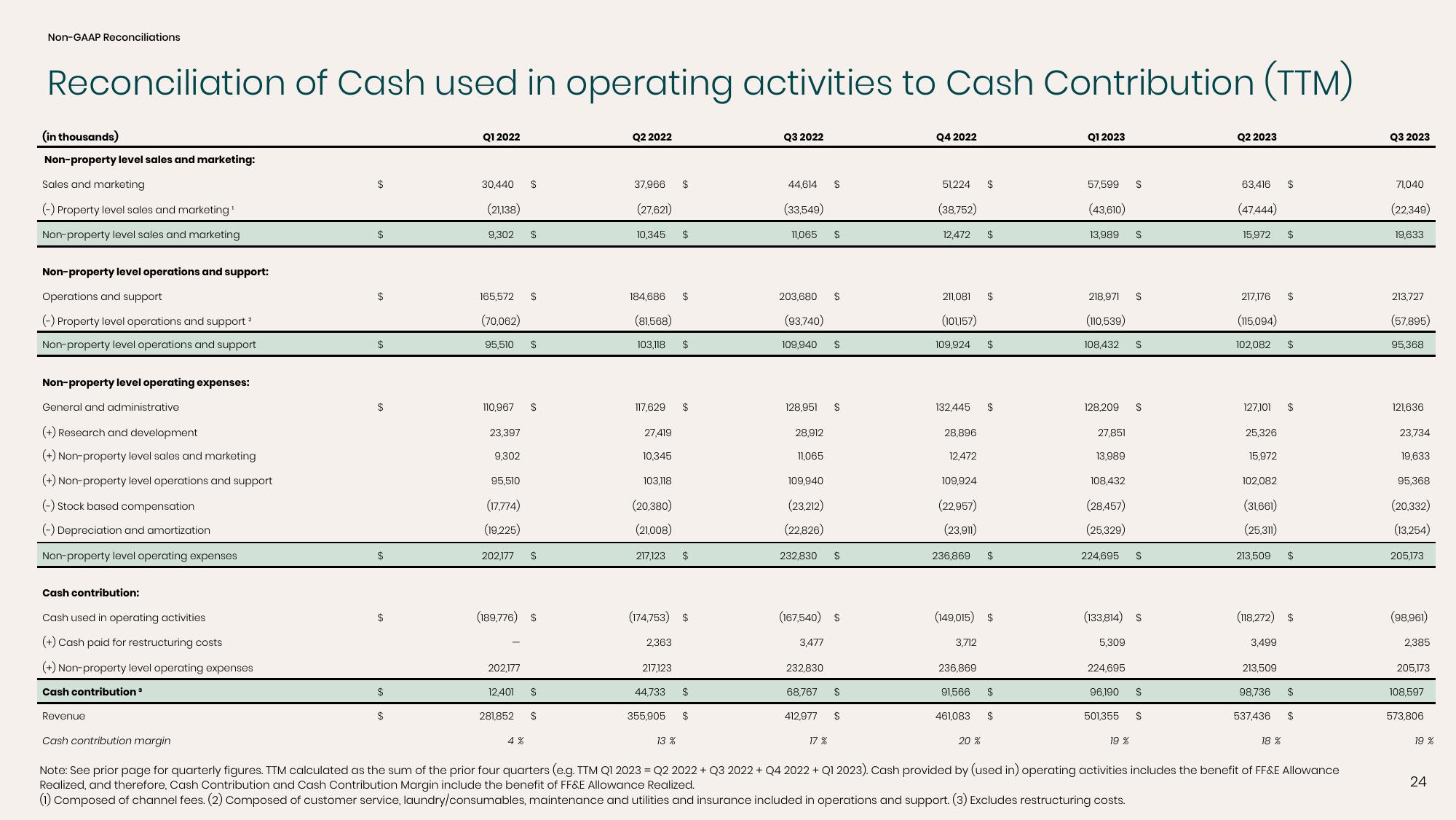

Non-GAAP Reconciliations

Reconciliation of Cash used in operating activities to Cash Contribution (TTM)

(in thousands)

Non-property level sales and marketing:

Sales and marketing

(-) Property level sales and marketing¹

Non-property level sales and marketing

Non-property level operations and support:

Operations and support

(-) Property level operations and support ²

Non-property level operations and support

Non-property level operating expenses:

General and administrative

(+) Research and development

(+) Non-property level sales and marketing

(+) Non-property level operations and support

(-) Stock based compensation

(-) Depreciation and amortization

Non-property level operating expenses

Cash contribution:

Cash used in operating activities

(+) Cash paid for restructuring costs

(+) Non-property level operating expenses

Cash contribution ³

Revenue

Cash contribution margin

$

$

$

$

$

$

$

$

$

Q1 2022

30,440

(21,138)

9,302

165,572

110,967

23,397

(70,062)

95,510 S

9,302

202,177

S

12,401

S

95,510

(17,774)

(19,225)

202,177 S

281,852

S

(189,776) S

4%

S

S

S

Q2 2022

37,966

(27,621)

10,345

184,686

(81,568)

103,118

117,629

27,419

10,345

103,118

(20,380)

(21,008)

217,123

2,363

217,123

44,733

355.905

$

13 %

$

(174,753) $

$

$

$

$

$

$

Q3 2022

44,614

(33,549)

11,065

109,940

203,680 $

(93,740)

128,951

28,912

11,065

109,940

(23,212)

(22,826)

232,830

3,477

232,830

$

68,767

412,977

$

17%

(167,540) $

$

$

$

$

$

Q4 2022

51,224 $

(38,752)

12,472

211,081

(101,157)

109,924

28,896

12,472

132,445 $

109,924

(22,957)

(23,911)

236,869

3,712

236,869

91,566

$

(149,015) $

461,083

$

20 %

$

$

$

$

Q1 2023

57,599

(43,610)

13,989

218,971

(110,539)

108,432

128,209

27,851

13,989

108,432

(28,457)

(25,329)

224,695

5,309

224,695

96.190

$

$

19 %

$

(133,814) $

$

$

$

$

501,355 $

Q2 2023

63,416

(47,444)

15,972 $

217,176

(115,094)

102,082

127,101

25,326

15,972

3,499

213,509

$

102,082

(31,661)

(25,311)

213,509 $

98,736

(118,272) $

537,436

$

18%

$

$

$

$

Note: See prior page for quarterly figures. TTM calculated as the sum of the prior four quarters (e.g. TTM Q1 2023 = Q2 2022 + Q3 2022 + Q4 2022 + Q1 2023). Cash provided by (used in) operating activities includes the benefit of FF&E Allowance

Realized, and therefore, Cash Contribution and Cash Contribution Margin include the benefit of FF&E Allowance Realized.

(1) Composed of channel fees. (2) Composed of customer service, laundry/consumables, maintenance and utilities and insurance included in operations and support. (3) Excludes restructuring costs.

Q3 2023

71,040

(22,349)

19,633

213,727

(57,895)

95,368

121,636

23,734

19,633

95,368

(20,332)

(13,254)

205,173

(98,961)

2,385

205,173

108,597

573,806

19%

24View entire presentation