Summit Hotel Properties Investor Presentation Deck

21

Glamping Investment Rationale

Strategic Rationale

Glamping segment positions Summit to benefit from emerging guest preferences

towards experiential travel and non-traditional accommodation types

Highly compelling unit economics

●

.

Generate in place yields and unlevered IRR profiles that are 400-600 bps and

500 - 1,000 bps higher than traditional lodging investments, respectively

Labor-light/highly efficient operating model is a natural extension of Summit's core

business of owning high-quality hotels with a predominately rooms-based revenue

model

●

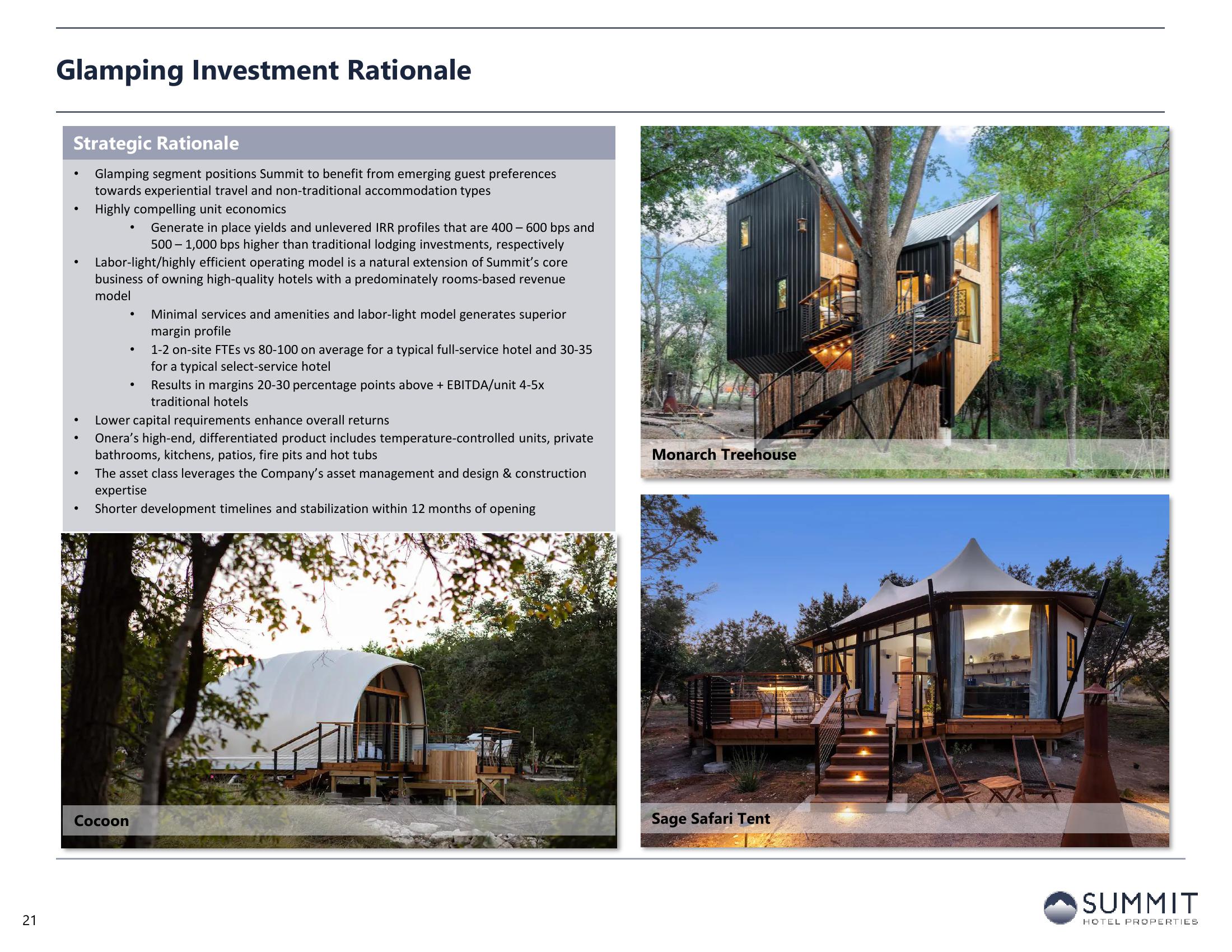

Cocoon

.

.

Minimal services and amenities and labor-light model generates superior

margin profile

1-2 on-site FTEs vs 80-100 on average for a typical full-service hotel and 30-35

for a typical select-service hotel

Results in margins 20-30 percentage points above + EBITDA/unit 4-5x

traditional hotels

Lower capital requirements enhance overall returns

Onera's high-end, differentiated product includes temperature-controlled units, private

bathrooms, kitchens, patios, fire pits and hot tubs

The asset class leverages the Company's asset management and design & construction

expertise

Shorter development timelines and stabilization within 12 months of opening

Monarch Treehouse

Sage Safari Tent

SUMMIT

HOTEL PROPERTIESView entire presentation