Evercore Investment Banking Pitch Book

Preliminary Valuation Detail - SIRE Financial Projections

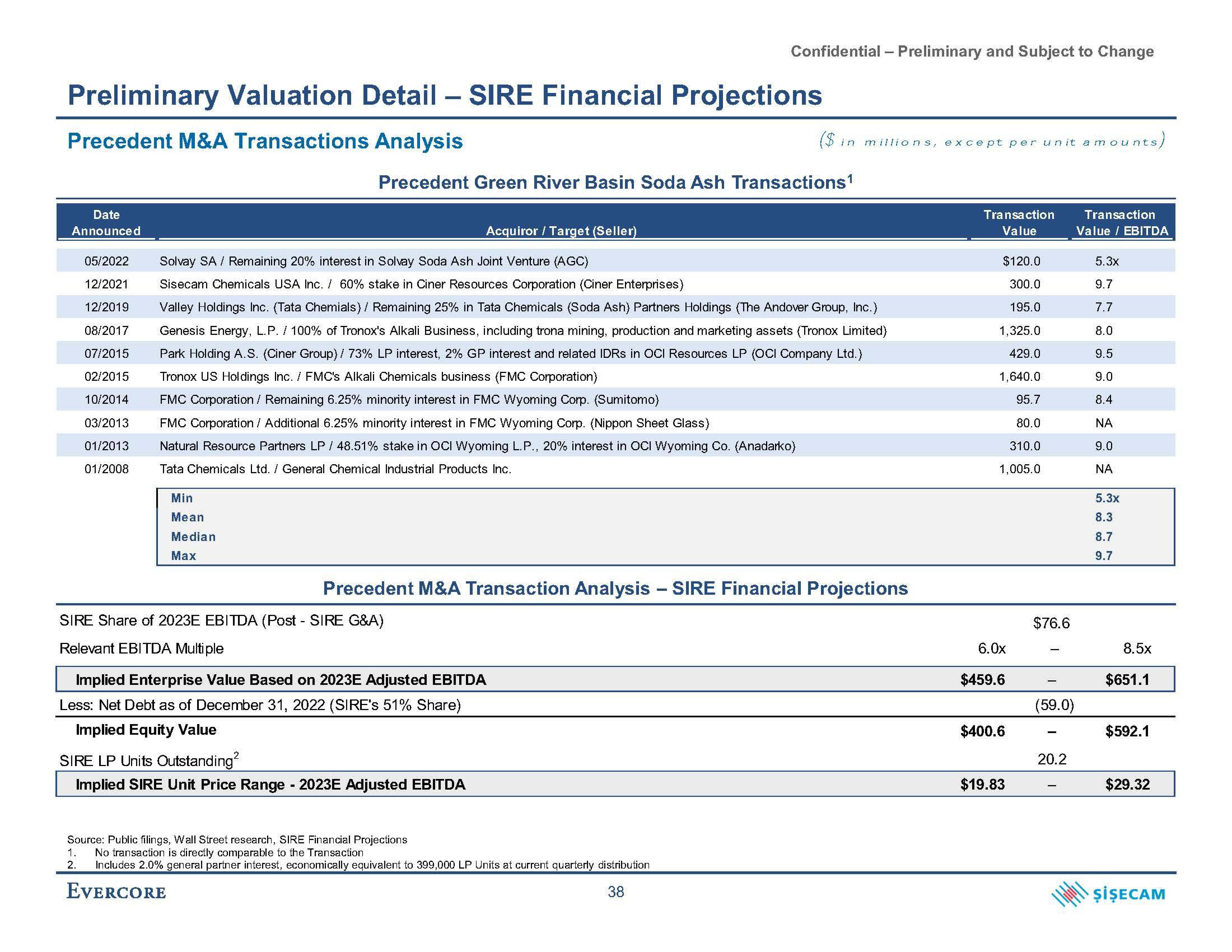

Precedent M&A Transactions Analysis

Date

Announced

Min

Mean

Median

Max

Precedent Green River Basin Soda Ash Transactions¹

Acquiror / Target (Seller)

ises)

05/2022 Solvay SA / Remaining 20% interest in Solvay Soda Ash Joint Venture (AGC)

12/2021 Sisecam Chemicals USA Inc. / 60% stake in Ciner Resources orporation (Ciner

12/2019 Valley Holdings Inc. (Tata Chemials) / Remaining 25% in Tata Chemicals (Soda Ash) Partners Holdings (The Andover Group, Inc.)

08/2017 Genesis Energy, L.P. / 100% of Tronox's Alkali Business, including trona mining, production and marketing assets (Tronox Limited)

07/2015 Park Holding A.S. (Ciner Group) / 73% LP interest, 2% GP interest and related IDRs in OCI Resources LP (OCI Company Ltd.)

Tronox US Holdings Inc. / FMC's Alkali Chemicals business (FMC Corporation)

02/2015

10/2014

FMC Corporation / Remaining 6.25% minority interest in FMC Wyoming Corp. (Sumitomo)

03/2013

FMC Corporation / Additional 6.25% minority interest in FMC Wyoming Corp. (Nippon Sheet Glass)

01/2013

Natural Resource Partners LP / 48.51% stake in OCI Wyoming L.P., 20% interest in OCI Wyoming Co. (Anadarko)

Tata Chemicals Ltd. / General Chemical Industrial Products Inc.

01/2008

Confidential - Preliminary and Subject to Change

SIRE Share of 2023E EBITDA (Post - SIRE G&A)

Relevant EBITDA Multiple

Precedent M&A Transaction Analysis - SIRE Financial Projections

Implied Enterprise Value Based on 2023E Adjusted EBITDA

Less: Net Debt as of December 31, 2022 (SIRE's 51% Share)

Implied Equity Value

($ in millions, except per unit amounts,

SIRE LP Units Outstanding²

Implied SIRE Unit Price Range - 2023E Adjusted EBITDA

Source: Public filings, Wall Street research, SIRE Financial Projections

1. No transaction is directly comparable to the Transaction

2.

Includes 2.0% general partner interest, economically equivalent to 399,000 LP Units at current quarterly distribution

EVERCORE

38

Transaction

Value

$120.0

300.0

195.0

1,325.0

429.0

1,640.0

95.7

80.0

310.0

1,005.0

6.0x

$459.6

$400.6

$19.83

$76.6

(59.0)

20.2

Transaction

Value / EBITDA

5.3x

9.7

7.7

8.0

9.5

9.0

8.4

ΝΑ

9.0

ΝΑ

5.3x

8.3

8.7

9.7

8.5x

$651.1

$592.1

$29.32

ŞİŞECAMView entire presentation