Citi Investment Banking Pitch Book

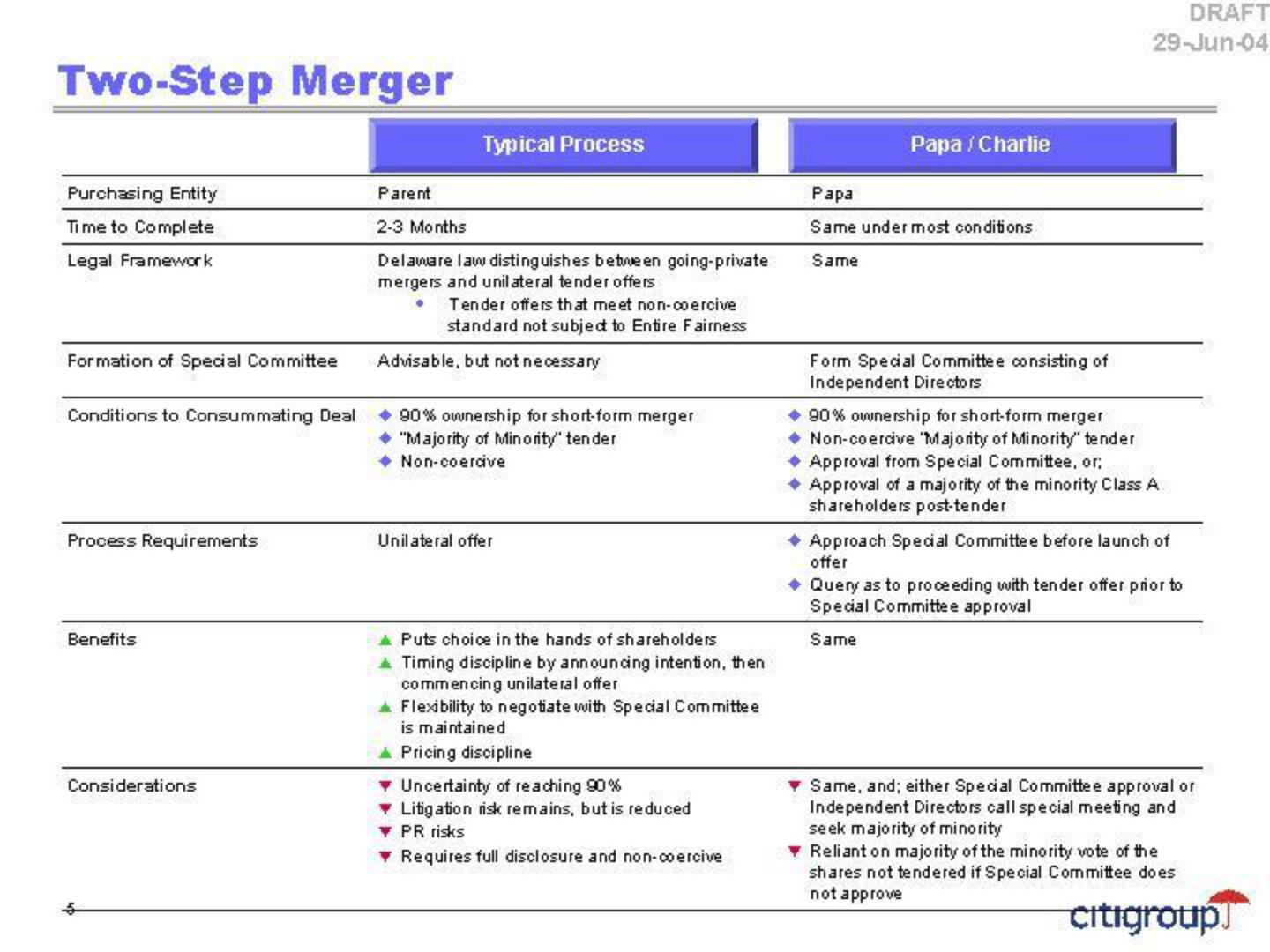

Two-Step Merger

Purchasing Entity

Time to Complete

Legal Framework

Formation of Special Committee

Conditions to Consummating Deal

Process Requirements

Benefits

Considerations

Parent

2-3 Months

Typical Process

Delaware law distinguishes between going-private

mergers and unilateral tender offers

Tender offers that meet non-coercive

standard not subject to Entire Fairness

Advisable, but not necessary

◆ 90% ownership for short-form merger

"Majority of Minority" tender

◆ Non-coercive

Unilateral offer

Puts choice in the hands of shareholders

Timing discipline by announcing intention, then

commencing unilateral offer

Flexibility to negotiate with Special Committee

is maintained

▲ Pricing discipline

▾ Uncertainty of reaching 90%

▾ Litigation risk remains, but is reduced

PR risks

Requires full disclosure and non-coercive

Papa / Charlie

Papa

Same under most conditions

Same

Form Special Committee consisting of

Independent Directors

DRAFT

29-Jun-04

◆ 90% ownership for short-form merger

Non-coercive 'Majority of Minority" tender

◆ Approval from Special Committee, or;

◆ Approval of a majority of the minority Class A

shareholders post-tender

◆ Approach Special Committee before launch of

offer

◆ Query as to proceeding with tender offer prior to

Special Committee approval

Same

▾ Same, and; either Special Committee approval or

Independent Directors call special meeting and

seek majority of minority

▾ Reliant on majority of the minority vote of the

shares not tendered if Special Committee does

not approve

CitigroupView entire presentation