Netstreit IPO Presentation Deck

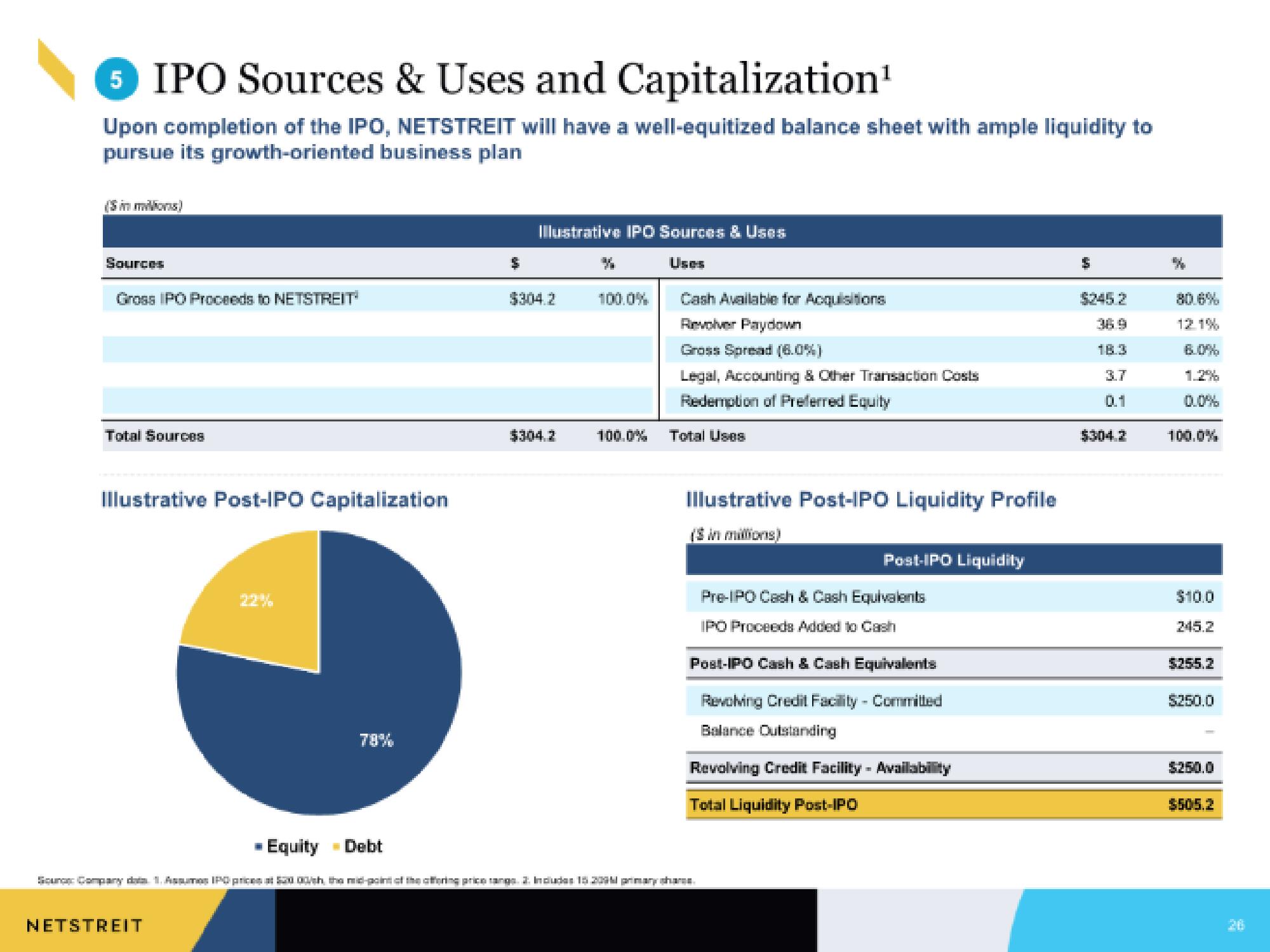

5 IPO Sources & Uses and Capitalization¹

Upon completion of the IPO, NETSTREIT will have a well-equitized balance sheet with ample liquidity to

pursue its growth-oriented business plan

(5 in milions)

Sources

Gross IPO Proceeds to NETSTREITÄ

Total Sources

Illustrative Post-IPO Capitalization

Equity

NETSTREIT

78%

Debt

$

Illustrative IPO Sources & Uses

Uses

$304.2

$304.2

%

100.0%

Cash Available for Acquisitions

Revolver Paydown

Gross Spread (6.0%)

Legal, Accounting & Other Transaction Costs

Redemption of Preferred Equity

100.0% Total Uses

Illustrative Post-IPO Liquidity Profile

($ in millions)

Source Company data 1. Aspumos IPO prices at 5000/sh, the mid-point of the offering price rango. 3. Includes 15 209 primary pharma.

Post-IPO Liquidity

Pre-IPO Cash & Cash Equivalents

IPO Proceeds Added to Cash

Post-IPO Cash & Cash Equivalents

Revolving Credit Facility - Committed

Balance Outstanding

Revolving Credit Facility - Availability

Total Liquidity Post-IPO

S

36.9

18.3

3.7

0.1

$304.2

%

12.1%

6.0%

1.2%

0.0%

100.0%

$10.0

245.2

$255.2

$250.0

$250.0

$505.2View entire presentation