Silicon Valley Bank Results Presentation Deck

Focus Area: Reducing interest rate

sensitivity 10f1

of

What we're doing

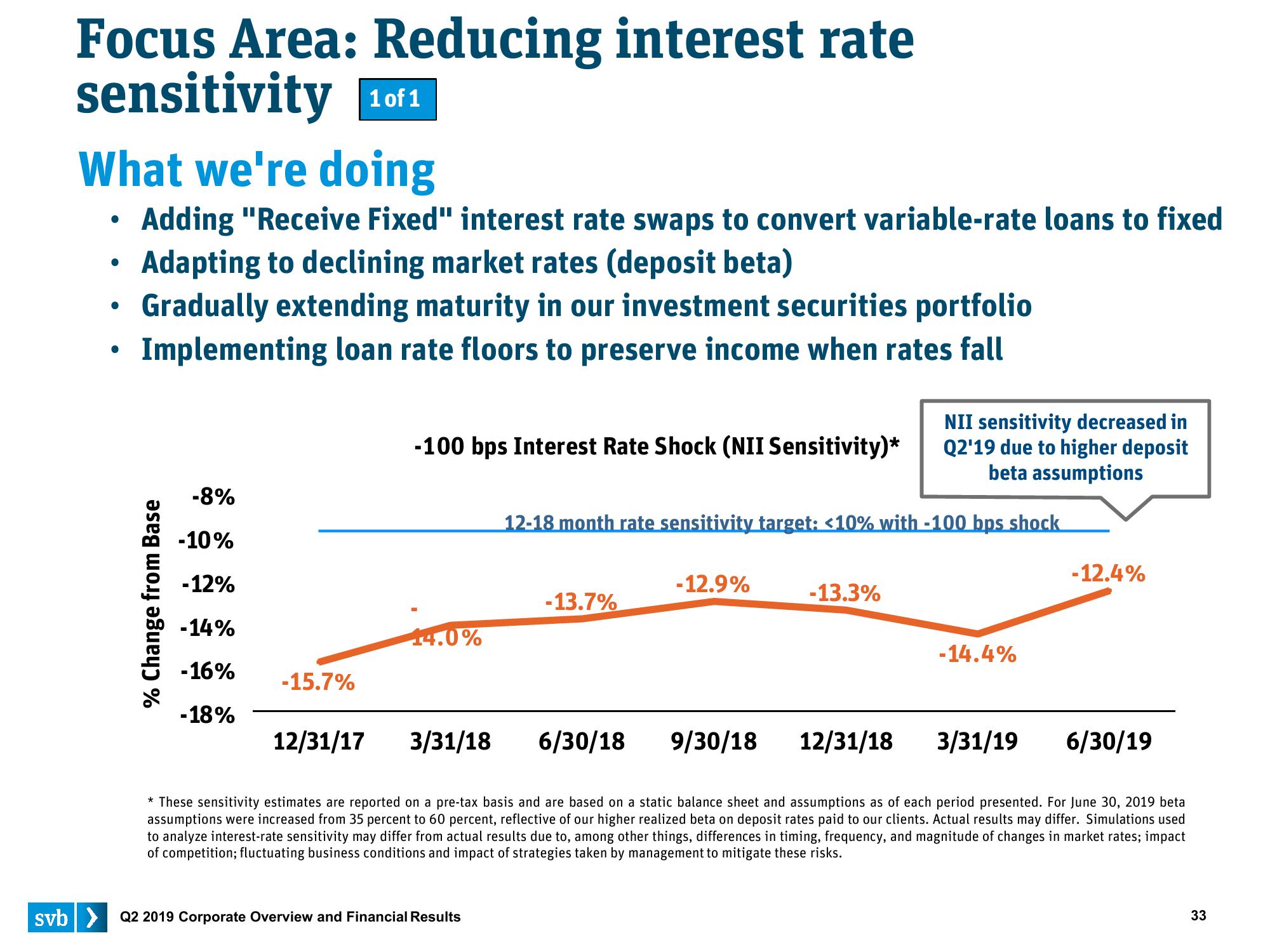

Adding "Receive Fixed" interest rate swaps to convert variable-rate loans to fixed

Adapting to declining market rates (deposit beta)

Gradually extending maturity in our investment securities portfolio

Implementing loan rate floors to preserve income when rates fall

●

●

●

% Change from Base

-8%

-10%

-12%

-14%

-16%

-18%

-15.7%

-100 bps Interest Rate Shock (NII Sensitivity)*

12/31/17

14.0%

svb> Q2 2019 Corporate Overview and Financial Results

12-18 month rate sensitivity target: <10% with -100 bps shock

-13.7%

-12.9%

6/30/18

-13.3%

9/30/18

3/31/18

6/30/19

* These sensitivity estimates are reported on a pre-tax basis and are based on a static balance sheet and assumptions as of each period presented. For June 30, 2019 beta

assumptions were increased from 35 percent to 60 percent, reflective of our higher realized beta on deposit rates paid to our clients. Actual results may differ. Simulations used

to analyze interest-rate sensitivity may differ from actual results due to, among other things, differences in timing, frequency, and magnitude of changes in market rates; impact

of competition; fluctuating business conditions and impact of strategies taken by management to mitigate these risks.

NII sensitivity decreased in

Q2'19 due to higher deposit

beta assumptions

12/31/18

-14.4%

-12.4%

3/31/19

33View entire presentation