Azure Power Investor Presentation

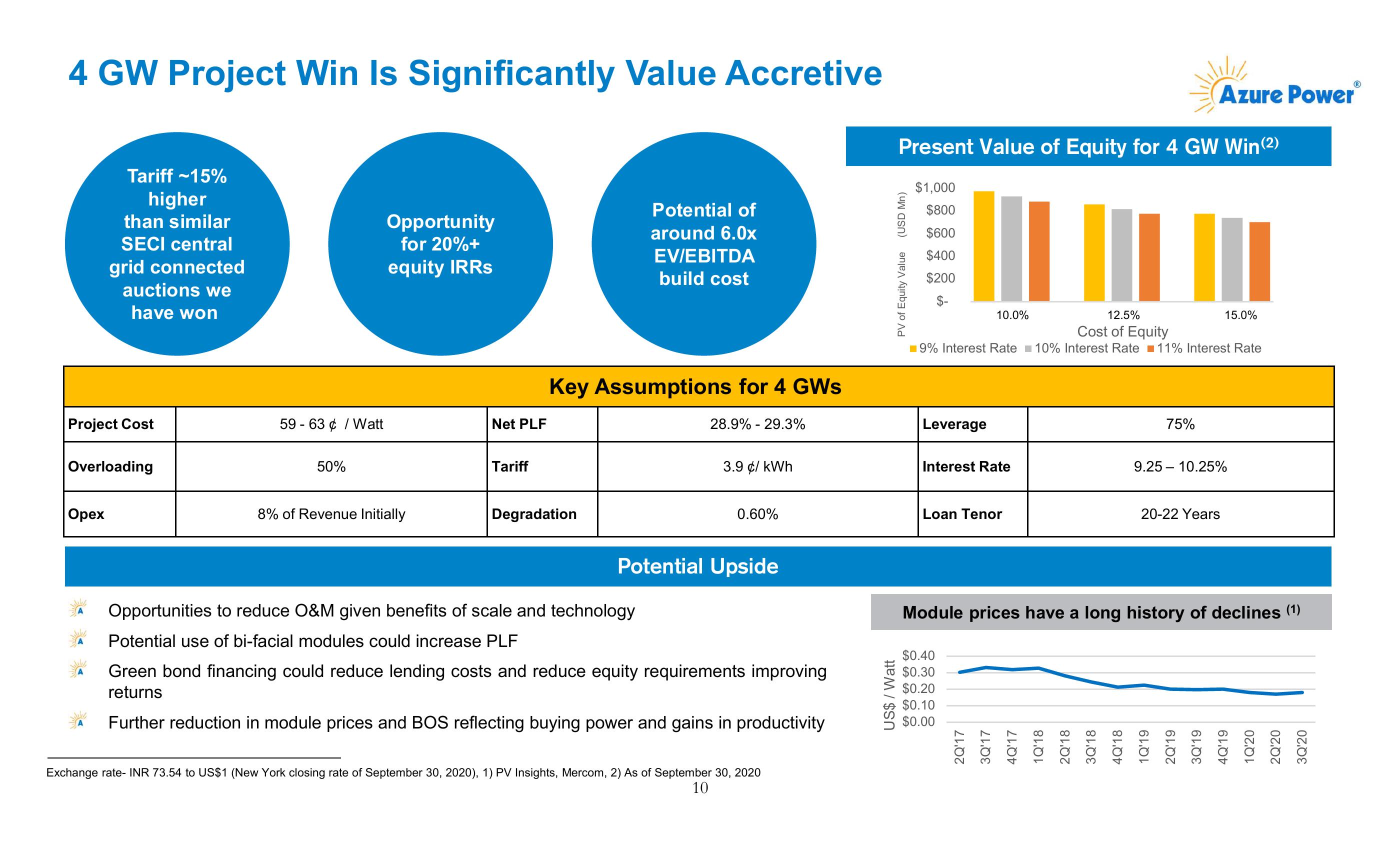

4 GW Project Win Is Significantly Value Accretive

Tariff ~15%

higher

than similar

SECI central

grid connected

auctions we

have won

Opportunity

for 20%+

equity IRRS

Potential of

around 6.0x

EV/EBITDA

build cost

Azure Power

Present Value of Equity for 4 GW Win (2)

PV of Equity Value

(USD Mn)

$1,000

$800

$600

$400

$200

10.0%

12.5%

15.0%

Cost of Equity

■9% Interest Rate 10% Interest Rate 11% Interest Rate

Project Cost

59 63/Watt

Net PLF

Overloading

50%

Tariff

Opex

8% of Revenue Initially

Key Assumptions for 4 GWS

28.9% 29.3%

Leverage

75%

3.9 ¢/ kWh

Interest Rate

9.25 10.25%

Degradation

0.60%

Potential Upside

Opportunities to reduce O&M given benefits of scale and technology

Potential use of bi-facial modules could increase PLF

Green bond financing could reduce lending costs and reduce equity requirements improving

returns

Further reduction in module prices and BOS reflecting buying power and gains in productivity

Exchange rate- INR 73.54 to US$1 (New York closing rate of September 30, 2020), 1) PV Insights, Mercom, 2) As of September 30, 2020

10

US$/ Watt

Loan Tenor

20-22 Years

Module prices have a long history of declines (1)

$0.40

$0.30

$0.20

$0.10

$0.00

2Q'17

3Q'17

4Q'17

1Q'18

2Q'18

3Q'18

4Q'18

1Q'19

2Q'19

3Q'19

4Q'19

1Q'20

2Q'20

3Q'20View entire presentation