Granite Ridge Investor Presentation Deck

Yield %

Overview

Strategy & Execution

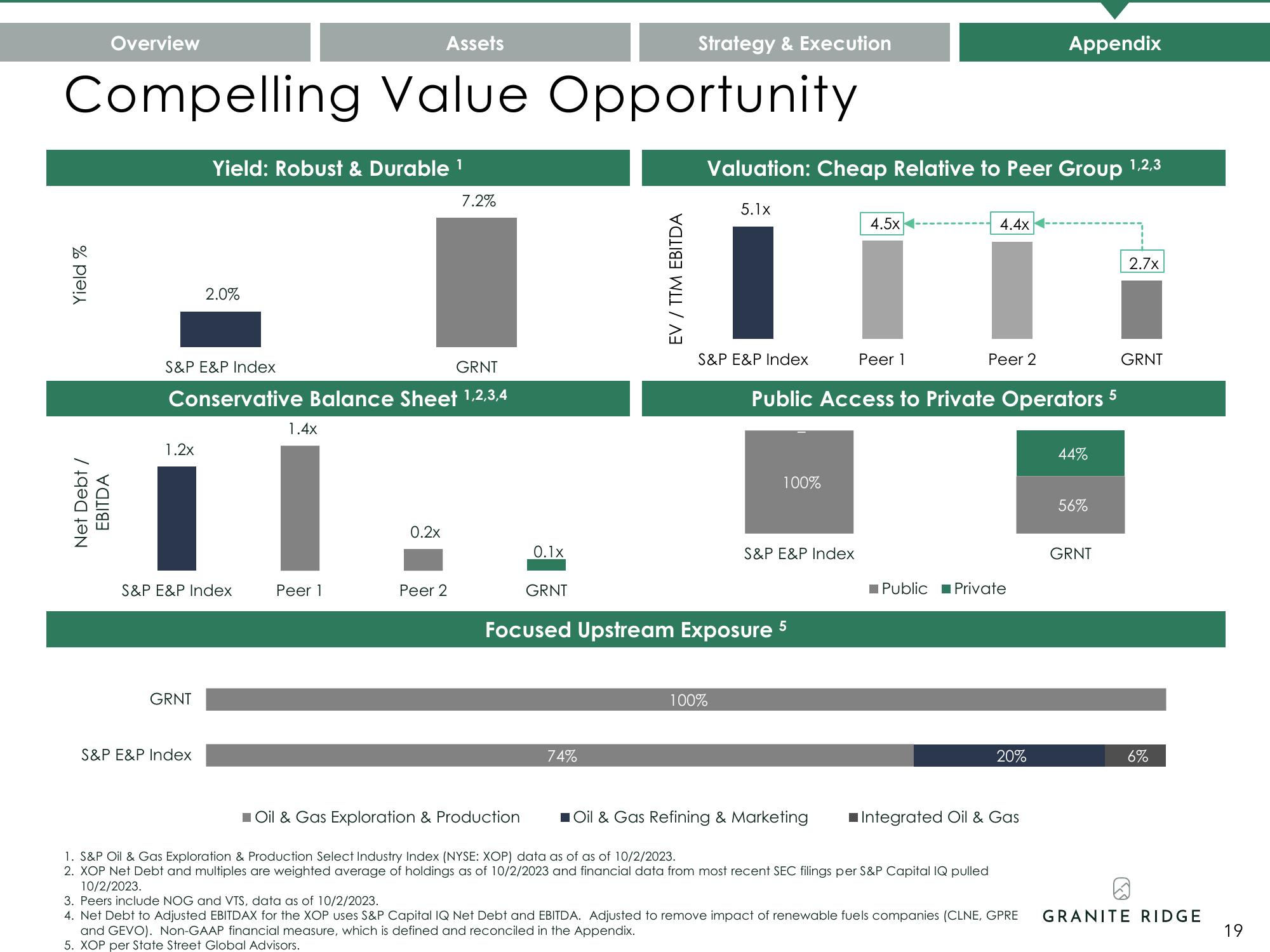

Compelling Value Opportunity

Net Debt /

EBITDA

1.2x

GRNT

Yield: Robust & Durable ¹

2.0%

S&P E&P Index

GRNT

Conservative Balance Sheet 1,2,3,4

S&P E&P Index

S&P E&P Index

Assets

1.4x

Peer 1

0.2x

7.2%

Peer 2

0.1x

■ Oil & Gas Exploration & Production

GRNT

EV / TTM EBITDA

74%

Valuation: Cheap Relative to Peer Group 1,2,3

5.1x

S&P E&P Index

Focused Upstream Exposure

100%

100%

S&P E&P Index

4.5x

Oil & Gas Refining & Marketing

Peer 1

Public Access to Private Operators

4.4x

Peer 2

Public Private

1. S&P Oil & Gas Exploration & Production Select Industry Index (NYSE: XOP) data as of as of 10/2/2023.

2. XOP Net Debt and multiples are weighted average of holdings as of 10/2/2023 and financial data from most recent SEC filings per S&P Capital IQ pulled

10/2/2023.

Appendix

20%

Integrated Oil & Gas

44%

56%

GRNT

5

2.7x

GRNT

6%

@

3. Peers include NOG and VTS, data as of 10/2/2023.

4. Net Debt to Adjusted EBITDAX for the XOP uses S&P Capital IQ Net Debt and EBITDA. Adjusted to remove impact of renewable fuels companies (CLNE, GPRE GRANITE RIDGE

and GEVO). Non-GAAP financial measure, which is defined and reconciled in the Appendix.

5. XOP per State Street Global Advisors.

19View entire presentation