Astra SPAC Presentation Deck

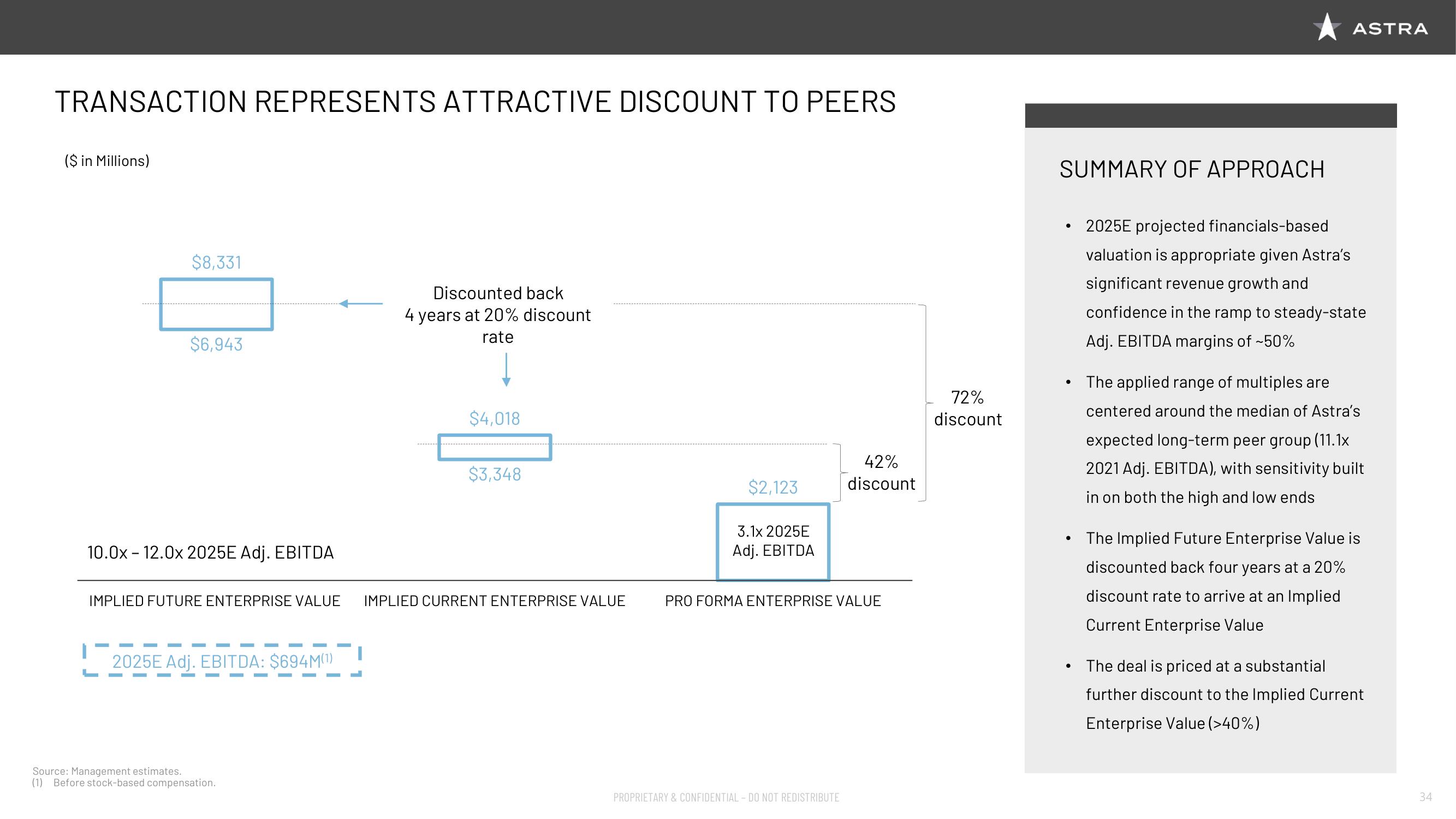

TRANSACTION REPRESENTS ATTRACTIVE DISCOUNT TO PEERS

($ in Millions)

$8,331

$6,943

10.0x - 12.0x2025E Adj. EBITDA

2025E Adj. EBITDA: $694M(1)

Discounted back

4 years at 20% discount

rate

Source: Management estimates.

(1) Before stock-based compensation.

$4,018

IMPLIED FUTURE ENTERPRISE VALUE IMPLIED CURRENT ENTERPRISE VALUE

$3,348

$2,123

3.1x 2025E

Adj. EBITDA

42%

discount

PRO FORMA ENTERPRISE VALUE

PROPRIETARY & CONFIDENTIAL - DO NOT REDISTRIBUTE

72%

discount

SUMMARY OF APPROACH

●

.

●

●

ASTRA

2025E projected financials-based

valuation is appropriate given Astra's

significant revenue growth and

confidence in the ramp to steady-state

Adj. EBITDA margins of ~50%

The applied range of multiples are

centered around the median of Astra's

expected long-term peer group (11.1x

2021 Adj. EBITDA), with sensitivity built

in on both the high and low ends

The Implied Future Enterprise Value is

discounted back four years at a 20%

discount rate to arrive at an Implied

Current Enterprise Value

The deal is priced at a substantial

further discount to the Implied Current

Enterprise Value (>40%)

34View entire presentation