Q2 Quarter 2023

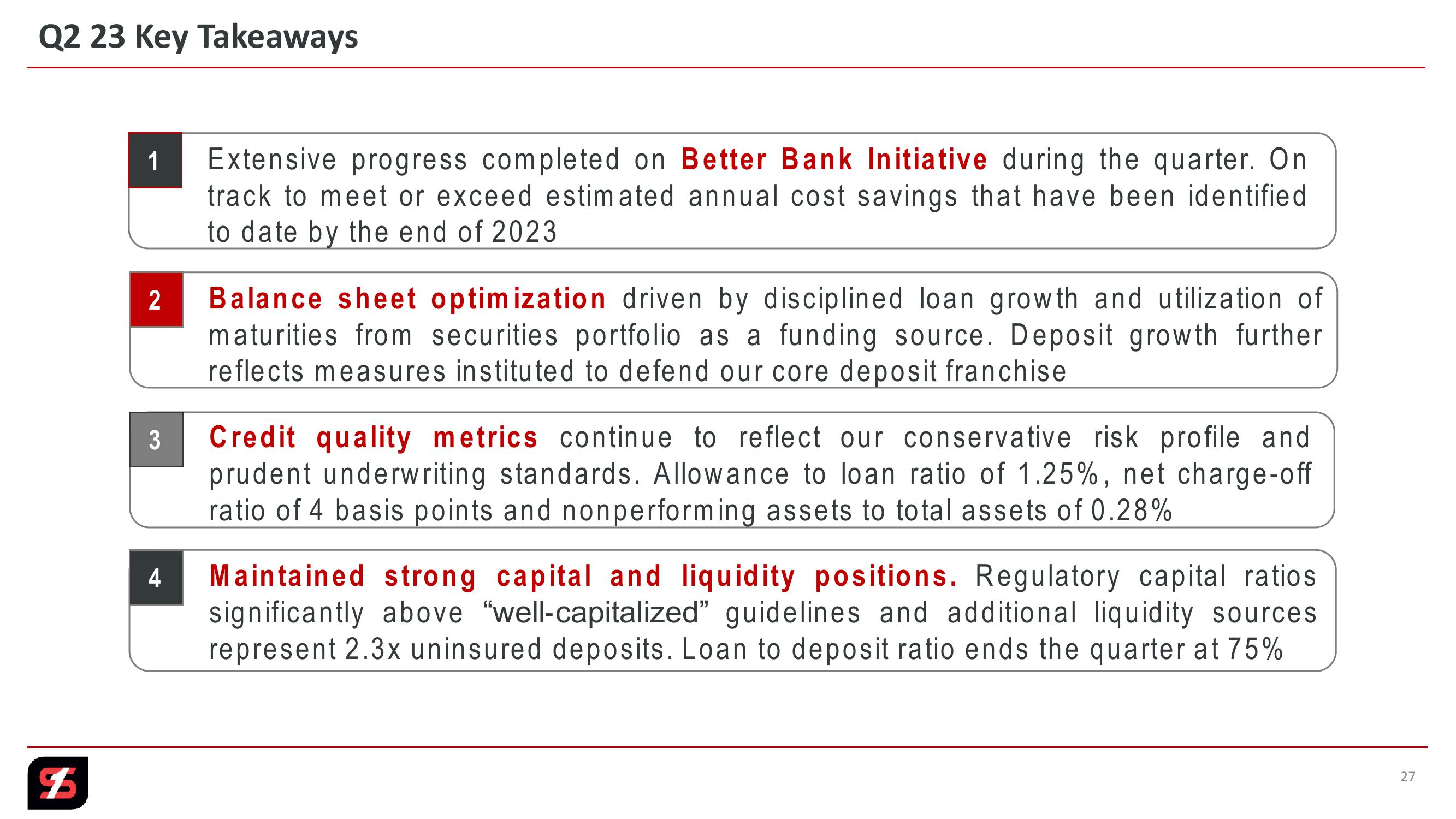

Q2 23 Key Takeaways

$

1

2

Extensive progress completed on Better Bank Initiative during the quarter. On

track to meet or exceed estimated annual cost savings that have been identified

to date by the end of 2023

Balance sheet optimization driven by disciplined loan growth and utilization of

maturities from securities portfolio as a funding source. Deposit growth further

reflects measures instituted to defend our core deposit franchise

3 Credit quality metrics continue to reflect our conservative risk profile and

prudent underwriting standards. Allowance to loan ratio of 1.25%, net charge-off

ratio of 4 basis points and nonperforming assets to total assets of 0.28%

4

Maintained strong capital and liquidity positions. Regulatory capital ratios

significantly above "well-capitalized" guidelines and additional liquidity sources

represent 2.3x uninsured deposits. Loan to deposit ratio ends the quarter at 75%

27View entire presentation