Morgan Stanley Investment Banking Pitch Book

Portions of this exhibit marked [*] are requested to be treated confidentially

Project Roosevelt

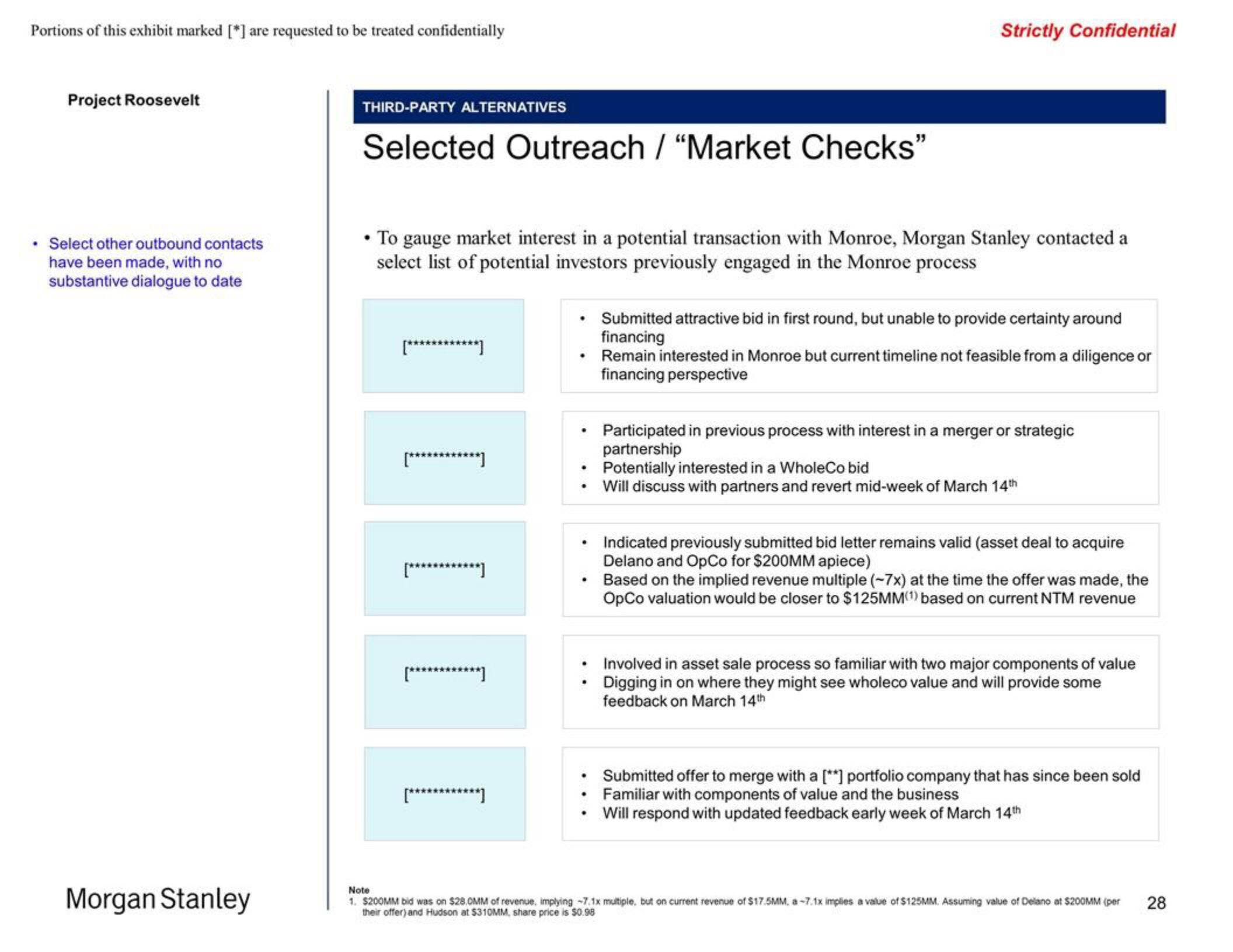

• Select other outbound contacts

have been made, with no

substantive dialogue to date

Morgan Stanley

THIRD-PARTY ALTERNATIVES

Selected Outreach / "Market Checks"

• To gauge market interest in a potential transaction with Monroe, Morgan Stanley contacted a

select list of potential investors previously engaged in the Monroe process

[************]

[************]

[************]

[************]

[************]

• Submitted attractive bid in first round, but unable to provide certainty around

financing

.

.

.

Strictly Confidential

.

.

Remain interested in Monroe but current timeline not feasible from a diligence or

financing perspective

Participated in previous process with interest in a merger or strategic

partnership

Potentially interested in a WholeCo bid

Will discuss with partners and revert mid-week of March 14th

Indicated previously submitted bid letter remains valid (asset deal to acquire

Delano and OpCo for $200MM apiece)

Based on the implied revenue multiple (-7x) at the time the offer was made, the

OpCo valuation would be closer to $125MM(¹) based on current NTM revenue

Involved in asset sale process so familiar with two major components of value

Digging in on where they might see wholeco value and will provide some

feedback on March 14th

Submitted offer to merge with a [**] portfolio company that has since been sold

Familiar with components of value and the business

Will respond with updated feedback early week of March 14th

Note

1. $200MM bid was on $28.0MM of revenue, implying -7.1x multiple, but on current revenue of $17.5MM, a-7.1x implies a value of $125MM. Assuming value of Delano at $200MM (per

their offer) and Hudson at $310MM, share price is $0.98

28View entire presentation