Blockbuster Video Investor Presentation Deck

Reconciliation of Non-GAAP Financial Measures

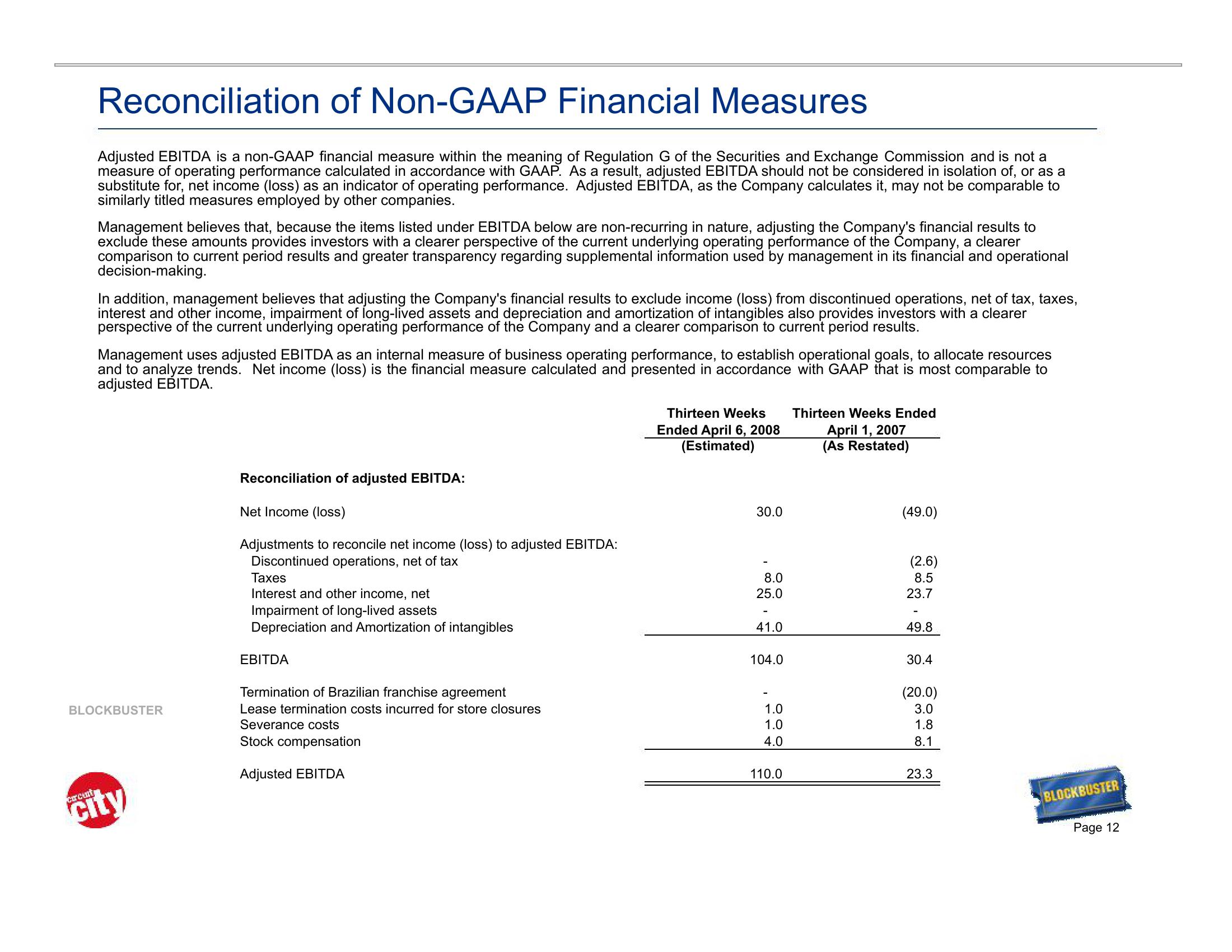

Adjusted EBITDA is a non-GAAP financial measure within the meaning of Regulation G of the Securities and Exchange Commission and is not a

measure of operating performance calculated in accordance with GAAP. As a result, adjusted EBITDA should not be considered in isolation of, or as a

substitute for, net income (loss) as an indicator of operating performance. Adjusted EBITDA, as the Company calculates it, may not be comparable to

similarly titled measures employed by other companies.

Management believes that, because the items listed under EBITDA below are non-recurring in nature, adjusting the Company's financial results to

exclude these amounts provides investors with a clearer perspective of the current underlying operating performance of the Company, a clearer

comparison to current period results and greater transparency regarding supplemental information used by management in its financial and operational

decision-making.

In addition, management believes that adjusting the Company's financial results to exclude income (loss) from discontinued operations, net of tax, taxes,

interest and other income, impairment of long-lived assets and depreciation and amortization of intangibles also provides investors with a clearer

perspective of the current underlying operating performance of the Company and a clearer comparison to current period results.

Management uses adjusted EBITDA as an internal measure of business operating performance, to establish operational goals, to allocate resources

and to analyze trends. Net income (loss) is the financial measure calculated and presented in accordance with GAAP that is most comparable to

adjusted EBITDA.

BLOCKBUSTER

city

Reconciliation of adjusted EBITDA:

Net Income (loss)

Adjustments to reconcile net income (loss) to adjusted EBITDA:

Discontinued operations, net of tax

Taxes

Interest and other income, net

Impairment of long-lived assets

Depreciation and Amortization of intangibles

EBITDA

Termination of Brazilian franchise agreement

Lease termination costs incurred for store closures

Severance costs

Stock compensation

Adjusted EBITDA

Thirteen Weeks

Ended April 6, 2008

(Estimated)

30.0

8.0

25.0

41.0

104.0

1.0

1.0

4.0

110.0

Thirteen Weeks Ended

April 1, 2007

(As Restated)

(49.0)

(2.6)

8.5

23.7

49.8

30.4

(20.0)

3.0

1.8

8.1

23.3

BLOCKBUSTER

Page 12View entire presentation