Aptiv Overview

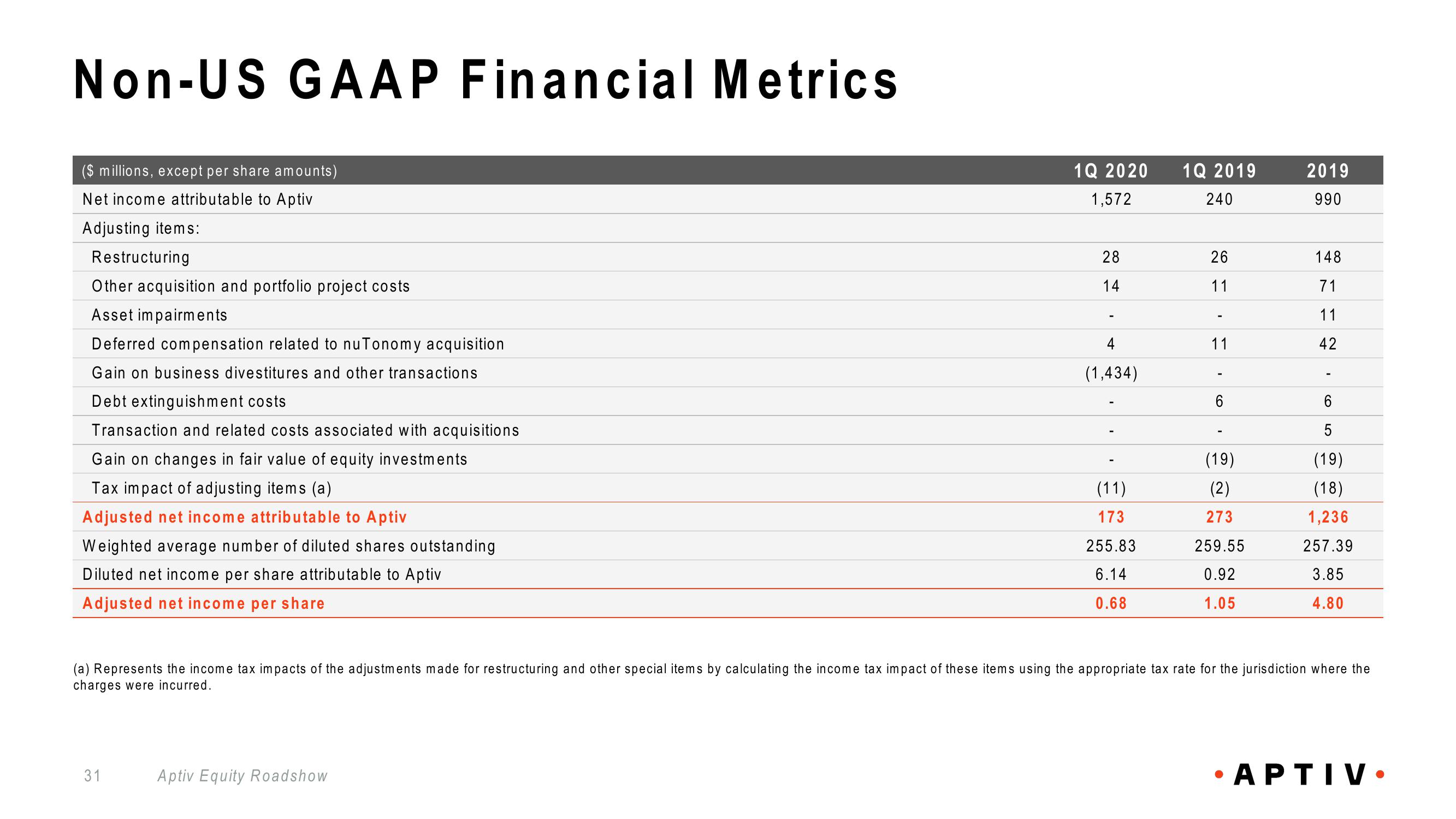

Non-US GAAP Financial Metrics

($ millions, except per share amounts)

Net income attributable to Aptiv

Adjusting items:

Restructuring

Other acquisition and portfolio project costs

Asset impairments

Deferred compensation related to nuTonomy acquisition

Gain on business divestitures and other transactions

Debt extinguishment costs

Transaction and related costs associated with acquisitions

Gain on changes in fair value of equity investments

Tax impact of adjusting items (a)

Adjusted net income attributable to Aptiv

Weighted average number of diluted shares outstanding

Diluted net income per share attributable to Aptiv

Adjusted net income per share

31

1Q 2020

1,572

Aptiv Equity Roadshow

28

14

4

(1,434)

(11)

173

255.83

6.14

0.68

1Q 2019

240

26

11

11

6

(19)

(2)

273

259.55

0.92

1.05

2019

990

148

71

11

42

(a) Represents the income tax impacts of the adjustments made for restructuring and other special items by calculating the income tax impact of these items using the appropriate tax rate for the jurisdiction where the

charges were incurred.

6

5

(19)

(18)

1,236

257.39

3.85

4.80

•APTIV.View entire presentation