Azerion Results Presentation Deck

Financial performance

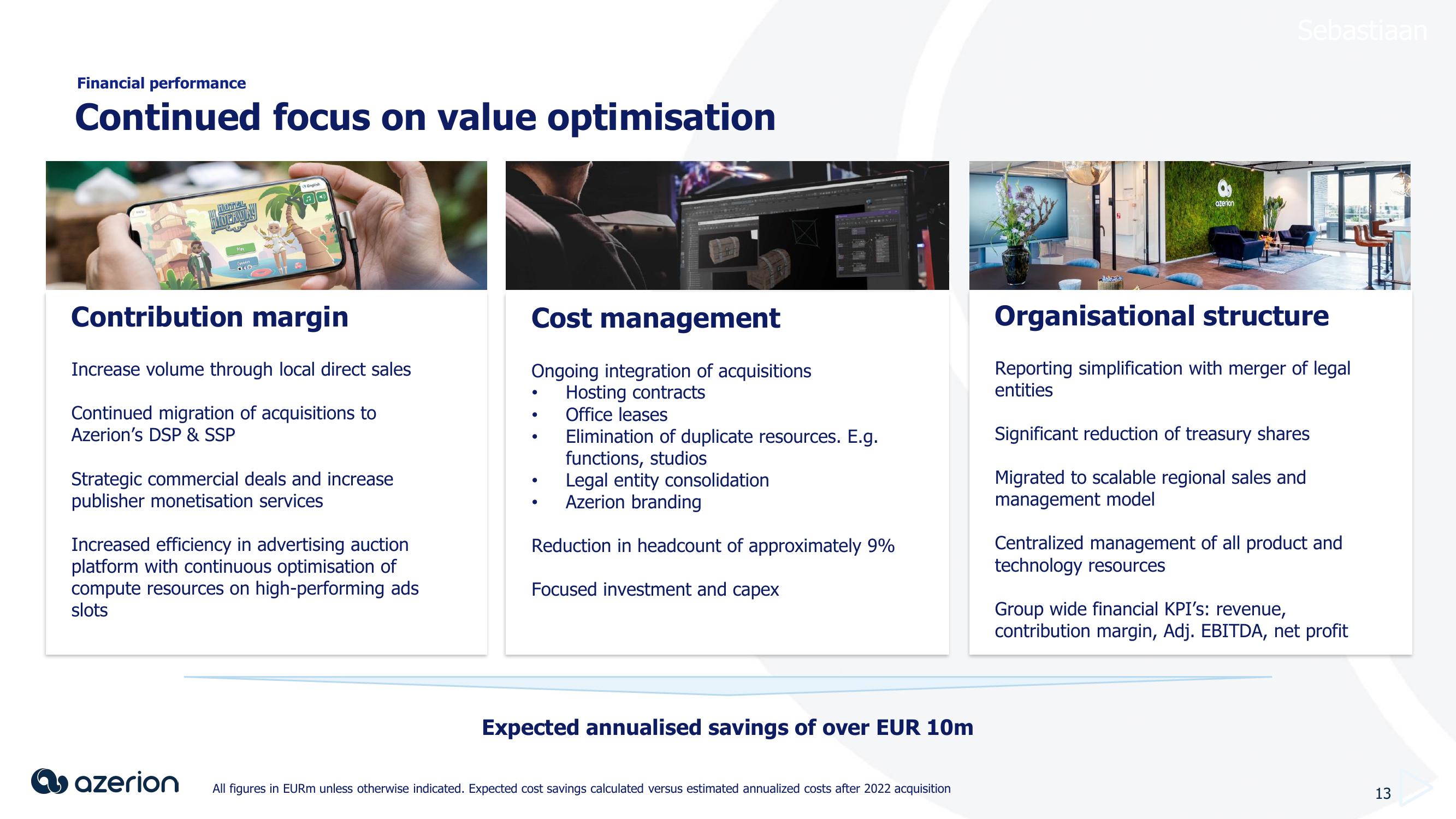

Continued focus on value optimisation

HOTEL

Play

040

azerion

English

QQ

Contribution margin

Increase volume through local direct sales

Continued migration of acquisitions to

Azerion's DSP & SSP

Strategic commercial deals and increase

publisher monetisation services

Increased efficiency in advertising auction

platform with continuous optimisation of

compute resources on high-performing ads

slots

Cost management

Ongoing integration of acquisitions

Hosting contracts

Office leases

●

●

●

●

Legal entity consolidation

Azerion branding

Reduction in headcount of approximately 9%

Focused investment and capex

Elimination of duplicate resources. E.g.

functions, studios

●

Expected annualised savings of over EUR 10m

All figures in EURm unless otherwise indicated. Expected cost savings calculated versus estimated annualized costs after 2022 acquisition

azerion

Sebastiaan

Organisational structure

Reporting simplification with merger of legal

entities

Significant reduction of treasury shares

Migrated to scalable regional sales and

management model

Centralized management of all product and

technology resources

Group wide financial KPI's: revenue,

contribution margin, Adj. EBITDA, net profit

13View entire presentation