AppHarvest SPAC Presentation Deck

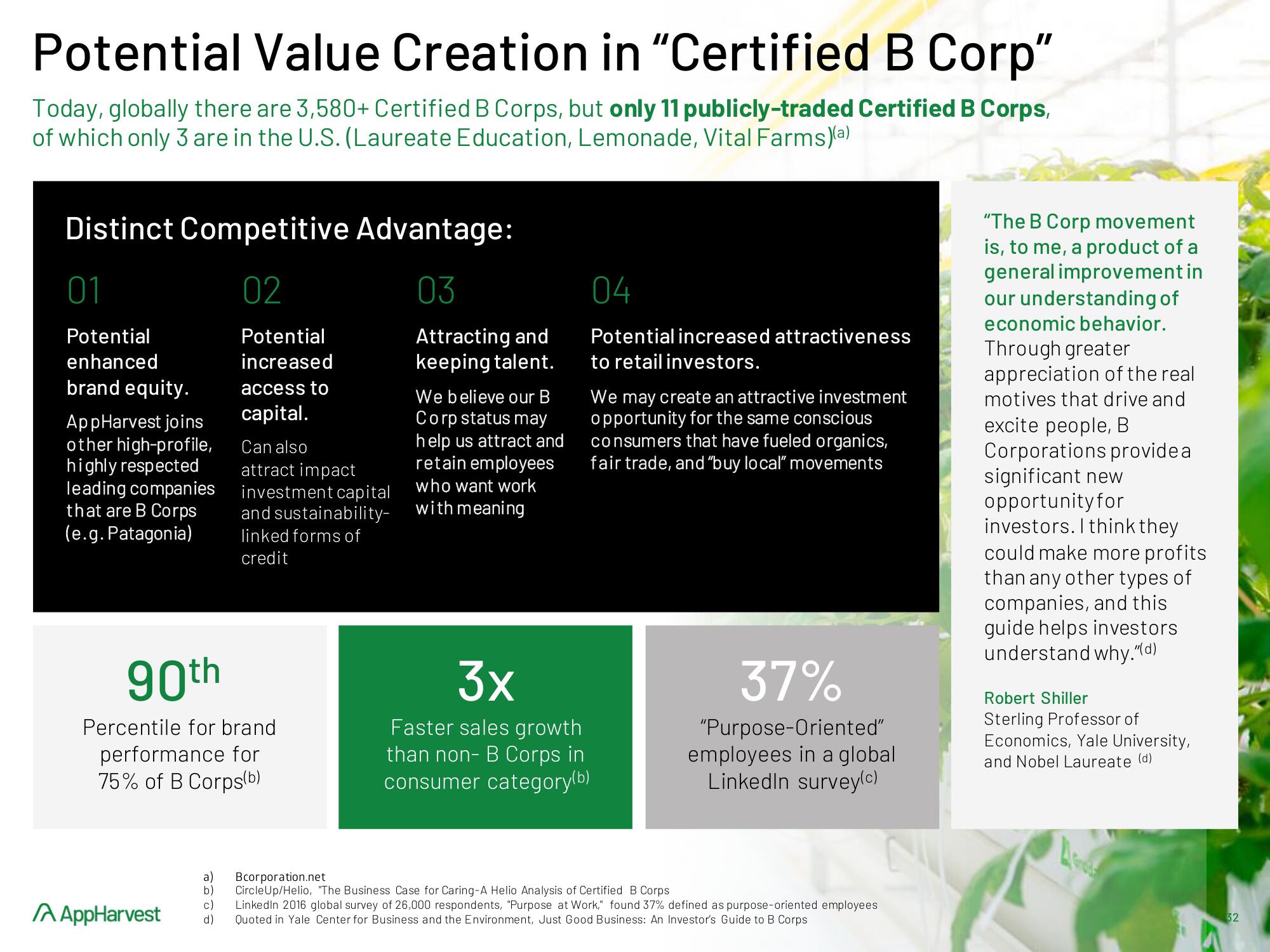

Potential Value Creation in "Certified B Corp"

Today, globally there are 3,580+ Certified B Corps, but only 11 publicly-traded Certified B Corps,

of which only 3 are in the U.S. (Laureate Education, Lemonade, Vital Farms)(a)

1

Distinct Competitive

02

Potential

increased

access to

capital.

01

Potential

enhanced

brand equity.

AppHarvest joins

other high-profile,

highly respected

leading companies

that are B Corps

(e.g. Patagonia)

90th

Percentile for brand

performance for

75% of B Corps(b)

A AppHarvest

a)

b)

Advantage:

03

Attracting and

keeping talent.

Can also

attract impact

investment capital

and sustainability-

linked forms of

credit

We believe our B

Corp status may

help us attract and

retain employees

who want work

with meaning

04

Potential increased attractiveness

to retail investors.

We may create an attractive investment

opportunity for the same conscious

consumers that have fueled organics,

fair trade, and "buy local" movements

3x

Faster sales growth

than non- B Corps in

consumer category(b)

37%

"Purpose-Oriented"

employees in a global

LinkedIn survey(c)

Bcorporation.net

Circle Up/Helio, "The Business Case for Caring-A Helio Analysis of Certified B Corps

c)

LinkedIn 2016 global survey of 26,000 respondents, "Purpose at Work," found 37% defined as purpose-oriented employees

d) Quoted in Yale Center for Business and the Environment, Just Good Business: An Investor's Guide to B Corps

"The B Corp movement

is, to me, a product of a

general improvement in

our understanding of

economic behavior.

Through greater

appreciation of the real

motives that drive and

excite people, B

Corporations provide a

significant new

opportunity for

investors. I think they

could make more profits

than any other types of

companies, and this

guide helps investors

understand why."(d)

Robert Shiller

Sterling Professor of

Economics, Yale University,

and Nobel Laureate (d)

32View entire presentation