Inovalon Results Presentation Deck

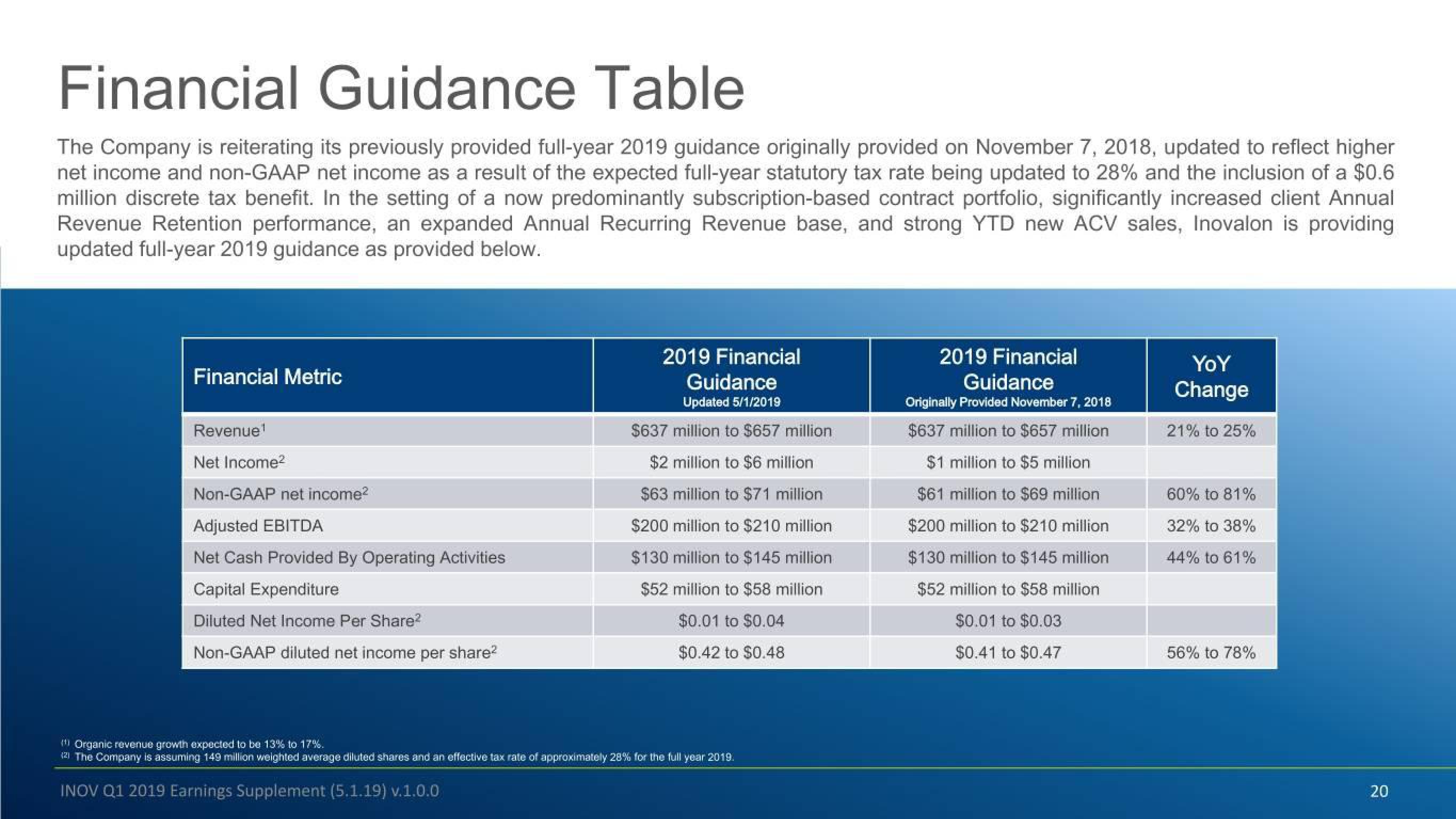

Financial Guidance Table

The Company is reiterating its previously provided full-year 2019 guidance originally provided on November 7, 2018, updated to reflect higher

net income and non-GAAP net income as a result of the expected full-year statutory tax rate being updated to 28% and the inclusion of a $0.6

million discrete tax benefit. In the setting of a now predominantly subscription-based contract portfolio, significantly increased client Annual

Revenue Retention performance, an expanded Annual Recurring Revenue base, and strong YTD new ACV sales, Inovalon is providing

updated full-year 2019 guidance as provided below.

Financial Metric

Revenue¹

Net Income²

Non-GAAP net income²

Adjusted EBITDA

Net Cash Provided By Operating Activities

Capital Expenditure

Diluted Net Income Per Share²

Non-GAAP diluted net income per share²

2019 Financial

Guidance

Updated 5/1/2019

$637 million to $657 million

$2 million to $6 million

$63 million to $71 million

$200 million to $210 million

$130 million to $145 million

$52 million to $58 million

$0.01 to $0.04

$0.42 to $0.48

(¹) Organic revenue growth expected to be 13% to 17%.

121 The Company is assuming 149 million weighted average diluted shares and an effective tax rate of approximately 28% for the full year 2019.

INOV Q1 2019 Earnings Supplement (5.1.19) v.1.0.0

2019 Financial

Guidance

Originally Provided November 7, 2018

$637 million to $657 million

$1 million to $5 million

$61 million to $69 million

$200 million to $210 million

$130 million to $145 million

$52 million to $58 million

$0.01 to $0.03

$0.41 to $0.47

YOY

Change

21% to 25%

60% to 81%

32% to 38%

44% to 61%

56% to 78%

20View entire presentation