Hanmi Financial Results Presentation Deck

●

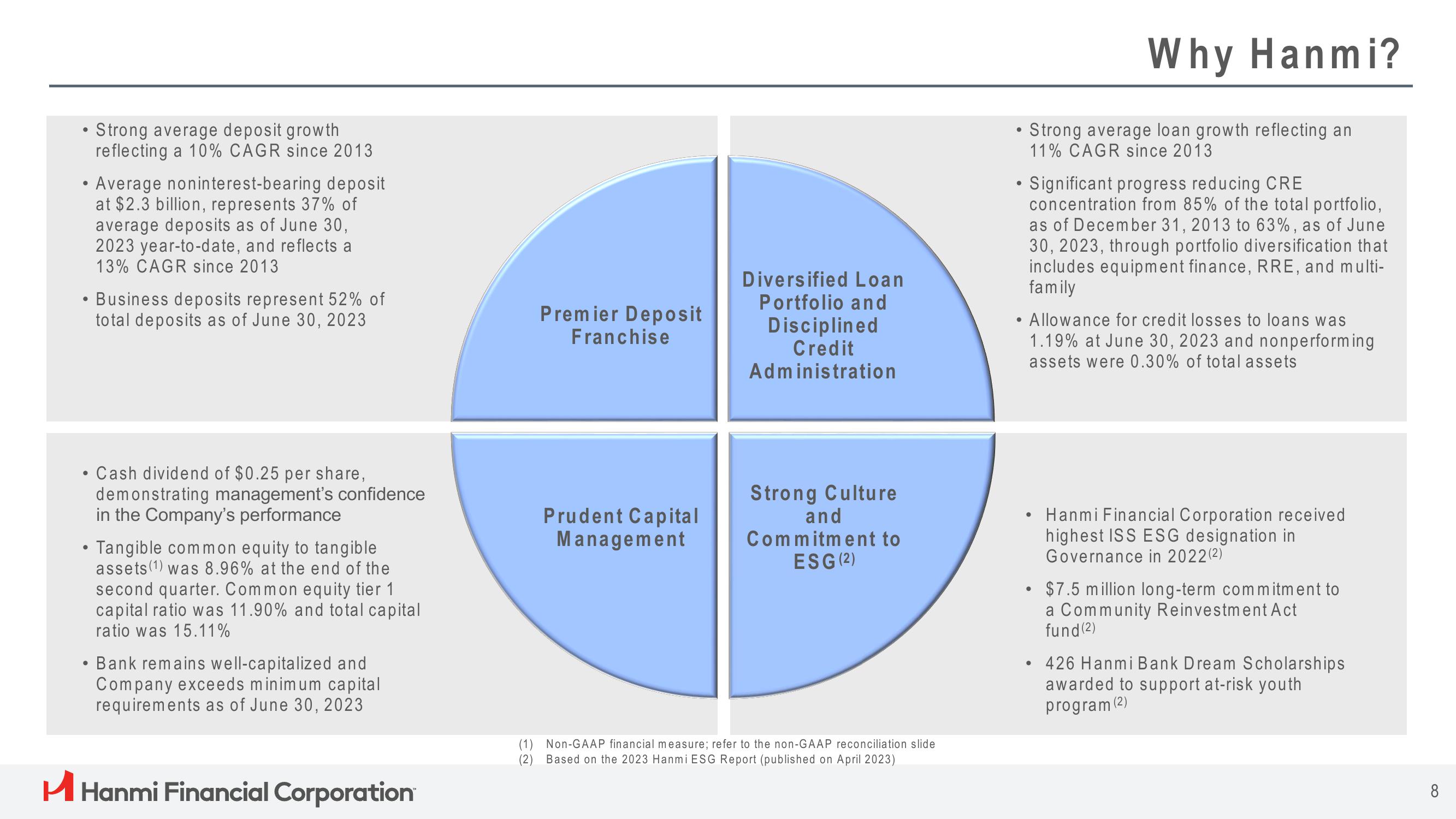

Strong average deposit growth

reflecting a 10% CAGR since 2013

• Average noninterest-bearing deposit

at $2.3 billion, represents 37% of

average deposits as of June 30,

2023 year-to-date, and reflects a

13% CAGR since 2013

• Business deposits represent 52% of

total deposits as of June 30, 2023

• Cash dividend of $0.25 per share,

demonstrating management's confidence

in the Company's performance

• Tangible common equity to tangible

assets (1) was 8.96% at the end of the

●

second quarter. Common equity tier 1

capital ratio was 11.90% and total capital

ratio was 15.11%

Bank remains well-capitalized and

Company exceeds minimum capital

requirements as of June 30, 2023

H Hanmi Financial Corporation

Premier Deposit

Franchise

Prudent Capital

Management

Diversified Loan

Portfolio and

Disciplined

Credit

Administration

Strong Culture

and

Commitment to

ESG (2)

(1) Non-GAAP financial measure; refer to the non-GAAP reconciliation slide

(2) Based on the 2023 Hanmi ESG Report (published on April 2023)

●

Strong average loan growth reflecting an

11% CAGR since 2013

Why Hanmi?

• Significant progress reducing CRE

concentration from 85% of the total portfolio,

as of December 31, 2013 to 63%, as of June

30, 2023, through portfolio diversification that

includes equipment finance, RRE, and multi-

family

●

• Allowance for credit losses to loans was

1.19% at June 30, 2023 and nonperforming

assets were 0.30% of total assets

●

●

Hanmi Financial Corporation received

highest ISS ESG designation in

Governance in 2022(²)

• $7.5 million long-term commitment to

a Community Reinvestment Act

fund (2)

426 Hanmi Bank Dream Scholarships

awarded to support at-risk youth

program (2)

8View entire presentation