Experian ESG Presentation Deck

Executive Summary Improving Financial Health

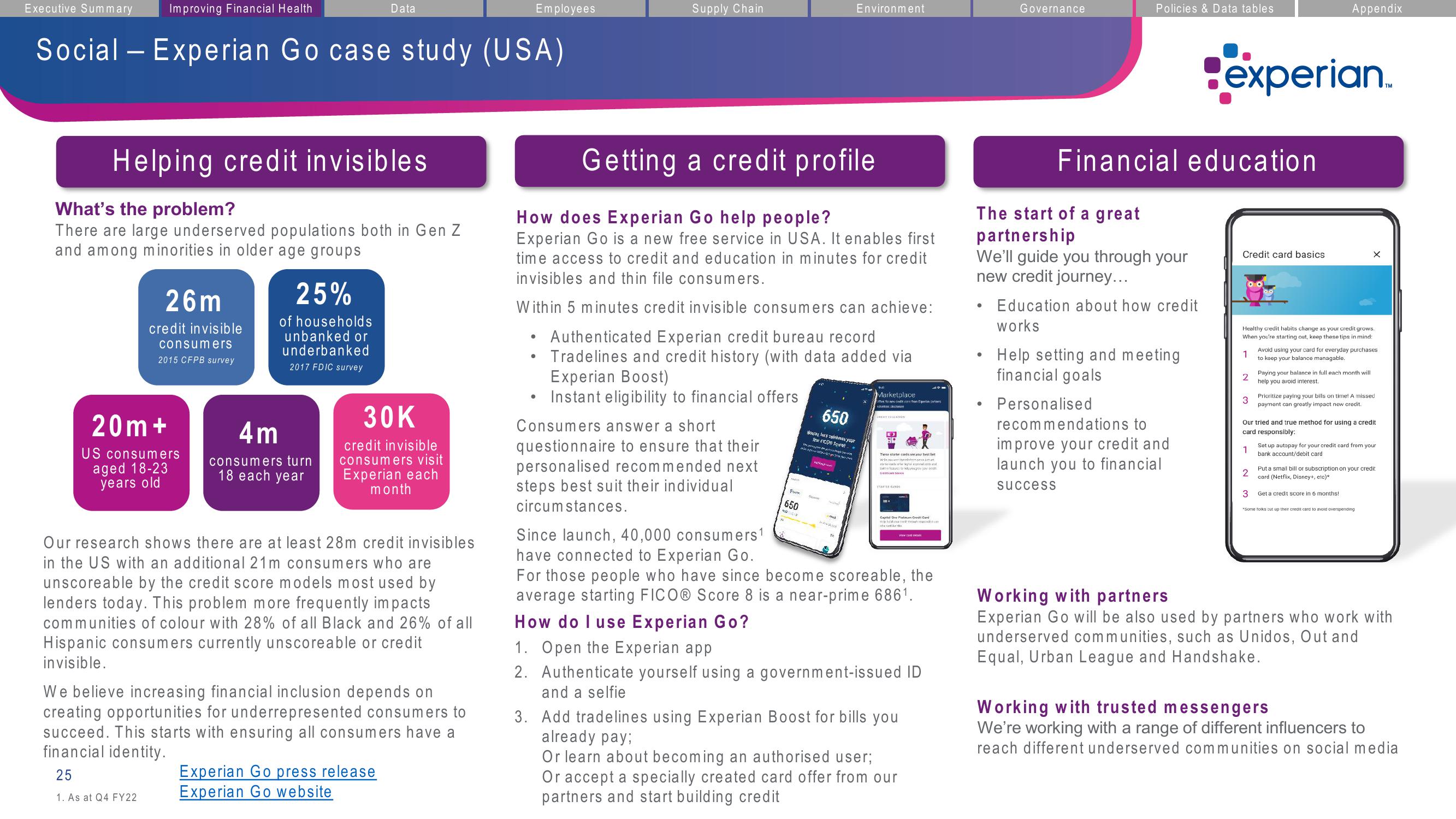

Social - Experian Go case study (USA)

Helping credit invisibles.

What's the problem?

There are large underserved populations both in Gen Z

and among minorities in older age groups

26m

credit invisible

consumers

2015 CFPB survey

20m+

US consumers

aged 18-23

years old

25%

of households

unbanked or

underbanked

2017 FDIC survey

Data

4m

consumers turn

18 each year

30K

credit invisible

consumers visit

Experian each

month

Our research shows there are at least 28m credit invisibles

in the US with an additional 21m consumers who are

unscoreable by the credit score models most used by

lenders today. This problem more frequently impacts

communities of colour with 28% of all Black and 26% of all

Hispanic consumers currently unscoreable or credit

invisible.

We believe increasing financial inclusion depends on

creating opportunities for underrepresented consumers to

succeed. This starts with ensuring all consumers have a

financial identity.

25

1. As at Q4 FY22

Experian Go press release

Experian Go website

Employees

Supply Chain

●

Getting a credit profile

How does Experian Go help people?

Experian Go is a new free service in USA. It enables first

time access to credit and education in minutes for credit

invisibles and thin file consumers.

Within 5 minutes credit invisible consumers can achieve:

• Authenticated Experian credit bureau record

Tradelines and credit history (with data added via

Experian Boost)

Instant eligibility to financial offers

Consumers answer a short

questionnaire to ensure that their

personalised recommended next

steps best suit their individual

circumstances.

FOTK

650

650

onayle's celebrace your

FICD Scores

mange 2

minggu zake you to the con

Environment

food

X

Marketplace

offer for new creduse fron Expertencen

SERTATION

These starter cards are your best bet

where

Den Dans

toetayou grov you ond

ARTE CANDI

Cap One Platnum Credit Card

siphiioue o po

Since launch, 40,000 consumers¹

have connected to Experian Go.

For those people who have since become scoreable, the

average starting FICO® Score 8 is a near-prime 686¹.

How do I use Experian Go?

1. Open the Experian app

2. Authenticate yourself using a government-issued ID

and a selfie

3. Add tradelines using Experian Boost for bills you

already pay;

View ca

Or learn about becoming an authorised user;

Or accept a specially created card offer from our

partners and start building credit

Governance

●

Policies & Data tables

The start of a great

partnership

We'll guide you through your

new credit journey...

Education about how credit

works

Financial education

Help setting and meeting

financial goals

Personalised

recommendations to

improve your credit and

launch you to financial

success

experian

Credit card basics

1

Healthy credit habits change as your credit grows.

When you're starting out, keep these tips in mind:

2

3

Appendix

2

Avoid using your card for everyday purchases

to keep your balance managable.

Paying your balance in full each month will

help you avoid interest.

X

Prioritize paying your bills on time! A missed

payment can greatly impact new credit.

Our tried and true method for using a credit

card responsibly:

1

Set up autopay for your credit card from your

bank account/debit card

Put a small bill or subscription on your credit

card (Netflix, Disney+, etc)*

3

*Some folks cut up their credit card to avoid overspending

Get a credit score in 6 months!

TM

Working with partners

Experian Go will be also used by partners who work with

underserved communities, such as Unidos, Out and

Equal, Urban League and Handshake.

Working with trusted messengers

We're working with a range of different influencers to

reach different underserved communities on social mediaView entire presentation