Main Street Capital Fixed Income Presentation Deck

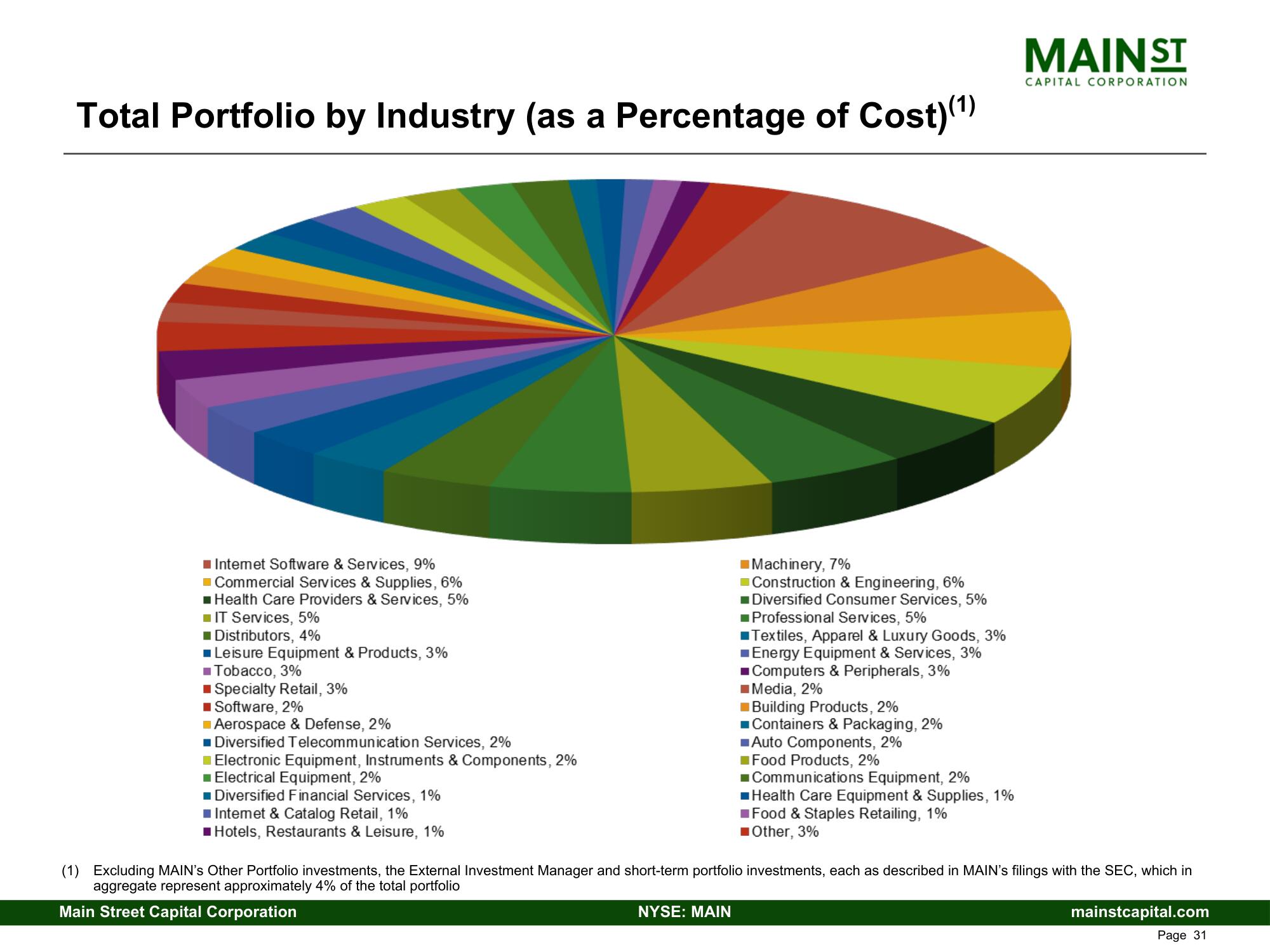

Total Portfolio by Industry (as a Percentage of Cost)(1)

Intemet Software & Services, 9%

■Commercial Services & Supplies, 6%

■Health Care Providers & Services, 5%

■IT Services, 5%

■ Distributors, 4%

■ Leisure Equipment & Products, 3%

■ Tobacco, 3%

■Specialty Retail, 3%

■ Software, 2%

Aerospace & Defense, 2%

■ Diversified Telecommunication Services, 2%

Electronic Equipment, Instruments & Components, 2%

■ Electrical Equipment, 2%

■ Diversified Financial Services, 1%

■ Internet & Catalog Retail, 1%

■Hotels, Restaurants & Leisure, 1%

Machinery, 7%

Construction & Engineering, 6%

■Diversified Consumer Services, 5%

■Professional Services, 5%

■Textiles, Apparel & Luxury Goods, 3%

■ Energy Equipment & Services, 3%

Computers & Peripherals, 3%

■Media, 2%

Building Products, 2%

■Containers & Packaging, 2%

■Auto Components, 2%

Food Products, 2%

NYSE: MAIN

■Communications Equipment, 2%

■Health Care Equipment & Supplies, 1%

■Food & Staples Retailing, 1%

■ Other, 3%

MAIN ST

CAPITAL CORPORATION

(1) Excluding MAIN's Other Portfolio investments, the External Investment Manager and short-term portfolio investments, each as described in MAIN's filings with the SEC, which in

aggregate represent approximately 4% of the total portfolio

Main Street Capital Corporation

mainstcapital.com

Page 31View entire presentation