Dragonfly Energy SPAC Presentation Deck

Investment Thesis

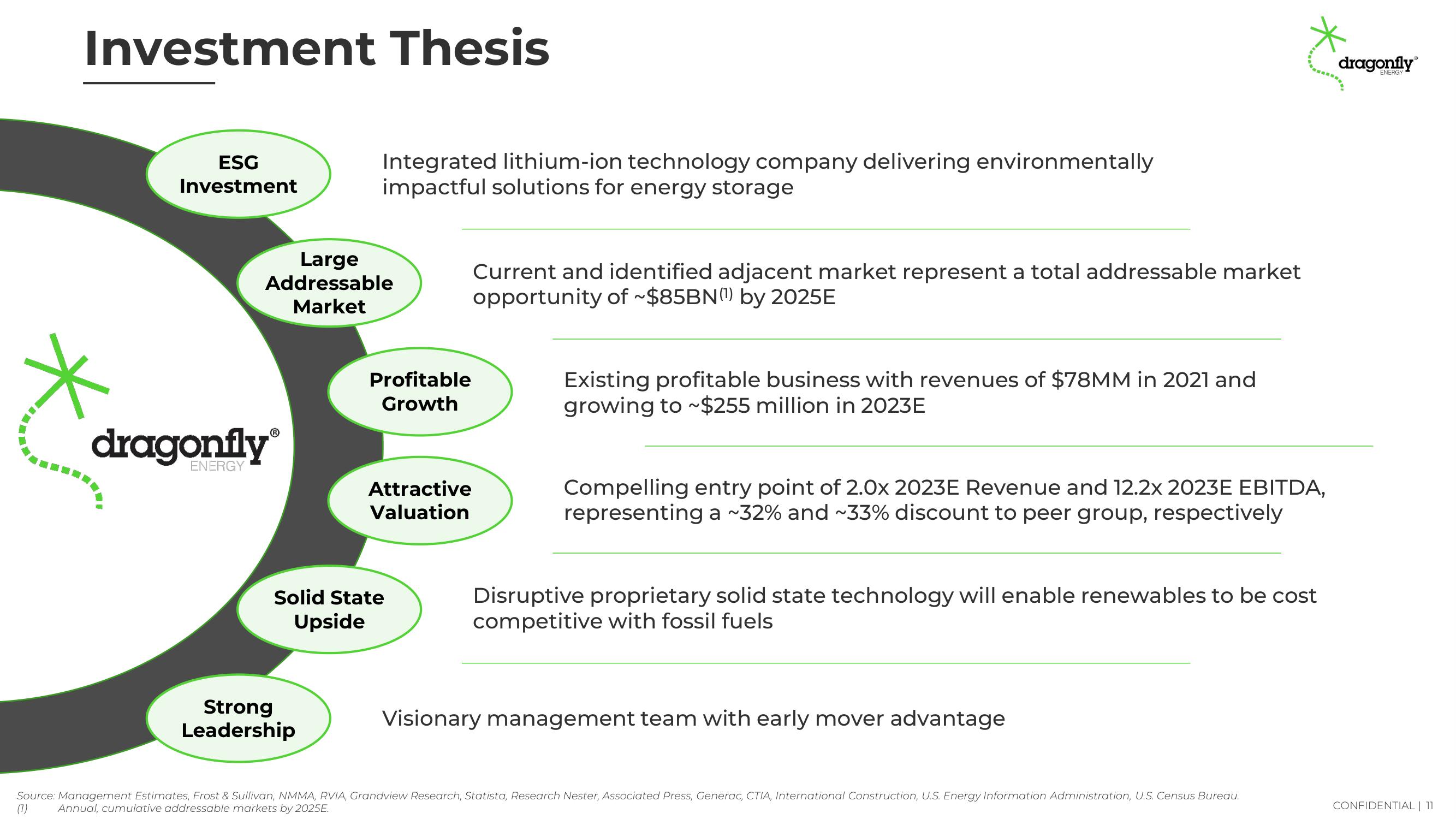

ESG

Investment

Large

Addressable

Market

dragonfly

ENERGY

Ⓡ

Integrated lithium-ion technology company delivering environmentally

impactful solutions for energy storage

Strong

Leadership

Profitable

Growth

Attractive

Valuation

Solid State

Upside

Current and identified adjacent market represent a total addressable market

opportunity of ~$85BN(¹) by 2025E

Existing profitable business with revenues of $78MM in 2021 and

growing to ~$255 million in 2023E

Compelling entry point of 2.0x 2023E Revenue and 12.2x 2023E EBITDA,

representing a ~32% and ~33% discount to peer group, respectively

Disruptive proprietary solid state technology will enable renewables to be cost

competitive with fossil fuels

Visionary management team with early mover advantage

Source: Management Estimates, Frost & Sullivan, NMMA, RVIA, Grandview Research, Statista, Research Nester, Associated Press, Generac, CTIA, International Construction, U.S. Energy Information Administration, U.S. Census Bureau.

(1) Annual, cumulative addressable markets by 2025E.

dragonfly

ENERGY

CONFIDENTIAL | 11View entire presentation