HPS Specialty Loan Fund VI

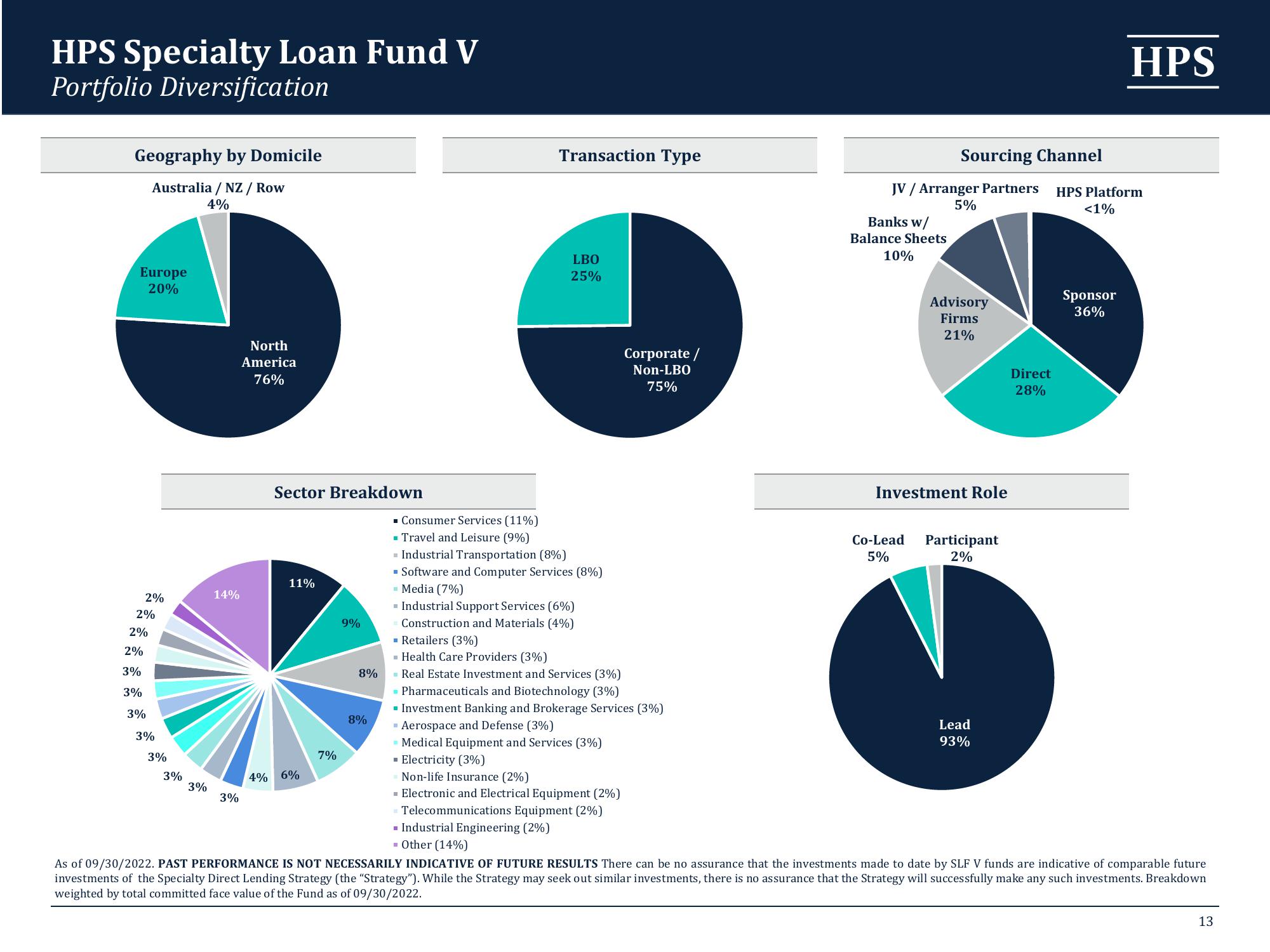

HPS Specialty Loan Fund V

Portfolio Diversification

Geography by Domicile

Australia / NZ / Row

4%

Europe

20%

2%

2%

2%

2%

3%

3%

3%

3%

3%

3%

3%

14%

3%

North

America

76%

Sector Breakdown

11%

4% 6%

7%

9%

8%

8%

Transaction Type

LBO

25%

■ Consumer Services (11%)

Travel and Leisure (9%)

Industrial Transportation (8%)

▪ Software and Computer Services (8%)

- Media (7%)

- Industrial Support Services (6%)

Construction and Materials (4%)

▪ Retailers (3%)

Health Care Providers (3%)

- Real Estate Investment and Services (3%)

▪ Pharmaceuticals and Biotechnology (3%)

Corporate /

Non-LBO

75%

▪ Investment Banking and Brokerage Services (3%)

▪ Aerospace and Defense (3%)

- Medical Equipment and Services (3%)

▪ Electricity (3%)

Non-life Insurance (2%)

- Electronic and Electrical Equipment (2%)

Telecommunications Equipment (2%)

■ Industrial Engineering (2%)

- Other (14%)

Sourcing Channel

JV / Arranger Partners HPS Platform

5%

<1%

Banks w/

Balance Sheets

10%

Advisory

Firms

21%

Investment Role

Co-Lead Participant

5%

2%

Lead

93%

Direct

28%

HPS

Sponsor

36%

As of 09/30/2022. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS There can be no assurance that the investments made to date by SLF V funds are indicative of comparable future

investments of the Specialty Direct Lending Strategy (the "Strategy"). While the Strategy may seek out similar investments, there is no assurance that the Strategy will successfully make any such investments. Breakdown

weighted by total committed face value of the Fund as of 09/30/2022.

13View entire presentation