J.P.Morgan Investment Banking Pitch Book

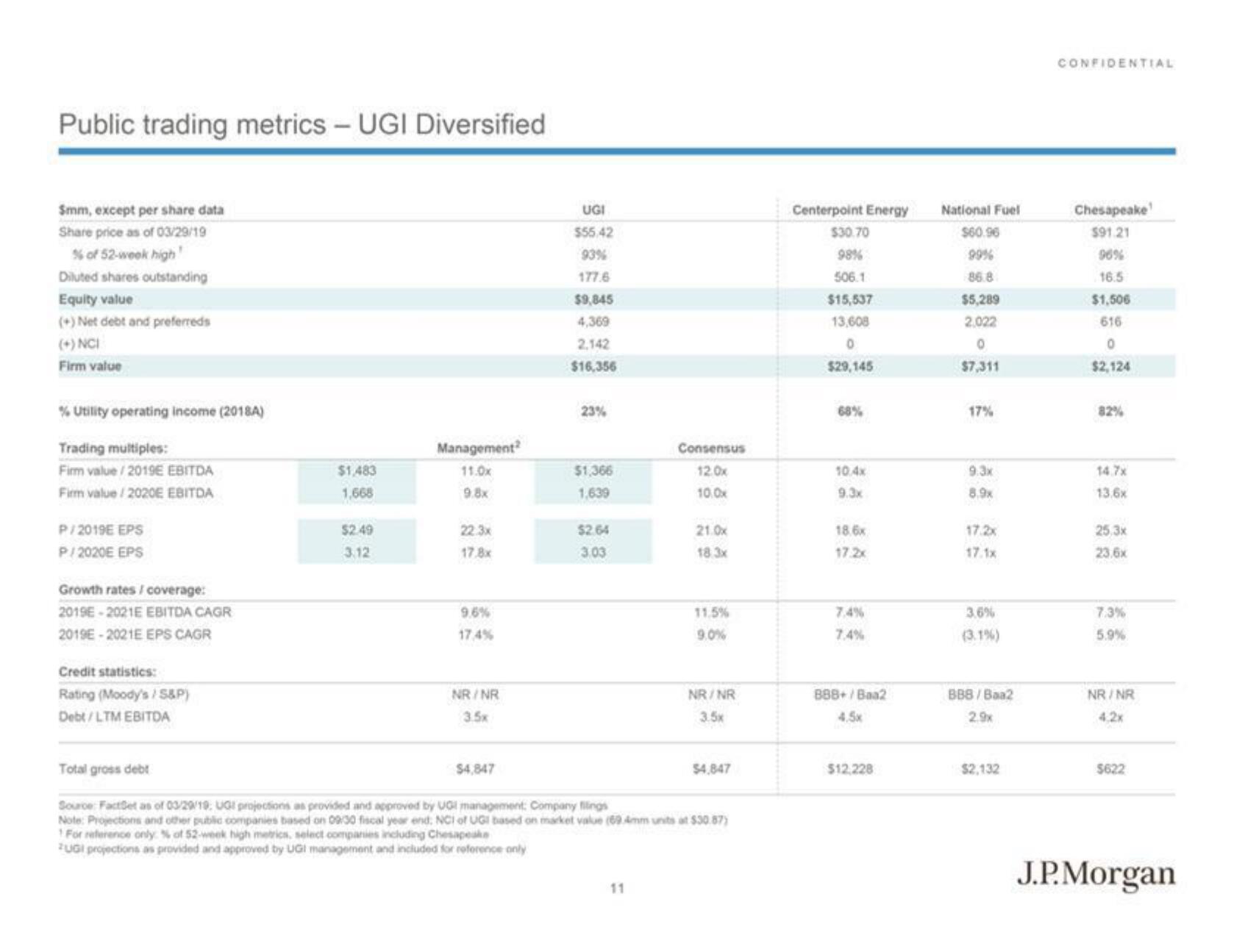

Public trading metrics - UGI Diversified

Smm, except per share data

Share price as of 03/29/19

% of 52-week high!

Diluted shares outstanding

Equity value

(+) Net debt and preferreds

(+) NCI

Firm value

% Utility operating income (2018A)

Trading multiples:

Firm value/2019E EBITDA

Firm value/2020E EBITDA

P/2019E EPS

P/2020E EPS

Growth rates / coverage:

2019E-2021E EBITDA CAGR

2019E-2021E EPS CAGR

Credit statistics:

Rating (Moody's/S&P)

Debt/LTM EBITDA

$1,483

1,668

$2.49

3.12

Management

11.0x

9.8x

22.3x

17.8x

9.6%

17.4%

NR/NR

3.5x

$4,847

UGI

$55.42

93%

177.6

$9,845

4,369

2,142

$16,356

23%

$1,366

1.639

$2.64

3.03

Consensus

12.0x

10.0x

11

21.0x

18.3x

11.5%

9.0%

Total gross debt

Source: FactSet as of 03/29/19. UGI projections as provided and approved by UGI management Company filings

Note: Projections and other public companies based on 09:30 fiscal year end. NOI of UGI based on market value (69.4mm units at $30.87)

For reference only % of 52-week high metrics, select companies including Chesapeake

FUGI projections as provided and approved by UGI management and included for reference only

NR/NR

3.5x

$4,847

Centerpoint Energy

$30.70

98%

506.1

$15,537

13,608

0

$29,145

68%

10.4x

9.3x

18.6x

17.2x

7.4%

7.4%

888+/Baa2

4.5x

$12,228

National Fuel

$60.96

99%

86.8

$5,289

2.022

0

$7,311

17%

9.3x

8.9x

17.1x

3.6%

(3.1%)

BB8/Baa2

2.9x

$2,132

CONFIDENTIAL

Chesapeake

$91.21

96%

16.5

$1,506

616

0

$2,124

82%

14.7x

13.6x

25.3x

23,6x

7.3%

5.9%

NR/NR

4.2x

$622

J.P. MorganView entire presentation