UBS Results Presentation Deck

Personal & Corporate Banking (CHF)

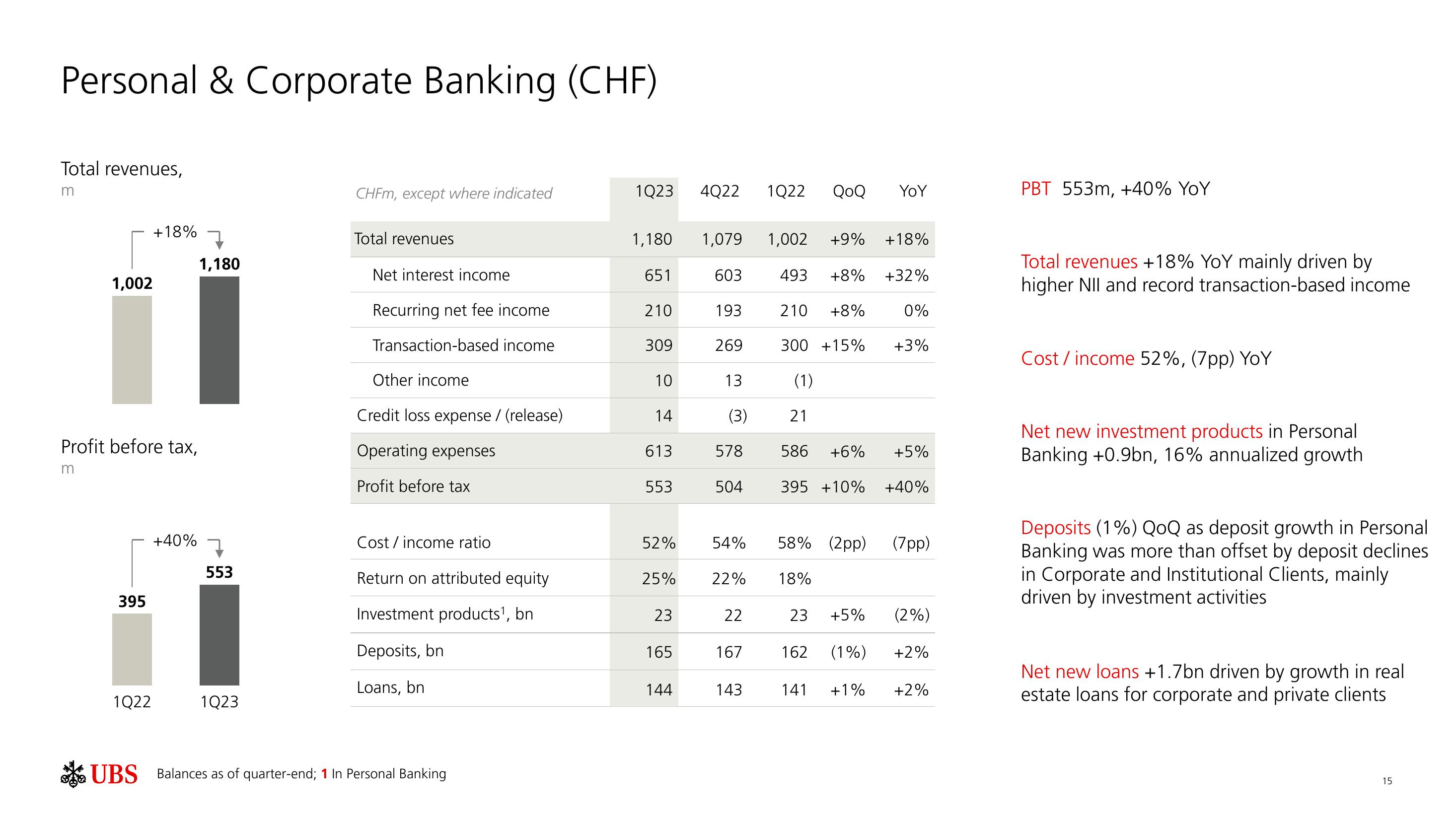

Total revenues,

m

1,002

Profit before tax,

m

395

+18% 7

1Q22

+40%

1,180

553

1Q23

CHFm, except where indicated

Total revenues

Net interest income

Recurring net fee income

Transaction-based income

Other income

Credit loss expense / (release)

Operating expenses

Profit before tax

Cost / income ratio

Return on attributed equity

Investment products¹, bn

Deposits, bn

Loans, bn

UBS Balances as of quarter-end; 1 In Personal Banking

1Q23 4Q22 1Q22 QoQ

1,180

651

210

309

10

14

613

553

52%

25%

23

165

144

1,079 1,002 +9% +18%

493 +8% +32%

603

193

210 +8%

300 +15%

(1)

269

13

(3)

578

504

54%

22%

22

167

143

58% (2pp)

18%

YoY

21

586 +6% +5%

395 +10% +40%

23 +5%

162 (1%)

141 +1%

0%

+3%

(7pp)

(2%)

+2%

+2%

PBT 553m, +40% YoY

Total revenues +18% YoY mainly driven by

higher NII and record transaction-based income

Cost / income 52%, (7pp) YoY

Net new investment products in Personal

Banking +0.9bn, 16% annualized growth

Deposits (1%) QoQ as deposit growth in Personal

Banking was more than offset by deposit declines

in Corporate and Institutional Clients, mainly

driven by investment activities

Net new loans +1.7bn driven by growth in real

estate loans for corporate and private clients

15View entire presentation