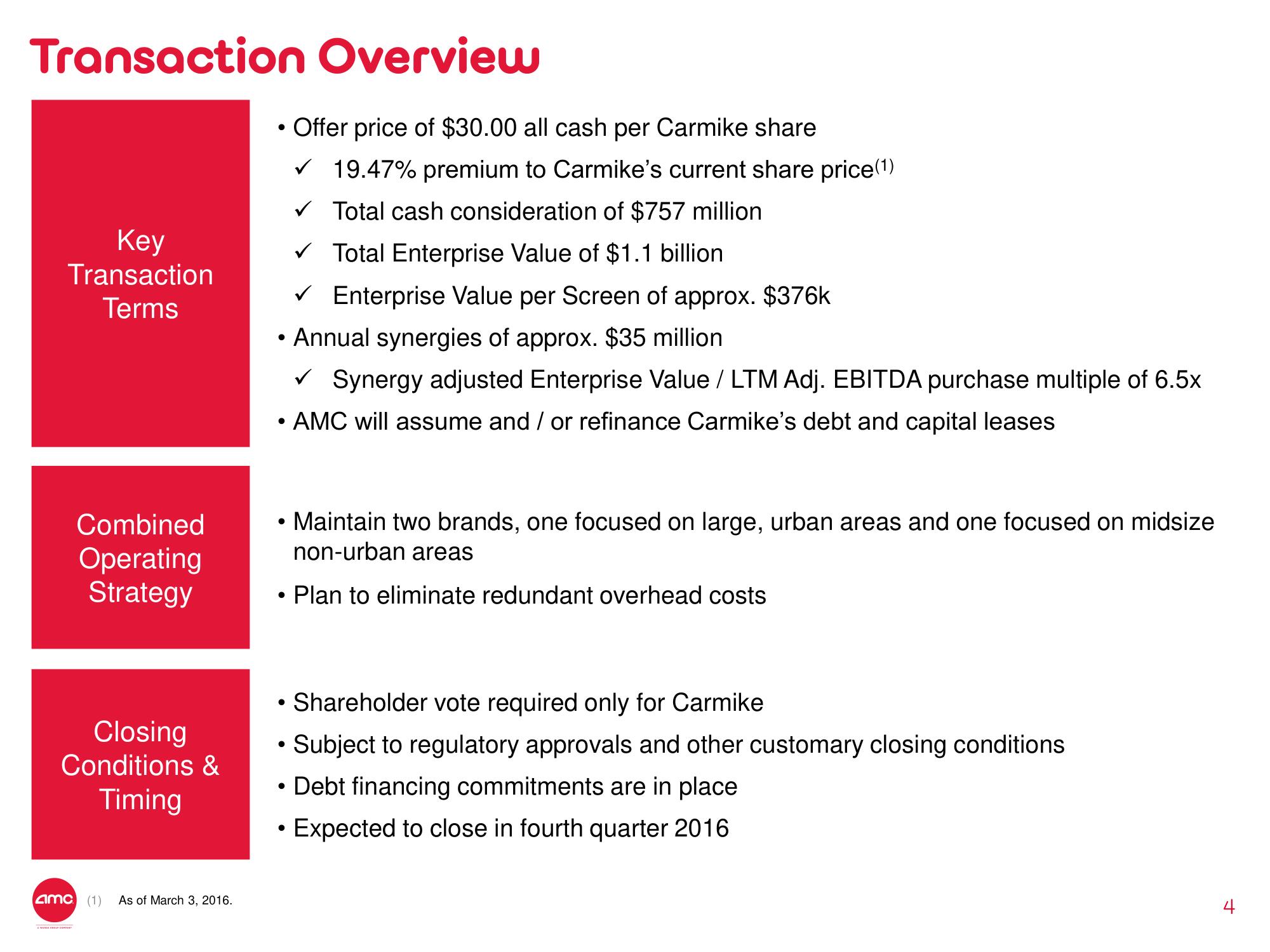

AMC Mergers and Acquisitions Presentation Deck

Transaction Overview

Key

Transaction

Terms

Combined

Operating

Strategy

Closing

Conditions &

Timing

amc (1)

As of March 3, 2016.

●

●

• Annual synergies of approx. $35 million

✓ Synergy adjusted Enterprise Value / LTM Adj. EBITDA purchase multiple of 6.5x

• AMC will assume and / or refinance Carmike's debt and capital leases

●

●

●

●

Offer price of $30.00 all cash per Carmike share

✓ 19.47% premium to Carmike's current share price(1)

✓ Total cash consideration of $757 million

●

✓ Total Enterprise Value of $1.1 billion.

✓ Enterprise Value per Screen of approx. $376k

Maintain two brands, one focused on large, urban areas and one focused on midsize

non-urban areas

Plan to eliminate redundant overhead costs

Shareholder vote required only for Carmike

Subject to regulatory approvals and other customary closing conditions

Debt financing commitments are in place

Expected to close in fourth quarter 2016

+View entire presentation