Blackwells Capital Activist Presentation Deck

BALANCE SHEET

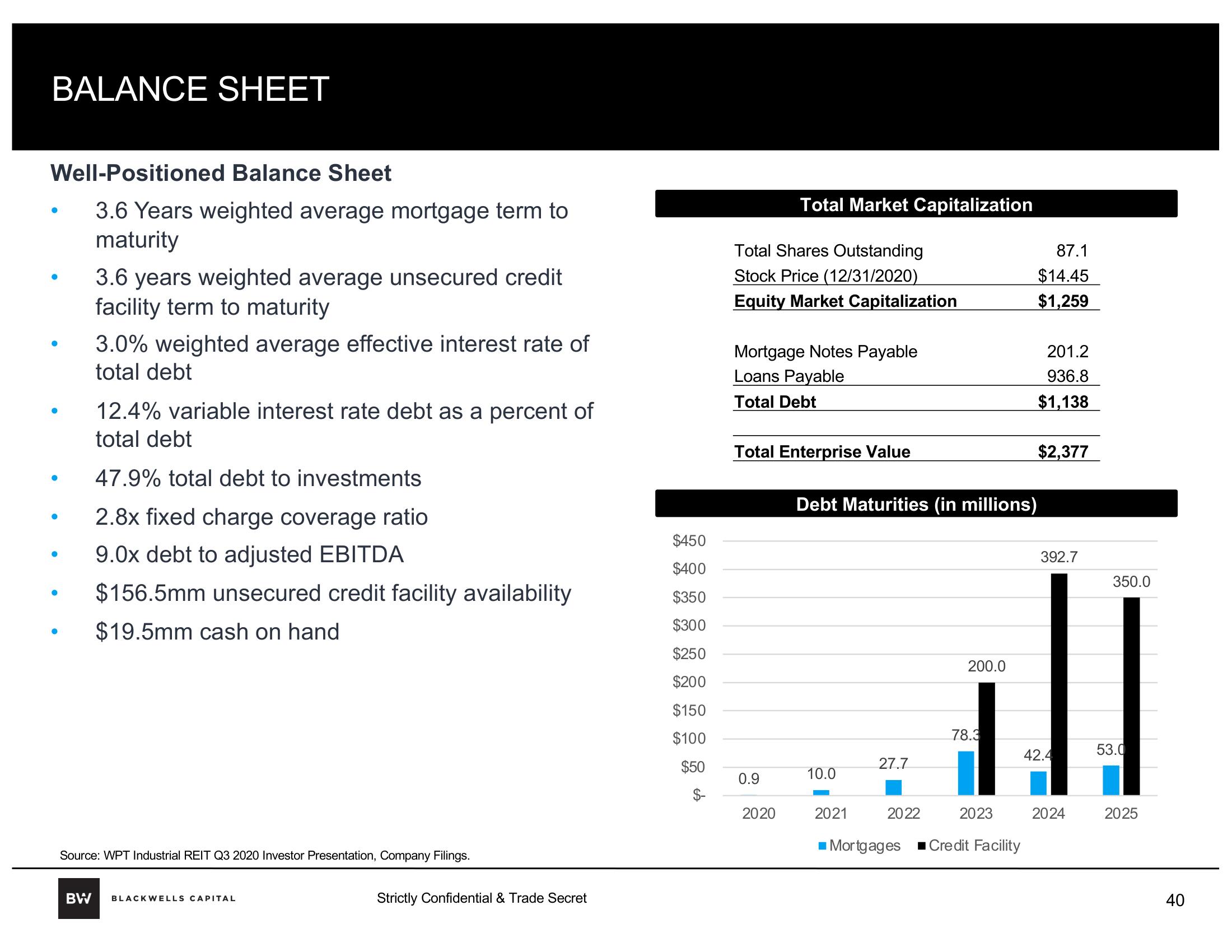

Well-Positioned Balance Sheet

3.6 Years weighted average mortgage term to

maturity

●

3.6 years weighted average unsecured credit

facility term to maturity

3.0% weighted average effective interest rate of

total debt

12.4% variable interest rate debt as a percent of

total debt

47.9% total debt to investments

2.8x fixed charge coverage ratio

9.0x debt to adjusted EBITDA

$156.5mm unsecured credit facility availability

$19.5mm cash on hand

Source: WPT Industrial REIT Q3 2020 Investor Presentation, Company Filings.

BW BLACKWELLS CAPITAL

Strictly Confidential & Trade Secret

$450

$400

$350

$300

$250

$200

$150

$100

$50

Total Shares Outstanding

Stock Price (12/31/2020)

Equity Market Capitalization

Total Market Capitalization

Mortgage Notes Payable

Loans Payable

Total Debt

Total Enterprise Value

0.9

2020

10.0

27.7

Debt Maturities (in millions)

2021

■ Mortgages ■Credit Facility

2022

87.1

$14.45

$1,259

201.2

936.8

$1,138

2023

$2,377

392.7

350.0

200.0

¡ll

78.3

53.0

42.4

2024

2025

40View entire presentation