Third Quarter 2022 Earnings Conference Call

Insurance Holdings

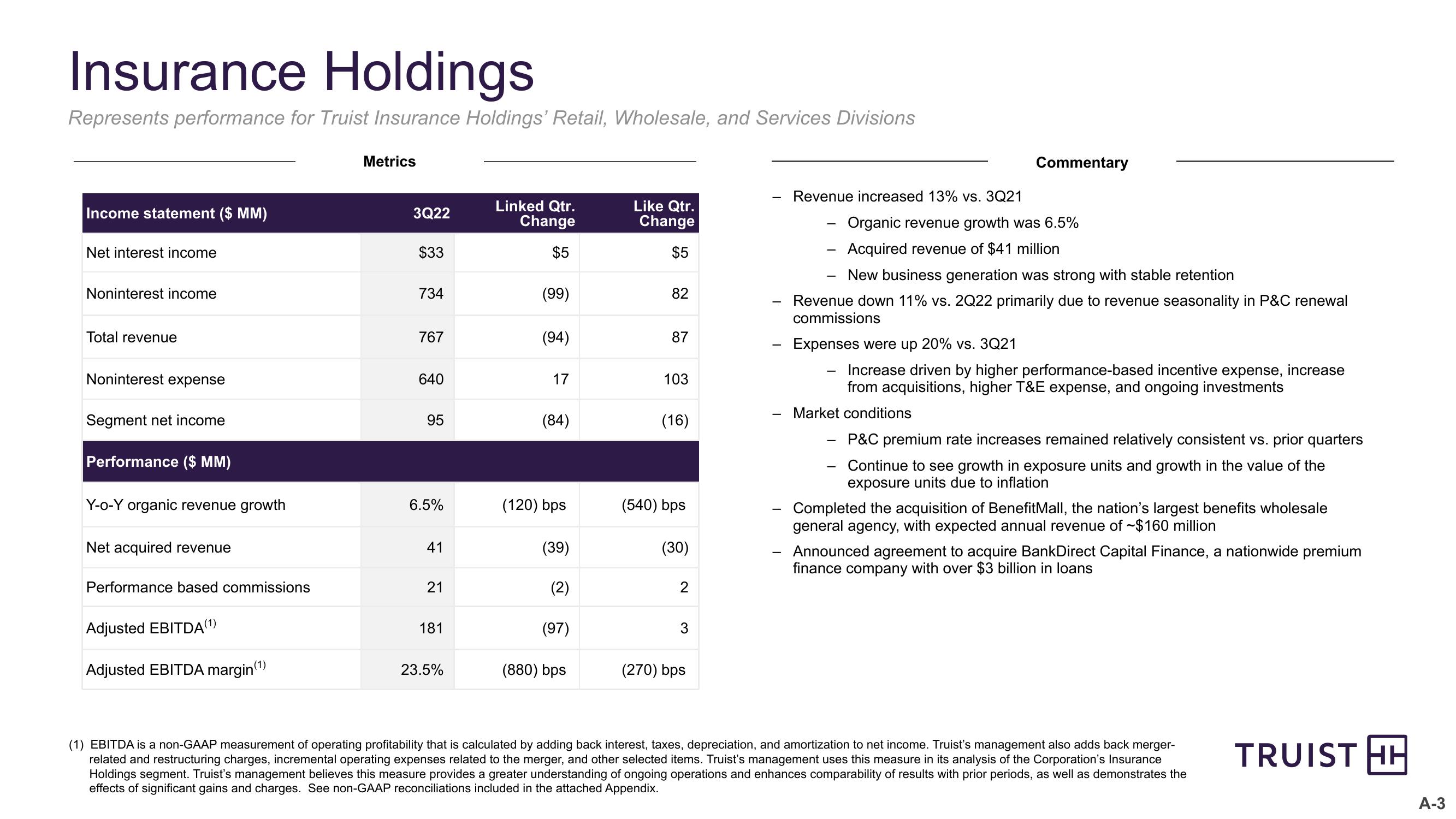

Represents performance for Truist Insurance Holdings' Retail, Wholesale, and Services Divisions

Metrics

Income statement ($ MM)

Net interest income

Noninterest income

Total revenue

Commentary

Revenue increased 13% vs. 3Q21

3Q22

Linked Qtr.

Change

Like Qtr.

Change

-

$33

$5

$5

734

(99)

82

767

(94)

87

Noninterest expense

640

17

103

-

Segment net income

95

(84)

(16)

Performance ($ MM)

Y-o-Y organic revenue growth

6.5%

(120) bps

(540) bps

-

Net acquired revenue

41

(39)

(30)

-

Organic revenue growth was 6.5%

Acquired revenue of $41 million

New business generation was strong with stable retention

Revenue down 11% vs. 2Q22 primarily due to revenue seasonality in P&C renewal

commissions

Expenses were up 20% vs. 3Q21

Increase driven by higher performance-based incentive expense, increase

from acquisitions, higher T&E expense, and ongoing investments

Market conditions

-

-

P&C premium rate increases remained relatively consistent vs. prior quarters

Continue to see growth in exposure units and growth in the value of the

exposure units due to inflation

Completed the acquisition of BenefitMall, the nation's largest benefits wholesale

general agency, with expected annual revenue of $160 million

Announced agreement to acquire BankDirect Capital Finance, a nationwide premium

finance company with over $3 billion in loans

Performance based commissions

21

(2)

2

Adjusted EBITDA (1)

181

(97)

3

Adjusted EBITDA margin (1)

23.5%

(880) bps

(270) bps

(1) EBITDA is a non-GAAP measurement of operating profitability that is calculated by adding back interest, taxes, depreciation, and amortization to net income. Truist's management also adds back merger-

related and restructuring charges, incremental operating expenses related to the merger, and other selected items. Truist's management uses this measure in its analysis of the Corporation's Insurance

Holdings segment. Truist's management believes this measure provides a greater understanding of ongoing operations and enhances comparability of results with prior periods, as well as demonstrates the

effects of significant gains and charges. See non-GAAP reconciliations included in the attached Appendix.

TRUIST HH

A-3View entire presentation