Credit Suisse Investment Banking Pitch Book

Preliminary illustrative Maine NAV analysis assumptions

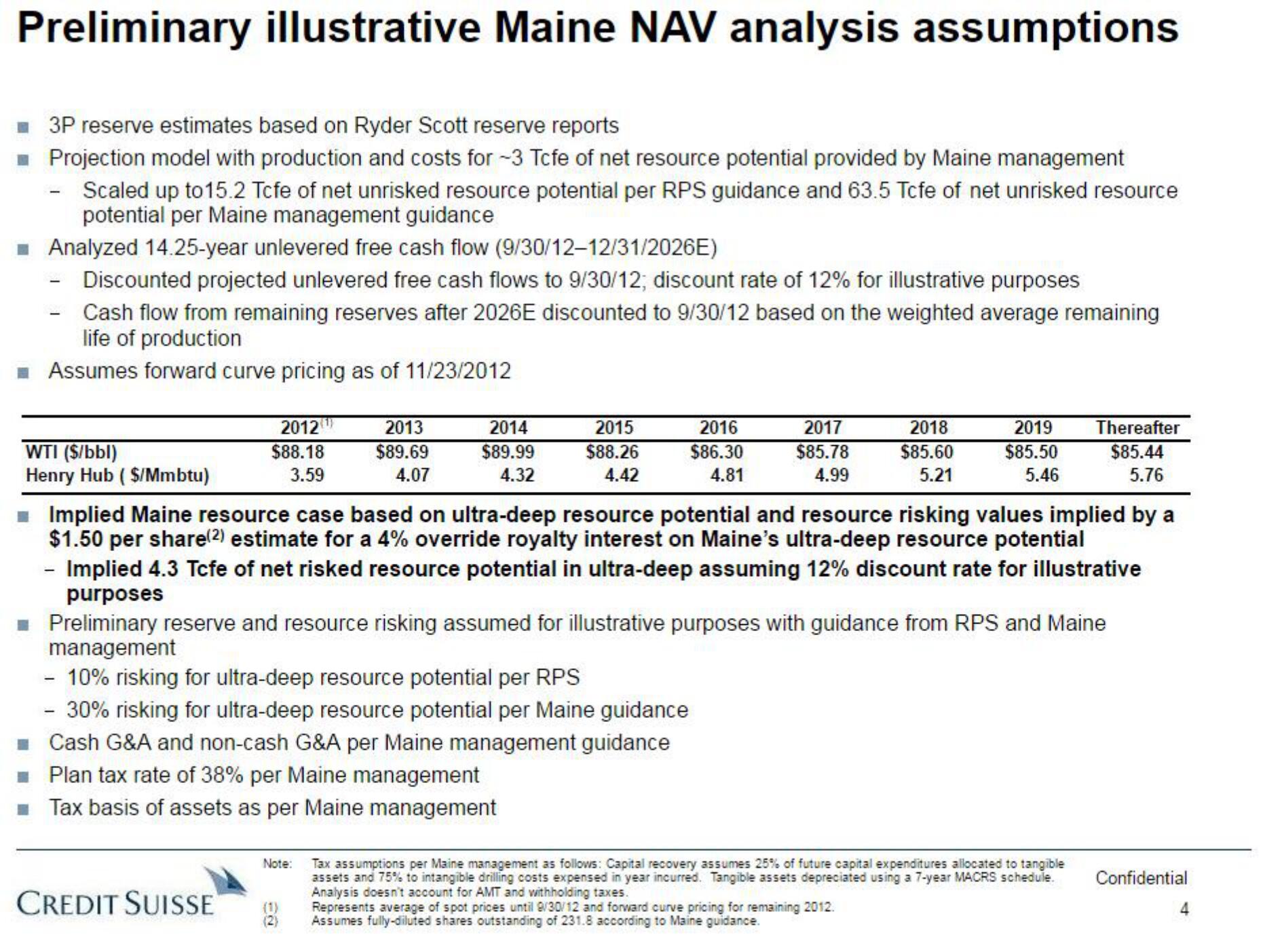

3P reserve estimates based on Ryder Scott reserve reports

Projection model with production and costs for -3 Tcfe of net resource potential provided by Maine management

- Scaled up to 15.2 Tcfe of net unrisked resource potential per RPS guidance and 63.5 Tcfe of net unrisked resource

potential per Maine management guidance

Analyzed 14.25-year unlevered free cash flow (9/30/12-12/31/2026E)

- Discounted projected unlevered free cash flows to 9/30/12; discount rate of 12% for illustrative purposes

Cash flow from remaining reserves after 2026E discounted to 9/30/12 based on the weighted average remaining

life of production

Assumes forward curve pricing as of 11/23/2012

WTI ($/bbl)

Henry Hub ($/Mmbtu)

2012

$88.18

3.59

CREDIT SUISSE

2013

$89.69

4.07

Note:

2014

$89.99

4.32

- 10% risking for ultra-deep resource potential per RPS

- 30% risking for ultra-deep resource potential per Maine guidance

Cash G&A and non-cash G&A per Maine management guidance

Plan tax rate of 38% per Maine management

Tax basis of assets as per Maine management

(1)

(2)

2015

$88.26

4.42

2016

$86.30

4.81

2017

$85.78

4.99

Implied Maine resource case based on ultra-deep resource potential and resource risking values implied by a

$1.50 per share(2) estimate for a 4% override royalty interest on Maine's ultra-deep resource potential

- Implied 4.3 Tcfe of net risked resource potential in ultra-deep assuming 12% discount rate for illustrative

purposes

Preliminary reserve and resource risking assumed for illustrative purposes with guidance from RPS and Maine

management

2018

$85.60

5.21

2019

$85.50

5.46

Thereafter

$85.44

5.76

Tax assumptions per Maine management as follows: Capital recovery assumes 25% of future capital expenditures allocated to tangible

assets and 75% to intangible drilling costs expensed in year incurred. Tangible assets depreciated using a 7-year MACRS schedule.

Analysis doesn't account for AMT and withholding taxes.

Represents average of spot prices until 9/30/12 and forward curve pricing for remaining 2012.

Assumes fully-diluted shares outstanding of 231.8 according to Maine guidance.

ConfidentialView entire presentation