Matson Results Presentation Deck

20

Appendix -Non-GAAP Measures

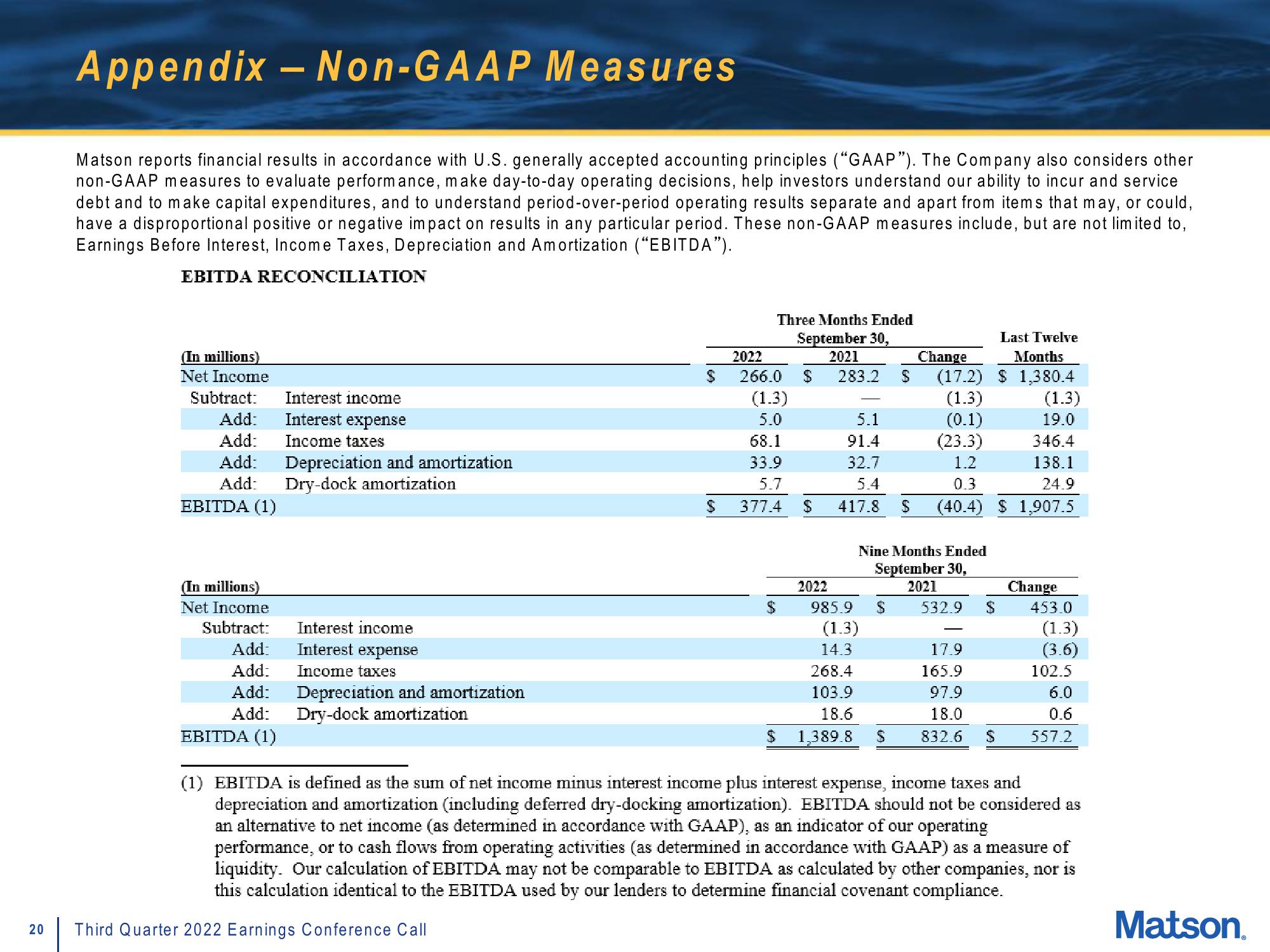

Matson reports financial results in accordance with U.S. generally accepted accounting principles ("GAAP"). The Company also considers other

non-GAAP measures to evaluate performance, make day-to-day operating decisions, help investors understand our ability to incur and service

debt and to make capital expenditures, and to understand period-over-period operating results separate and apart from items that may, or could,

have a disproportional positive or negative impact on results in any particular period. These non-GAAP measures include, but are not limited to,

Earnings Before Interest, Income Taxes, Depreciation and Amortization ("EBITDA").

EBITDA RECONCILIATION

(In millions)

Net Income

Subtract:

Add:

Add:

Add:

Add:

EBITDA (1)

(In millions)

Net Income

Subtract:

Add:

Add:

Add:

Add:

EBITDA (1)

Interest income

Interest expense

Income taxes

Depreciation and amortization

Dry-dock amortization

Interest income

Interest expense

Income taxes

Depreciation and amortization

Dry-dock amortization

S

Third Quarter 2022 Earnings Conference Call

2022

266.0

(1.3)

5.0

68.1

33.9

5.7

$ 377.4

Three Months Ended

September 30,

2021

Last Twelve

Change

Months

$ 283.2 $ (17.2) $ 1,380.4

(1.3)

(1.3)

5.1

(0.1)

19.0

91.4

(23.3)

32.7

1.2

5.4

0.3

417.8 $ (40.4) $1,907.5

$

$

$

2022

985.9

(1.3)

14.3

268.4

103.9

18.6

1,389.8

Nine Months Ended

September 30,

2021

$

532.9 $

17.9

165.9

97.9

18.0

832.6

346.4

138.1

24.9

Change

453.0

(1.3)

(3.6)

102.5

6.0

0.6

557.2

(1) EBITDA is defined as the sum of net income minus interest income plus interest expense, income taxes and

depreciation and amortization (including deferred dry-docking amortization). EBITDA should not be considered as

an alternative to net income (as determined in accordance with GAAP), as an indicator of our operating

performance, or to cash flows from operating activities (as determined in accordance with GAAP) as a measure of

liquidity. Our calculation of EBITDA may not be comparable to EBITDA as calculated by other companies, nor is

this calculation identical to the EBITDA used by our lenders to determine financial covenant compliance.

Matson.View entire presentation