FY 2023 Second Quarter Earnings Call

FY2023 operating environment

////

//////

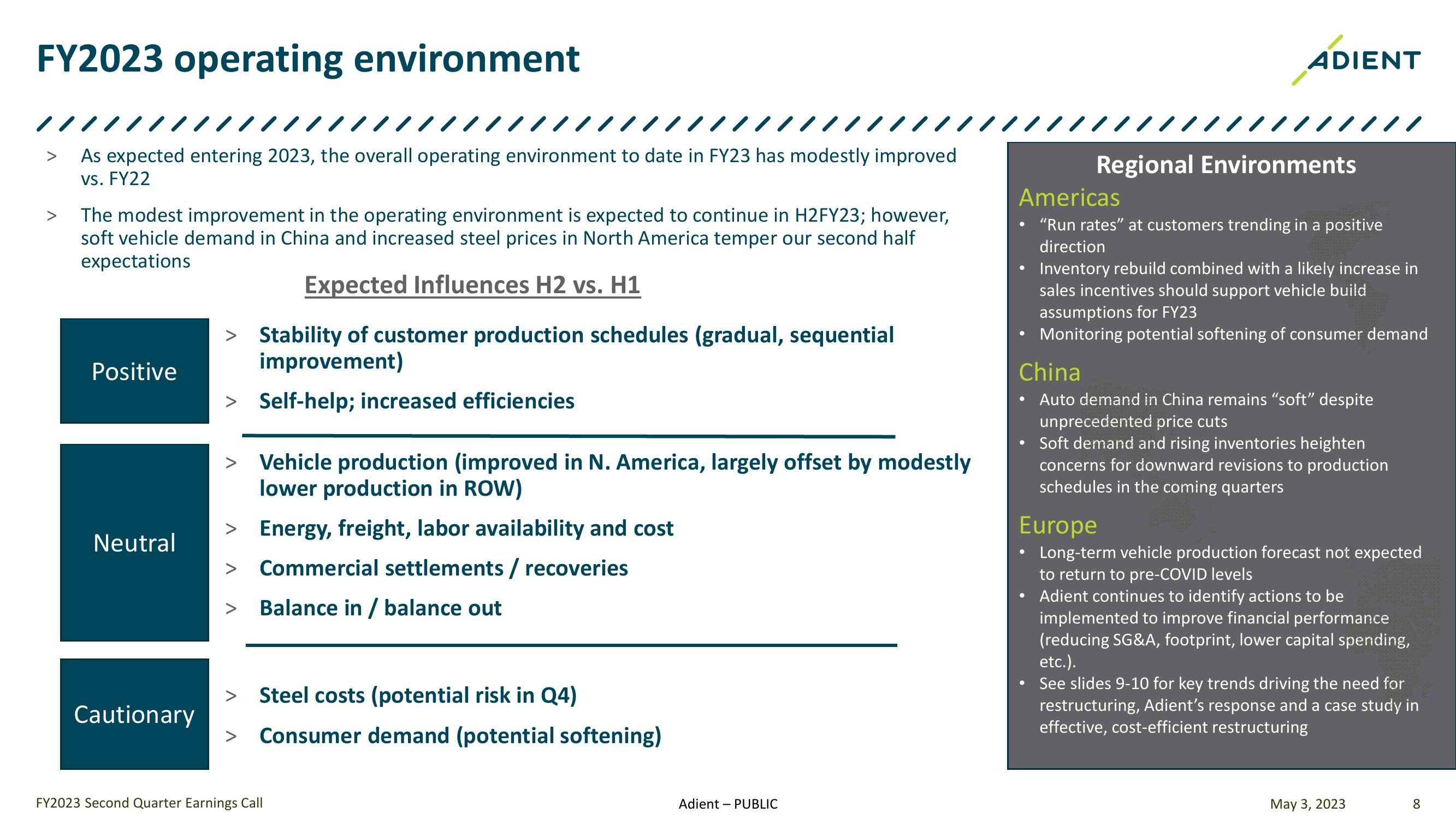

> As expected entering 2023, the overall operating environment to date in FY23 has modestly improved

vs. FY22

>

The modest improvement in the operating environment is expected to continue in H2FY23; however,

soft vehicle demand in China and increased steel prices in North America temper our second half

expectations

Positive

Neutral

Expected Influences H2 vs. H1

> Stability of customer production schedules (gradual, sequential

improvement)

> Self-help; increased efficiencies

Vehicle production (improved in N. America, largely offset by modestly

lower production in ROW)

> Energy, freight, labor availability and cost

Commercial settlements / recoveries

>

Balance in/balance out

>

Steel costs (potential risk in Q4)

Cautionary

>

Consumer demand (potential softening)

ADIENT

/////////////

Regional Environments

Americas

•

"Run rates" at customers trending in a positive

direction

Inventory rebuild combined with a likely increase in

sales incentives should support vehicle build

assumptions for FY23

Monitoring potential softening of consumer demand

China

•

Auto demand in China remains "soft" despite

unprecedented price cuts

•

Soft demand and rising inventories heighten

concerns for downward revisions to production

schedules in the coming quarters

Europe

Long-term vehicle production forecast not expected

to return to pre-COVID levels

Adient continues to identify actions to be

implemented to improve financial performance

(reducing SG&A, footprint, lower capital spending,

etc.).

See slides 9-10 for key trends driving the need for

restructuring, Adient's response and a case study in

effective, cost-efficient restructuring

FY2023 Second Quarter Earnings Call

Adient - PUBLIC

May 3, 2023

8View entire presentation