ironSource SPAC Presentation Deck

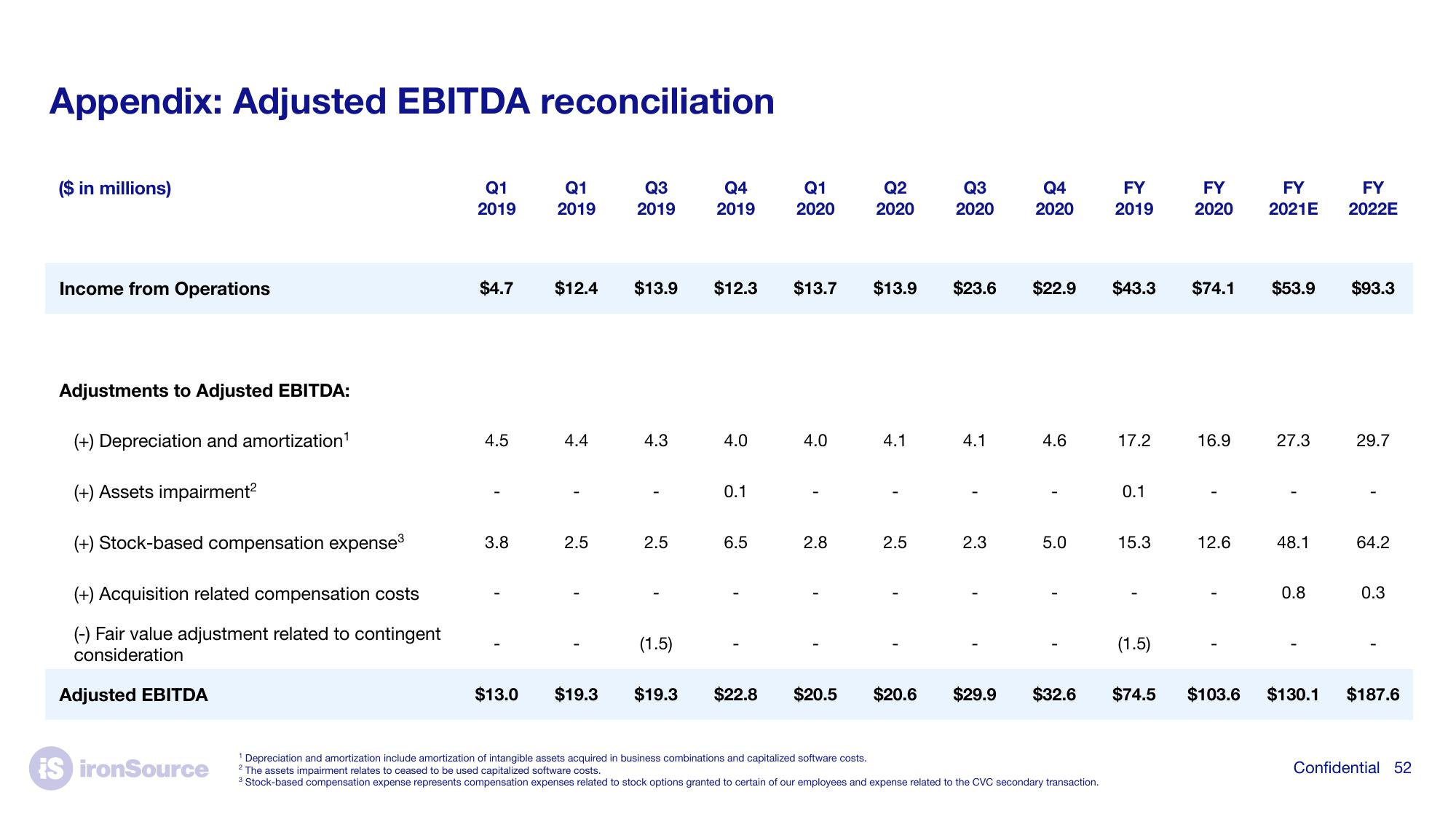

Appendix: Adjusted EBITDA reconciliation

($ in millions)

Income from Operations

Adjustments to Adjusted EBITDA:

(+) Depreciation and amortization¹

(+) Assets impairment²

(+) Stock-based compensation expense³

(+) Acquisition related compensation costs

(-) Fair value adjustment related to contingent

consideration

Adjusted EBITDA

IS ironSource

Q1

2019

$4.7 $12.4

4.5

3.8

Q1

2019

$13.0

4.4

1

2.5

$19.3

Q3

2019

$13.9 $12.3

4.3

2.5

Q4

2019

(1.5)

4.0

0.1

6.5

$19.3 $22.8

Q1

2020

$13.7

4.0

1

2.8

$20.5

Q2

2020

$13.9

4.1

2.5

Q3

2020

$23.6 $22.9

4.1

Q4

2020

2.3

4.6

5.0

$20.6 $29.9 $32.6

¹ Depreciation and amortization include amortization of intangible assets acquired in business combinations and capitalized software costs.

2 The assets impairment relates to ceased to be used capitalized software costs.

3 Stock-based compensation expense represents compensation expenses related to stock options granted to certain of our employees and expense related to the CVC secondary transaction.

FY

2019

$43.3

17.2

0.1

15.3

(1.5)

$74.5

FY

2020

$74.1

16.9

12.6

$103.6

FY

2021E

$53.9

27.3

48.1

0.8

$130.1

FY

2022E

$93.3

29.7

64.2

0.3

$187.6

Confidential 52View entire presentation