Hilltop Holdings Results Presentation Deck

Non-GAAP to GAAP Reconciliation and Management's Explanation of Non-GAAP

Financial Measures

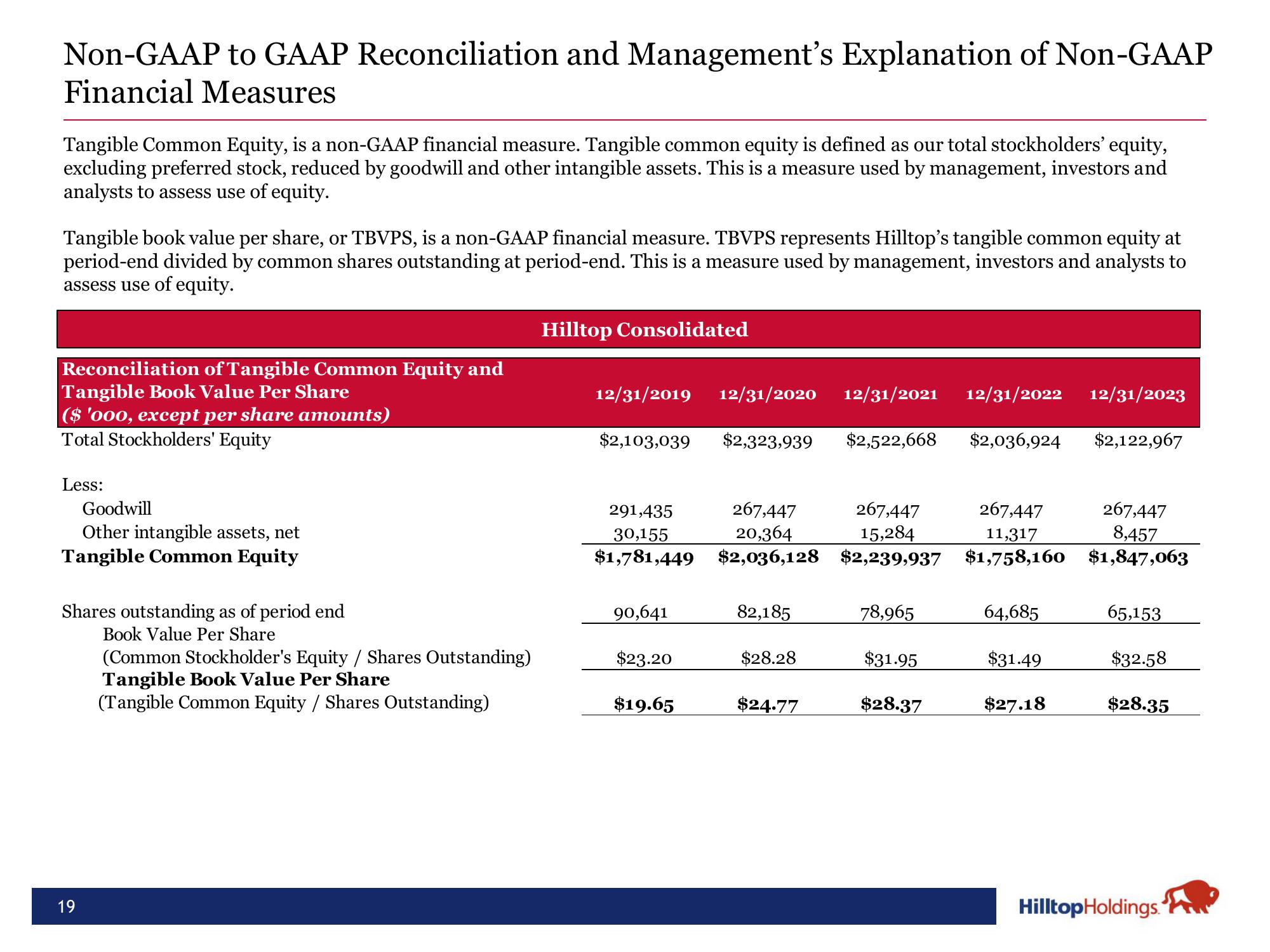

Tangible Common Equity, is a non-GAAP financial measure. Tangible common equity is defined as our total stockholders' equity,

excluding preferred stock, reduced by goodwill and other intangible assets. This is a measure used by management, investors and

analysts to assess use of equity.

Tangible book value per share, or TBVPS, is a non-GAAP financial measure. TBVPS represents Hilltop's tangible common equity at

period-end divided by common shares outstanding at period-end. This is a measure used by management, investors and analysts to

assess use of equity.

Reconciliation of Tangible Common Equity and

Tangible Book Value Per Share

($ '000, except per share amounts)

Total Stockholders' Equity

Less:

Goodwill

Other intangible assets, net

Tangible Common Equity

Shares outstanding as of period end

Book Value Per Share

19

(Common Stockholder's Equity / Shares Outstanding)

Tangible Book Value Per Share

(Tangible Common Equity / Shares Outstanding)

Hilltop Consolidated

12/31/2019 12/31/2020 12/31/2021 12/31/2022 12/31/2023

$2,103,039 $2,323,939 $2,522,668 $2,036,924

$2,122,967

291,435

267,447

267,447

267,447

15,284

20,364

11,317

30,155

$1,781,449 $2,036,128 $2,239,937 $1,758,160

90,641

$23.20

$19.65

82,185

$28.28

$24.77

78,965

$31.95

$28.37

64,685

$31.49

$27.18

267,447

8,457

$1,847,063

65,153

$32.58

$28.35

Hilltop Holdings.View entire presentation