Netstreit Investor Presentation Deck

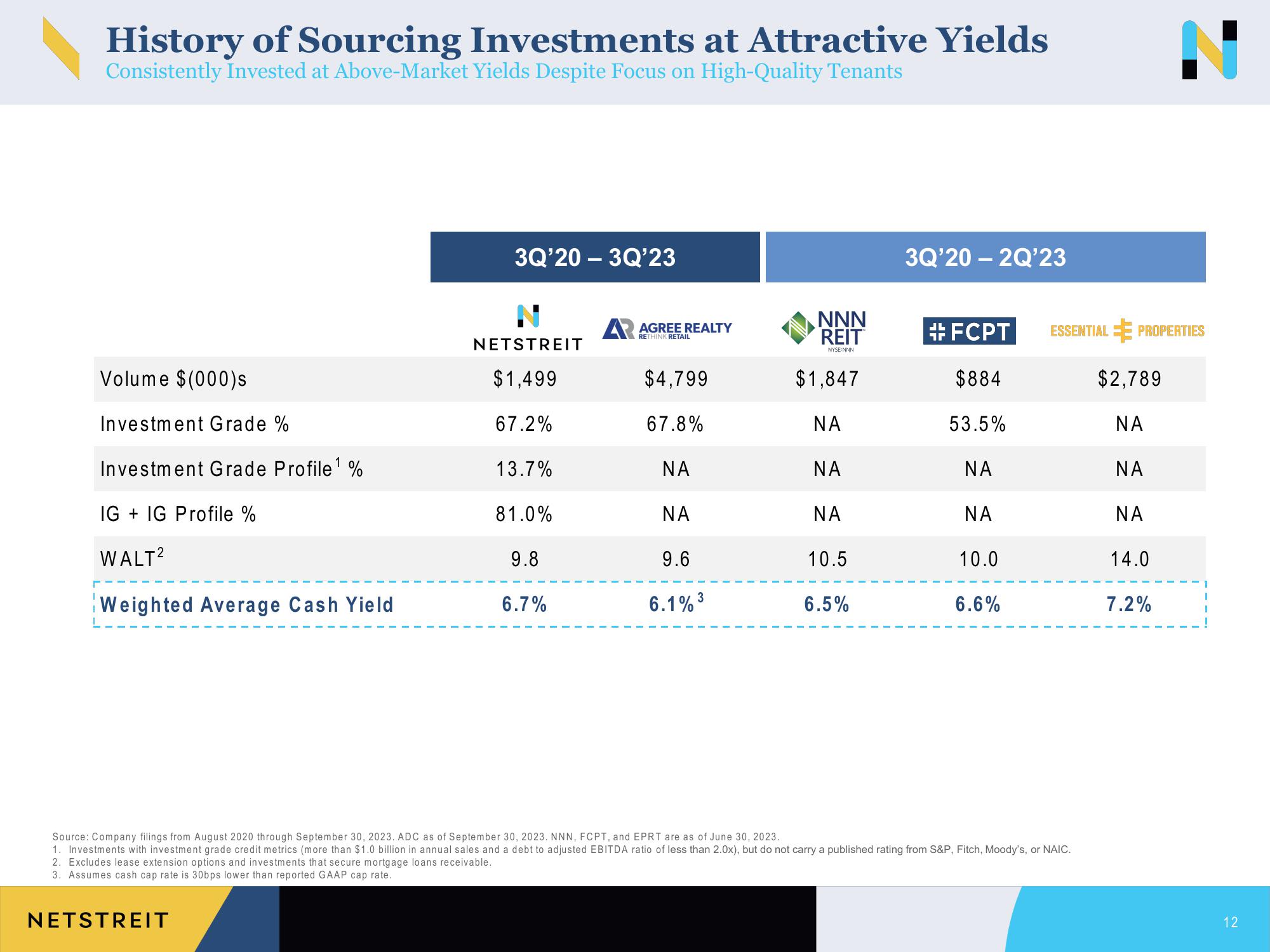

History of Sourcing Investments at Attractive Yields

Consistently Invested at Above-Market Yields Despite Focus on High-Quality Tenants

Volume $(000)s

Investment Grade %

Investment Grade Profile ¹ %

IG IG Profile %

WALT²

Weighted Average Cash Yield

3Q'20 - 3Q'23

NETSTREIT

NETSTREIT

$1,499

67.2%

13.7%

81.0%

9.8

6.7%

AR AGREE REALTY

RETHINK RETAIL

$4,799

67.8%

ΝΑ

ΝΑ

9.6

3

6.1% ³

NNN

REIT

NYSE:NNN

$1,847

ΝΑ

ΝΑ

ΝΑ

10.5

6.5%

3Q'20-2Q'23

#FCPT

$884

53.5%

ΝΑ

ΝΑ

10.0

6.6%

ESSENTIAL PROPERTIES

Source: Company filings from August 2020 through September 30, 2023. ADC as of September 30, 2023. NNN, FCPT, and EPRT are as of June 30, 2023.

1. Investments with investment grade credit metrics (more than $1.0 billion in annual sales and a debt to adjusted EBITDA ratio of less than 2.0x), but do not carry a published rating from S&P, Fitch, Moody's, or NAIC.

2. Excludes lease extension options and investments that secure mortgage loans receivable.

3. Assumes cash cap rate is 30bps lower than reported GAAP cap rate.

$2,789

ΝΑ

ΝΑ

ΝΑ

14.0

7.2%

12View entire presentation