Presto SPAC Presentation Deck

Transaction Detail

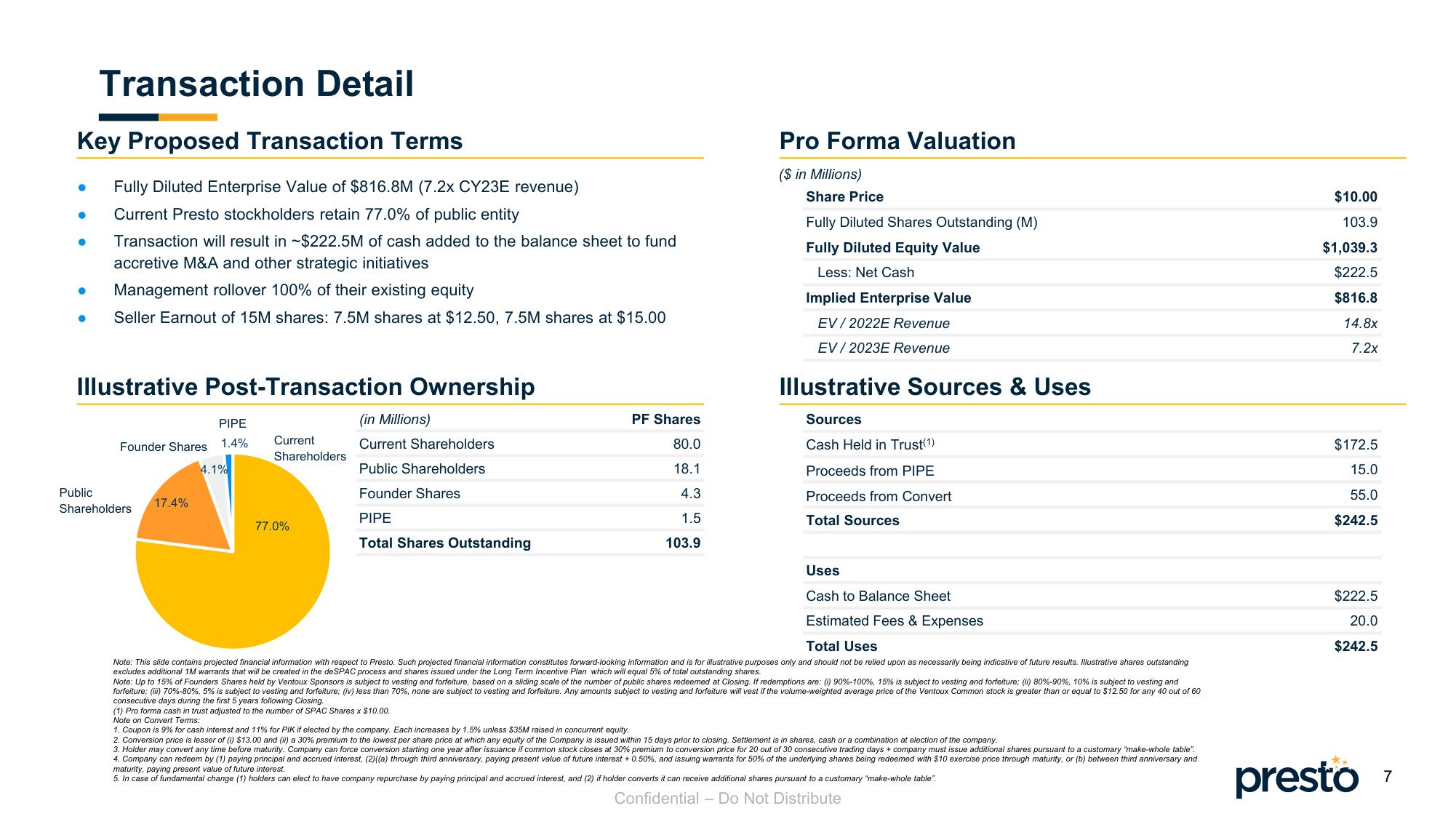

Key Proposed Transaction Terms

● Fully Diluted Enterprise Value of $816.8M (7.2x CY23E revenue)

● Current Presto stockholders retain 77.0% of public entity

Transaction will result in ~$222.5M of cash added to the balance sheet to fund

accretive M&A and other strategic initiatives

● Management rollover 100% of their existing equity

Seller Earnout of 15M shares: 7.5M shares at $12.50, 7.5M shares at $15.00

●

●

Illustrative Post-Transaction Ownership

Current

Shareholders

Founder Shares

Public

Shareholders

17.4%

PIPE

1.4%

4.1%

77.0%

(in Millions)

Current Shareholders

Public Shareholders

Founder Shares

PIPE

Total Shares Outstanding

PF Shares

80.0

18.1

4.3

1.5

103.9

Pro Forma Valuation

($ in Millions)

Share Price

Fully Diluted Shares Outstanding (M)

Fully Diluted Equity Value

Less: Net Cash

Implied Enterprise Value

EV/2022E Revenue

EV/2023E Revenue

Illustrative Sources & Uses

Sources

Cash Held in Trust(1)

Proceeds from PIPE

Proceeds from Convert

Total Sources

Uses

Cash to Balance Sheet

Estimated Fees & Expenses

Total Uses

Note: This slide contains projected financial information with respecti Presto. Such projected financial information constitutes forward-looking information and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. Illustrative shares outstanding

excludes additional 1M warrants that will be created in the deSPAC process and shares issued under the Long Term Incentive Plan which will equal 5% of total outstanding shares.

Note: Up to 15% of Founders Shares held by Ventoux Sponsors is subject to vesting and forfeiture, based on a sliding scale of the number of public shares redeemed Closing. If redemptions are: (i) 90%-100%, 15% is subject to vesting and forfeiture; (ii) 80%-90%, 10% is subject to vesting and

forfeiture; (iii) 70%-80%, 5% is subject to vesting and forfeiture; (iv) less than 70%, none are subject to vesting and forfeiture. Any amounts subject to vesting and forfeiture will vest if the volume-weighted average price of the Ventoux Common stock is greater than or equal to $12.50 for any 40 out of 60

consecutive days during the first 5 years following Closing.

(1) Pro forma cash in trust adjusted to the number of SPAC Shares x $10.00.

Note on Convert Terms:

1. Coupon is 9% for cash interest and 11% for PIK if elected by the company. Each increases by 1.5% unless $35M raised in concurrent equity.

2. Conversion price is lesser of (i) $13.00 and (ii) a 30% premium to the lowest per share price at which any equity of the Company is issued within 15 days prior to closing. Settlement is in shares, cash or a combination at election of the company.

3. Holder may convert any time before maturity. Company can force conversion starting one year after issuance if common stock closes at 30% premium to conversion price for 20 out of 30 consecutive trading days + company must issue additional shares pursuant to a customary "make-whole table".

4. Company can redeem by (1) paying principal and accrued interest, (2) ((a) through third anniversary, paying present value of future interest + 0.50%, and issuing warrants for 50% of the underlying shares being redeemed with $10 exercise price through maturity, or (b) between third anniversary and

maturity, paying present value of future interest.

5. In case of fundamental change (1) holders can elect to have company repurchase by paying principal and accrued interest, and (2) if holder converts it can receive additional shares pursuant to a customary "make-whole table".

Confidential - Do Not Distribute

$10.00

103.9

$1,039.3

$222.5

$816.8

14.8x

7.2x

$172.5

15.0

55.0

$242.5

$222.5

20.0

$242.5

presto

7View entire presentation