EVE SPAC Presentation Deck

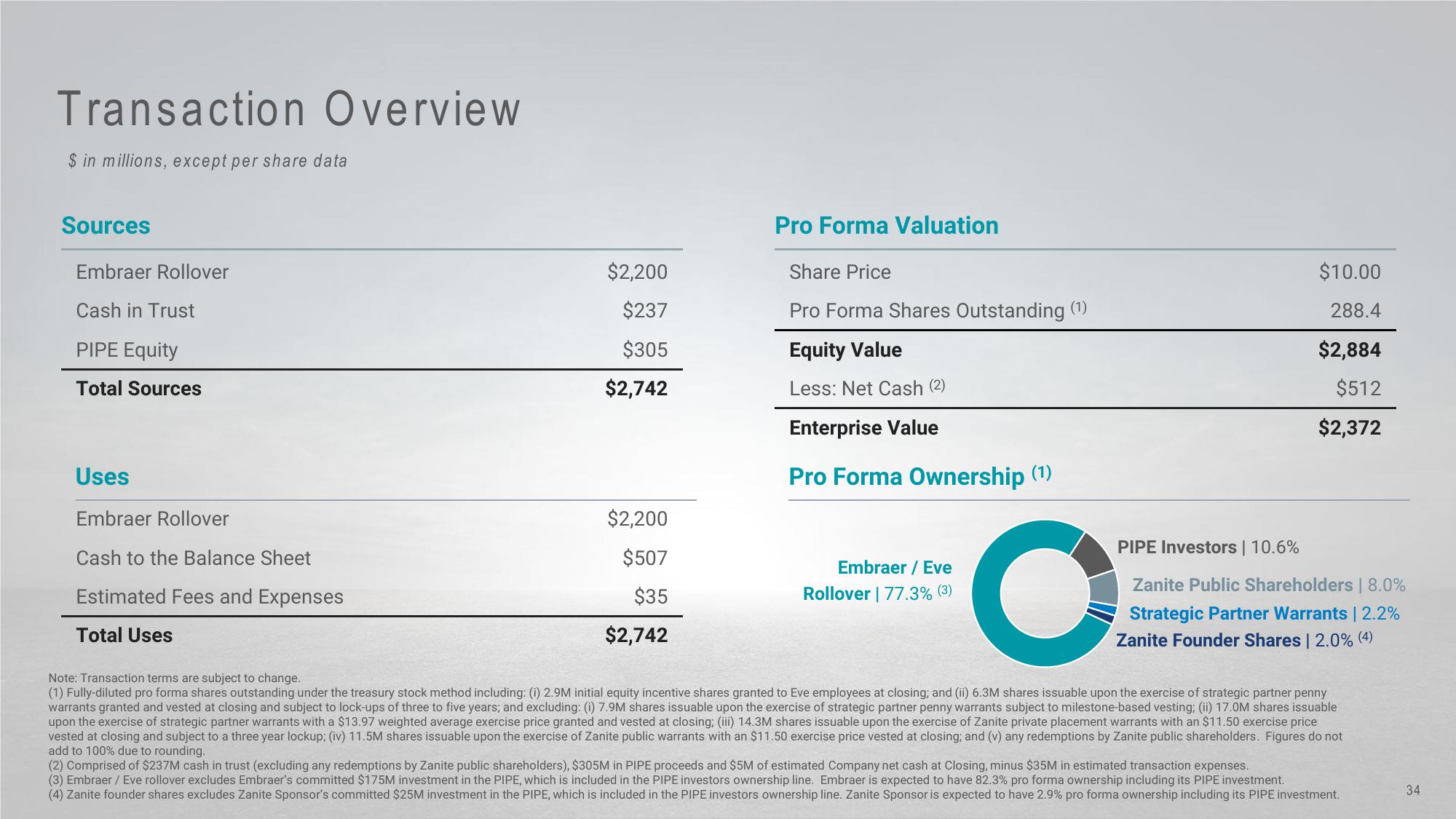

Transaction Overview

$ in millions, except per share data

Sources

Embraer Rollover

Cash in Trust

PIPE Equity

Total Sources

Uses

Embraer Rollover

Cash to the Balance Sheet

Estimated Fees and Expenses

Total Uses

$2,200

$237

$305

$2,742

$2,200

$507

$35

$2,742

Pro Forma Valuation

Share Price

Pro Forma Shares Outstanding (1)

Equity Value

Less: Net Cash (2)

Enterprise Value

Pro Forma Ownership (1)

Embraer / Eve

Rollover | 77.3% (3)

O

PIPE Investors | 10.6%

$10.00

288.4

$2,884

$512

$2,372

Zanite Public Shareholders | 8.0%

Strategic Partner Warrants | 2.2%

Zanite Founder Shares | 2.0% (4)

Note: Transaction terms are subject to change.

(1) Fully-diluted pro forma shares outstanding under the treasury stock method including: (i) 2.9M initial equity incentive shares granted to Eve employees at closing; and (ii) 6.3M shares issuable upon the exercise of strategic partner penny

warrants granted and vested at closing and subject to lock-ups of three to five years; and excluding: (i) 7.9M shares issuable upon the exercise of strategic partner penny warrants subject to milestone-based vesting; (ii) 17.0M shares issuable

upon the exercise of strategic partner warrants with a $13.97 weighted average exercise price granted and vested at closing; (iii) 14.3M shares issuable upon the exercise of Zanite private placement warrants with an $11.50 exercise price

vested at closing and subject to a three year lockup; (iv) 11.5M shares issuable upon the exercise of Zanite public warrants with an $11.50 exercise price vested at closing; and (v) any redemptions by Zanite public shareholders. Figures do not

add to 100% due to rounding.

(2) Comprised of $237M cash in trust (excluding any redemptions by Zanite public shareholders), $305M in PIPE proceeds and $5M of estimated Company net cash at Closing, minus $35M in estimated transaction expenses.

(3) Embraer / Eve rollover excludes Embraer's committed $175M investment in the PIPE, which is included in the PIPE investors ownership line. Embraer is expected to have 82.3% pro forma ownership including its PIPE investment.

(4) Zanite founder shares excludes Zanite Sponsor's committed $25M investment in the PIPE, which is included in the PIPE investors ownership line. Zanite Sponsor is expected to have 2.9% pro forma ownership including its PIPE investment.

34View entire presentation