MP Materials Investor Conference Presentation Deck

Reconciliation

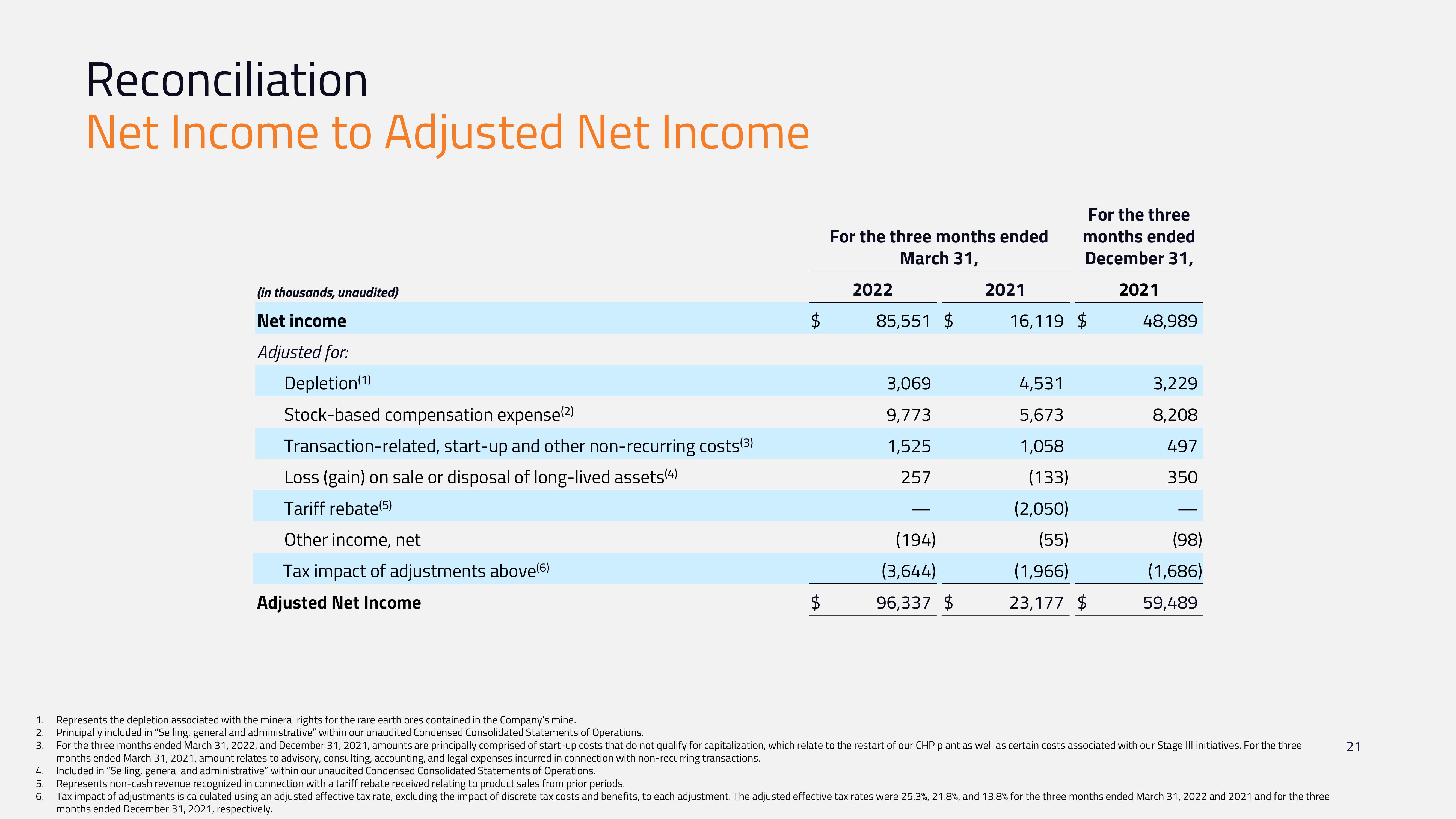

Net Income to Adjusted Net Income

1.

2.

3.

(in thousands, unaudited)

Net income

Adjusted for:

Depletion (¹)

Stock-based compensation expense(²)

Transaction-related, start-up and other non-recurring costs (3)

Loss (gain) on sale or disposal of long-lived assets(4)

Tariff rebate (5)

Other income, net

Tax impact of adjustments above(6)

Adjusted Net Income

$

For the three months ended

March 31,

2022

85,551 $

3,069

9,773

1,525

257

(194)

(3,644)

96,337 $

2021

For the three

months ended

December 31,

2021

16,119 $

4,531

5,673

1,058

(133)

(2,050)

(55)

(1,966)

23,177 $

48,989

3,229

8,208

497

350

(98)

(1,686)

59,489

Represents the depletion associated with the mineral rights for the rare earth ores contained in the Company's mine.

Principally included in "Selling, general and administrative" within our unaudited Condensed Consolidated Statements of Operations.

For the three months ended March 31, 2022, and December 31, 2021, amounts are principally comprised of start-up costs that do not qualify for capitalization, which relate to the restart of our CHP plant as well as certain costs associated with our Stage III initiatives. For the three

months ended March 31, 2021, amount relates to advisory, consulting, accounting, and legal expenses incurred in connection with non-recurring transactions.

4. Included in "Selling, general and administrative" within our unaudited Condensed Consolidated Statements of Operations.

5. Represents non-cash revenue recognized in connection with a tariff rebate received relating to product sales from prior periods.

6. Tax impact of adjustments is calculated using an adjusted effective tax rate, excluding the impact of discrete tax costs and benefits, to each adjustment. The adjusted effective tax rates were 25.3%, 21.8%, and 13.8% for the three months ended March 31, 2022 and 2021 and for the three

months ended December 31, 2021, respectively.

21View entire presentation