Credit Suisse Investment Banking Pitch Book

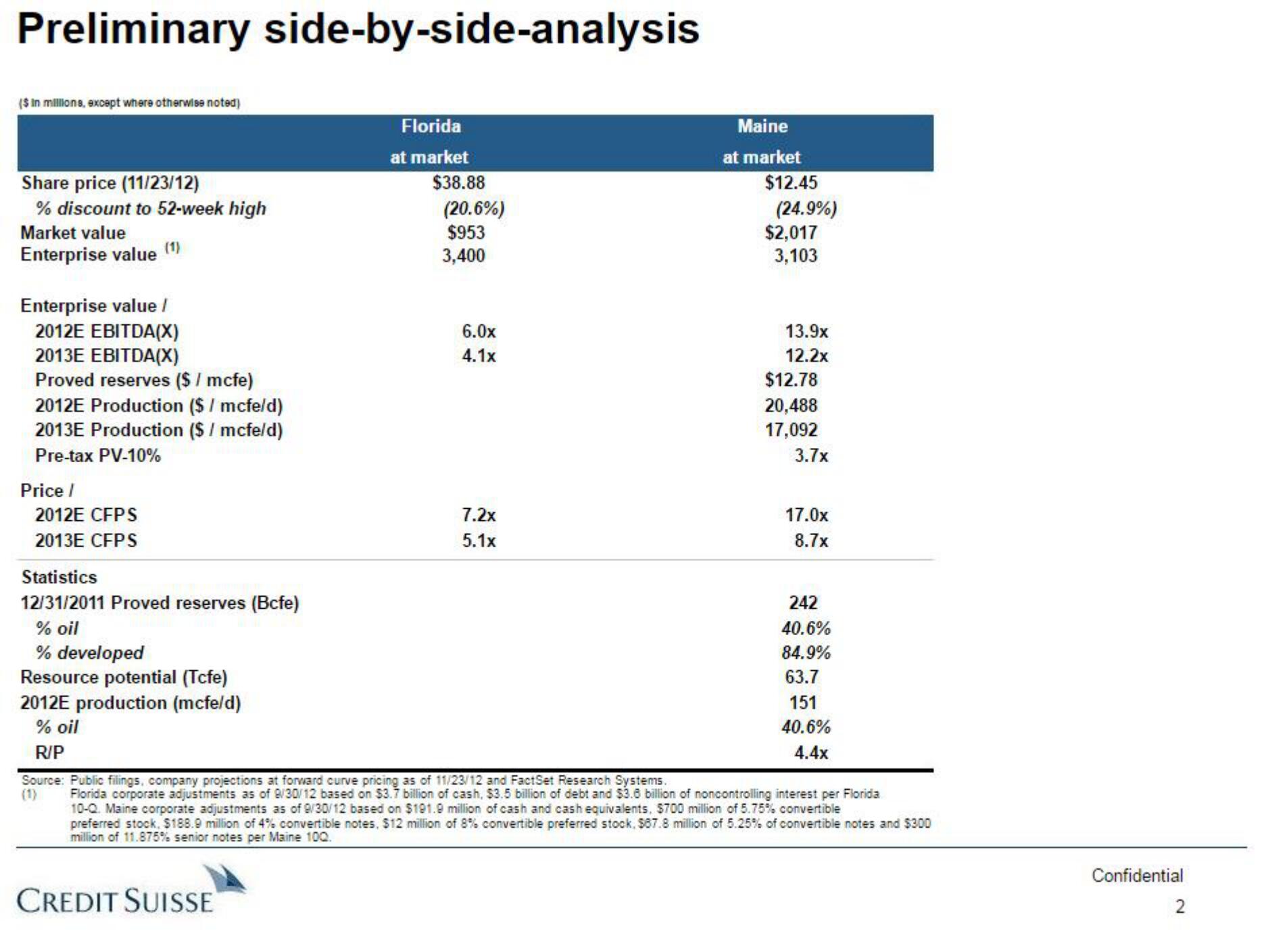

Preliminary side-by-side-analysis

($ in millions, except where otherwise noted)

Share price (11/23/12)

% discount to 52-week high

Market value

Enterprise value (1)

Enterprise value /

2012E EBITDA(X)

2013E EBITDA(X)

Proved reserves ($ / mcfe)

2012E Production ($ / mcfe/d)

2013E Production ($/mcfe/d)

Pre-tax PV-10%

Price /

2012E CFPS

2013E CFPS

Statistics

12/31/2011 Proved reserves (Bcfe)

% oil

% developed

Resource potential (Tcfe)

2012E production (mcfe/d)

% oil

R/P

Florida

at market

$38.88

(20.6%)

$953

3,400

6.0x

4.1x

7.2x

5.1x

Maine

at market

$12.45

(24.9%)

$2,017

3,103

13.9x

12.2x

$12.78

20,488

17,092

3.7x

17.0x

8.7x

242

40.6%

84.9%

63.7

151

40.6%

4.4x

Source: Public filings, company projections at forward curve pricing as of 11/23/12 and FactSet Research Systems.

Florida corporate adjustments as of 9/30/12 based on $3.7 billion of cash, $3.5 billion of debt and $3.6 billion of noncontrolling interest per Florida

10-Q. Maine corporate adjustments as of 9/30/12 based on $191.9 million of cash and cash equivalents, $700 million of 5.75% convertible

preferred stock, $188.9 million of 4% convertible notes, $12 million of 8% convertible preferred stock, $87.8 million of 5.25% of convertible notes and $300

million of 11.875% senior notes per Maine 100.

CREDIT SUISSE

Confidential

2View entire presentation