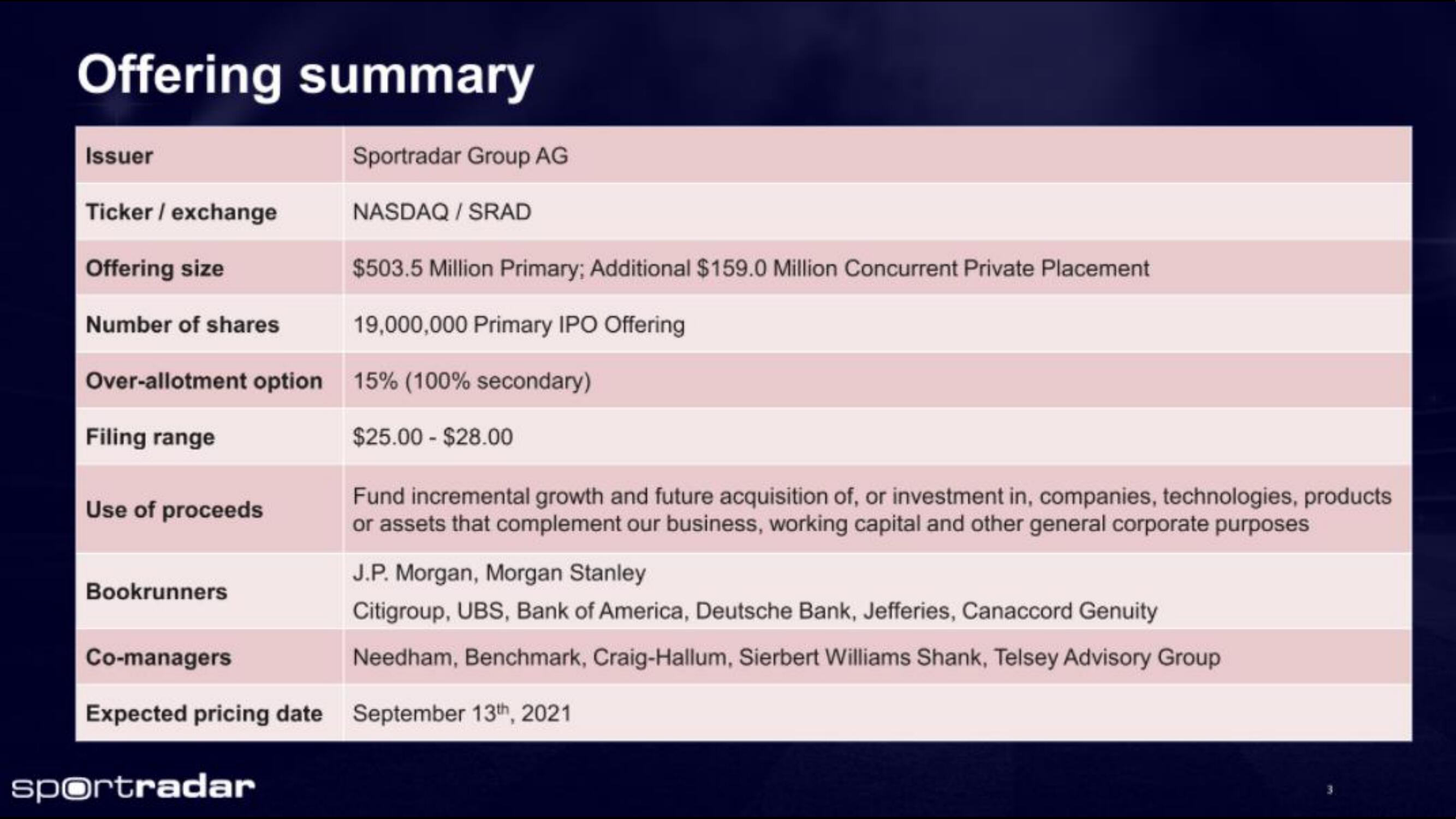

Sportradar IPO Presentation Deck

Offering summary

Sportradar Group AG

NASDAQ / SRAD

Issuer

Ticker / exchange

Offering size

Number of shares

Over-allotment option 15% (100% secondary)

Filing range

$25.00 $28.00

Use of proceeds

Bookrunners

$503.5 Million Primary; Additional $159.0 Million Concurrent Private Placement

19,000,000 Primary IPO Offering

sportradar

Fund incremental growth and future acquisition of, or investment in, companies, technologies, products

or assets that complement our business, working capital and other general corporate purposes

J.P. Morgan, Morgan Stanley

Citigroup, UBS, Bank of America, Deutsche Bank, Jefferies, Canaccord Genuity

Needham, Benchmark, Craig-Hallum, Sierbert Williams Shank, Telsey Advisory Group

Co-managers

Expected pricing date September 13th, 2021View entire presentation