Kore SPAC Presentation Deck

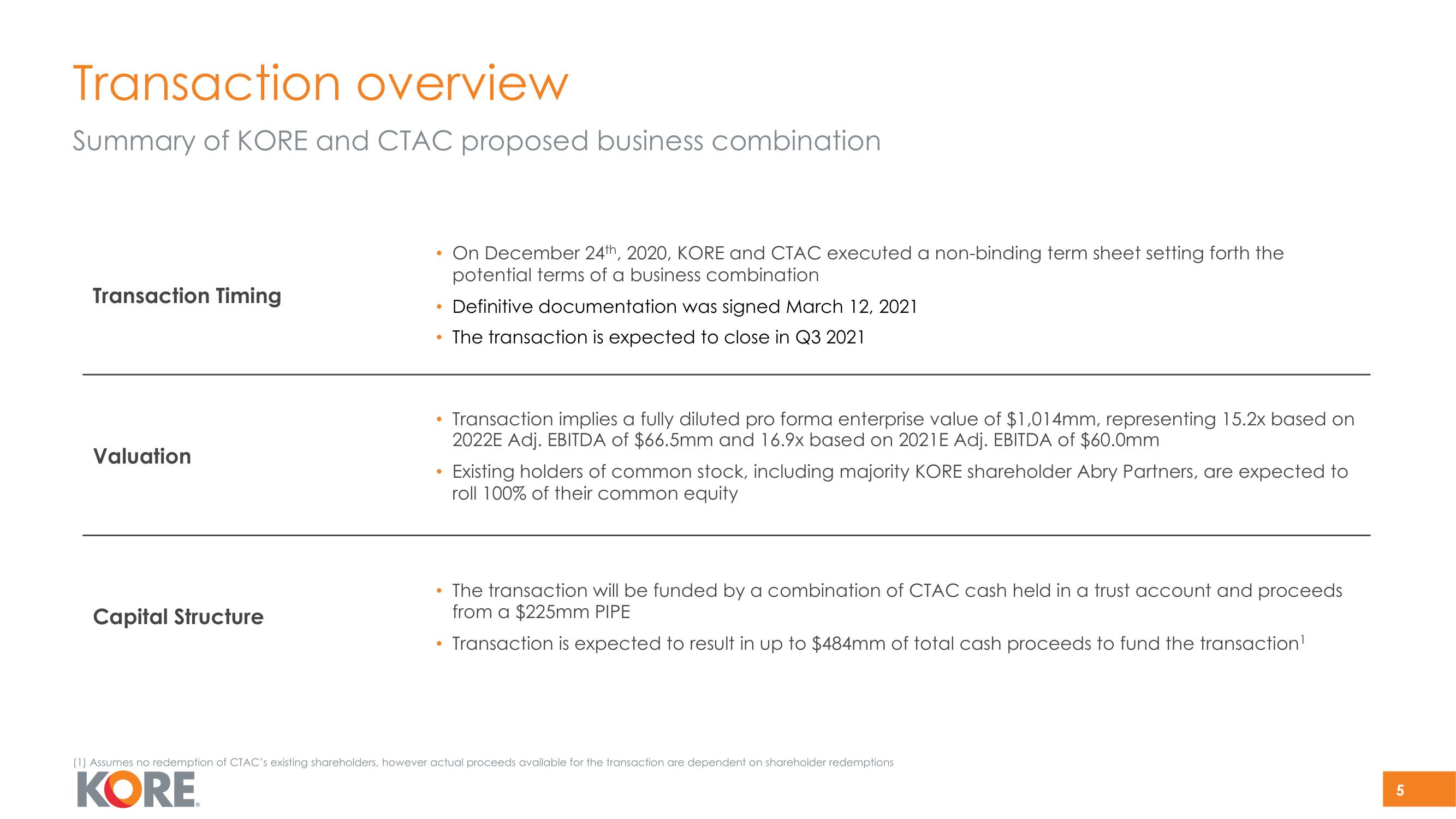

Transaction overview

Summary of KORE and CTAC proposed business combination

Transaction Timing

Valuation

Capital Structure

●

●

●

On December 24th, 2020, KORE and CTAC executed a non-binding term sheet setting forth the

potential terms of a business combination

Definitive documentation was signed March 12, 2021

The transaction is expected to close in Q3 2021

Transaction implies a fully diluted pro forma enterprise value of $1,014mm, representing 15.2x based on

2022E Adj. EBITDA of $66.5mm and 16.9x based on 2021E Adj. EBITDA of $60.0mm

Existing holders of common stock, including majority KORE shareholder Abry Partners, are expected to

roll 100% of their common equity

The transaction will be funded by a combination of CTAC cash held in a trust account and proceeds

from a $225mm PIPE

Transaction is expected to result in up to $484mm of total cash proceeds to fund the transaction¹

(1) Assumes no redemption of CTAC's existing shareholders, however actual proceeds available for the transaction are dependent on shareholder redemptions

KORE

5View entire presentation