KKR Real Estate Finance Trust Investor Presentation Deck

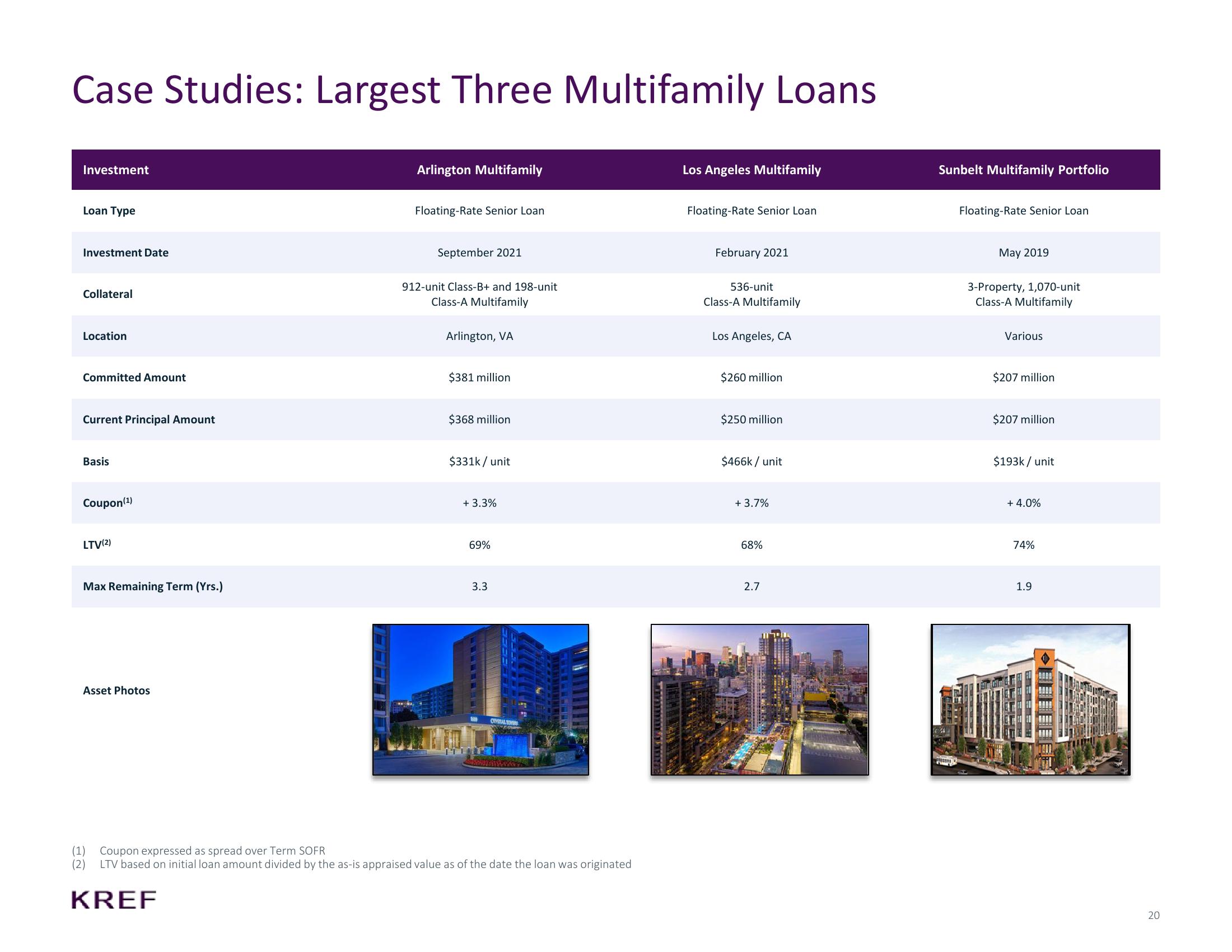

Case Studies: Largest Three Multifamily Loans

Investment

Loan Type

Investment Date

Collateral

Location

Committed Amount

Current Principal Amount

Basis

Coupon (¹)

LTV(2)

Max Remaining Term (Yrs.)

Asset Photos

Arlington Multifamily

Floating-Rate Senior Loan

September 2021

912-unit Class-B+ and 198-unit

Class-A Multifamily

Arlington, VA

$381 million.

$368 million

$331k/ unit

+ 3.3%

69%

3.3

OSTAL TOW

(1) Coupon expressed as spread over Term SOFR

(2)

LTV based on initial loan amount divided by the as-is appraised value as of the date the loan was originated

KREF

Los Angeles Multifamily

Floating-Rate Senior Loan

February 2021

536-unit

Class-A Multifamily

Los Angeles, CA

$260 million.

$250 million

$466k/ unit

+ 3.7%

68%

2.7

Sunbelt Multifamily Portfolio

04

Floating-Rate Senior Loan

RET

May 2019

3-Property, 1,070-unit

Class-A Multifamily

Various

$207 million

$207 million

$193k / unit

+ 4.0%

74%

1.9

20View entire presentation