Coppersmith Presentation to Alere Inc Stockholders

PAGE 21 |

Capital Allocation: Poor Stewards of Capital

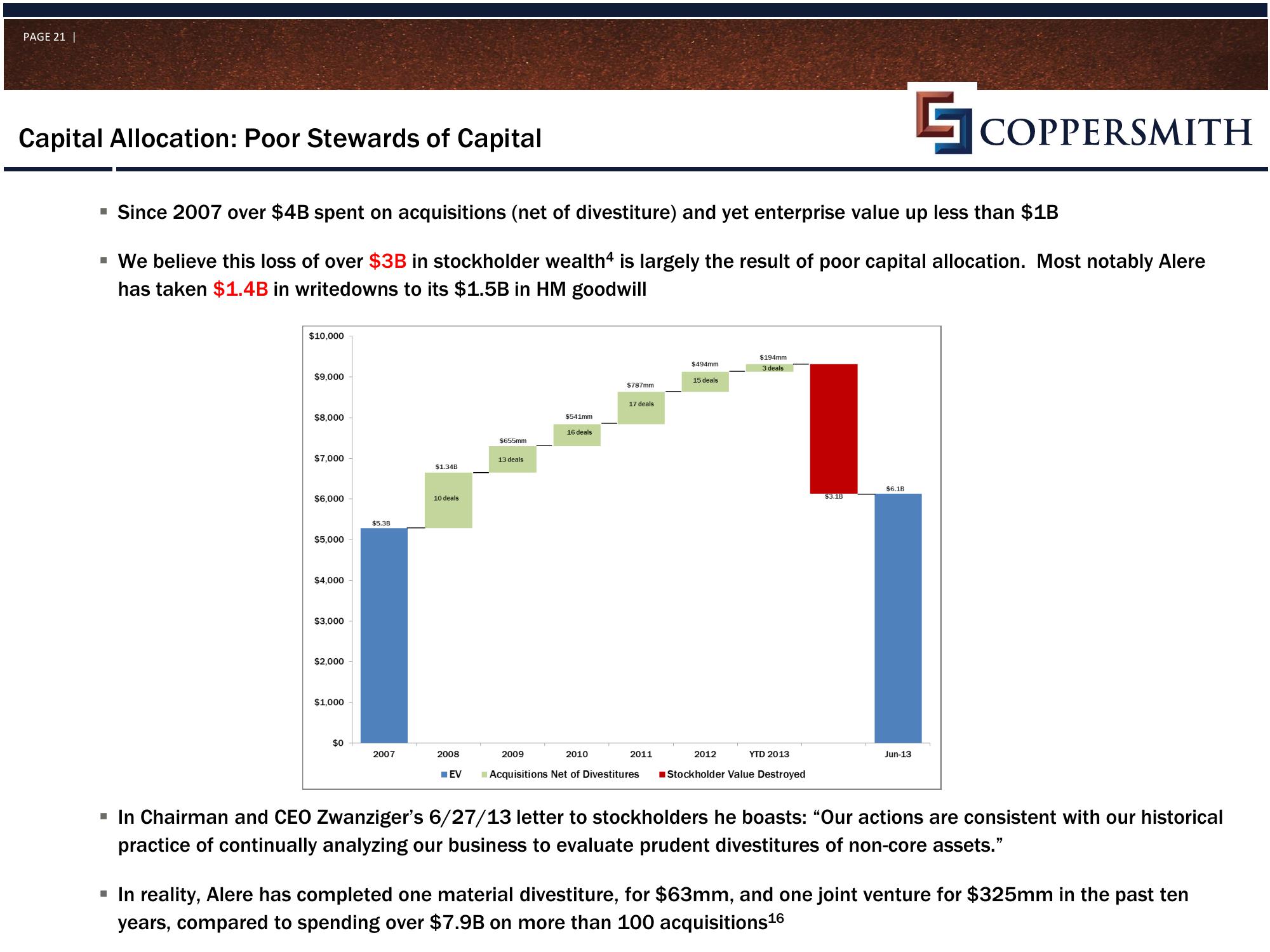

▪ Since 2007 over $4B spent on acquisitions (net of divestiture) and yet enterprise value up less than $1B

▪ We believe this loss of over $3B in stockholder wealth4 is largely the result of poor capital allocation. Most notably Alere

has taken $1.4B in writedowns to its $1.5B in HM goodwill

$10,000

$9,000

$8,000

$7,000

$6,000

$5,000

$4,000

$3,000

$2,000

$1,000

$0

$5.3B

2007

$1.34B

10 deals

2008

$655mm

13 deals

2009

$541mm

16 deals

2010

$787mm

17 deals

2011

■EV Acquisitions Net of Divestitures

$494mm

15 deals

$194mm

3 deals

2012

YTD 2013

Stockholder Value Destroyed

$3.18

$6.18

COPPERSMITH

Jun-13

Chairman and CEO Zwanziger's 6/27/13 letter to stoc holders he boasts: "Our actions are consistent with our historical

practice of continually analyzing our business to evaluate prudent divestitures of non-core assets."

▪ In reality, Alere has completed one material divestiture, for $63mm, and one joint venture for $325mm in the past ten

years, compared to spending over $7.9B on more than 100 acquisitions¹6View entire presentation