Flutter Results Presentation Deck

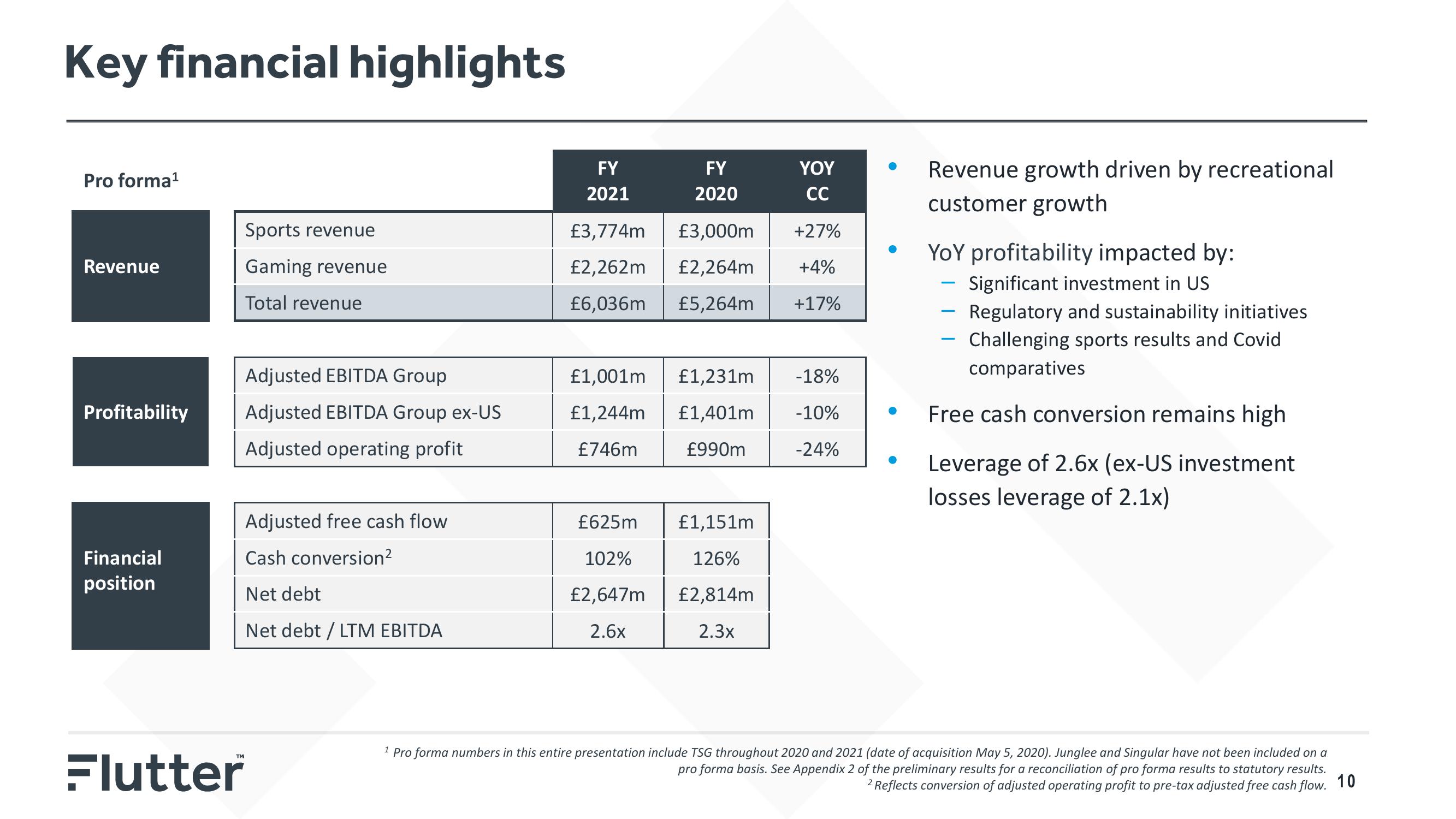

Key financial highlights

Pro forma¹

Revenue

Profitability

Financial

position

Flutter

Sports revenue

Gaming revenue

Total revenue

Adjusted EBITDA Group

Adjusted EBITDA Group ex-US

Adjusted operating profit

Adjusted free cash flow

Cash conversion²

Net debt

Net debt / LTM EBITDA

FY

2021

YOY

CC

£3,774m £3,000m

+27%

+4%

£2,262m £2,264m

£6,036m £5,264m +17%

FY

2020

£1,001m £1,231m

£1,244m

£1,401m

£990m

£746m

£625m

102%

£2,647m

2.6x

£1,151m

126%

£2,814m

2.3x

-18%

-10%

-24%

●

●

Revenue growth driven by recreational

customer growth

YoY profitability impacted by:

Significant investment in US

- Regulatory and sustainability initiatives

Challenging sports results and Covid

comparatives

Free cash conversion remains high

Leverage of 2.6x (ex-US investment

losses leverage of 2.1x)

¹ Pro forma numbers in this entire presentation include TSG throughout 2020 and 2021 (date of acquisition May 5, 2020). Junglee and Singular have not been included on a

pro forma basis. See Appendix 2 of the preliminary results for a reconciliation of pro forma results to statutory results.

2 Reflects conversion of adjusted operating profit to pre-tax adjusted free cash flow. 10View entire presentation