DigitalOcean Results Presentation Deck

ņ

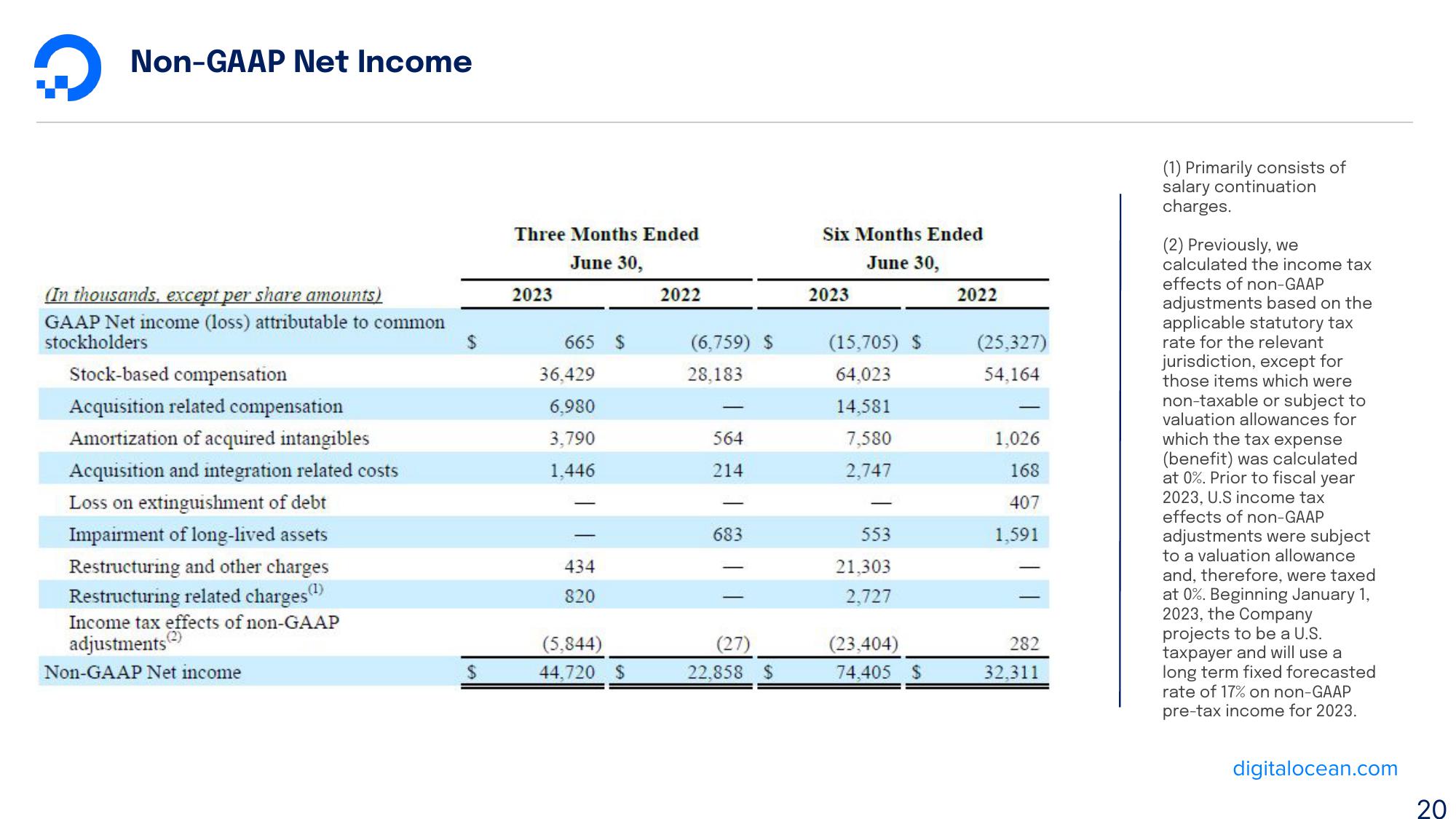

Non-GAAP Net Income

(In thousands, except per share amounts)

GAAP Net income (loss) attributable to common

stockholders

Stock-based compensation

Acquisition related compensation

Amortization of acquired intangibles

Acquisition and integration related costs

Loss on extinguishment of debt

Impairment of long-lived assets

Restructuring and other charges

Restructuring related charges(¹)

Income tax effects of non-GAAP

adjustments

Non-GAAP Net income

$

Three Months Ended

June 30,

2023

665 $

36,429

6,980

3,790

1,446

434

820

(5,844)

44,720 S

2022

(6,759) $

28,183

564

214

683

(27)

22,858 $

Six Months Ended

June 30,

2023

(15,705) $

64,023

14,581

7,580

2,747

553

21,303

2,727

(23,404)

74.405 $

2022

(25,327)

54,164

1,026

168

407

1,591

282

32,311

(1) Primarily consists of

salary continuation

charges.

(2) Previously, we

calculated the income tax

effects of non-GAAP

adjustments based on the

applicable statutory tax

rate for the relevant

jurisdiction, except for

those items which were

non-taxable or subject to

valuation allowances for

which the tax expense

(benefit) was calculated

at 0%. Prior to fiscal year

2023, U.S income tax

effects of non-GAAP

adjustments were subject

to a valuation allowance

and, therefore, were taxed

at 0%. Beginning January 1,

2023, the Company

projects to be a U.S.

taxpayer and will use a

long term fixed forecasted

rate of 17% on non-GAAP

pre-tax income for 2023.

digitalocean.com

20View entire presentation