HBT Financial Results Presentation Deck

Net Interest Margin

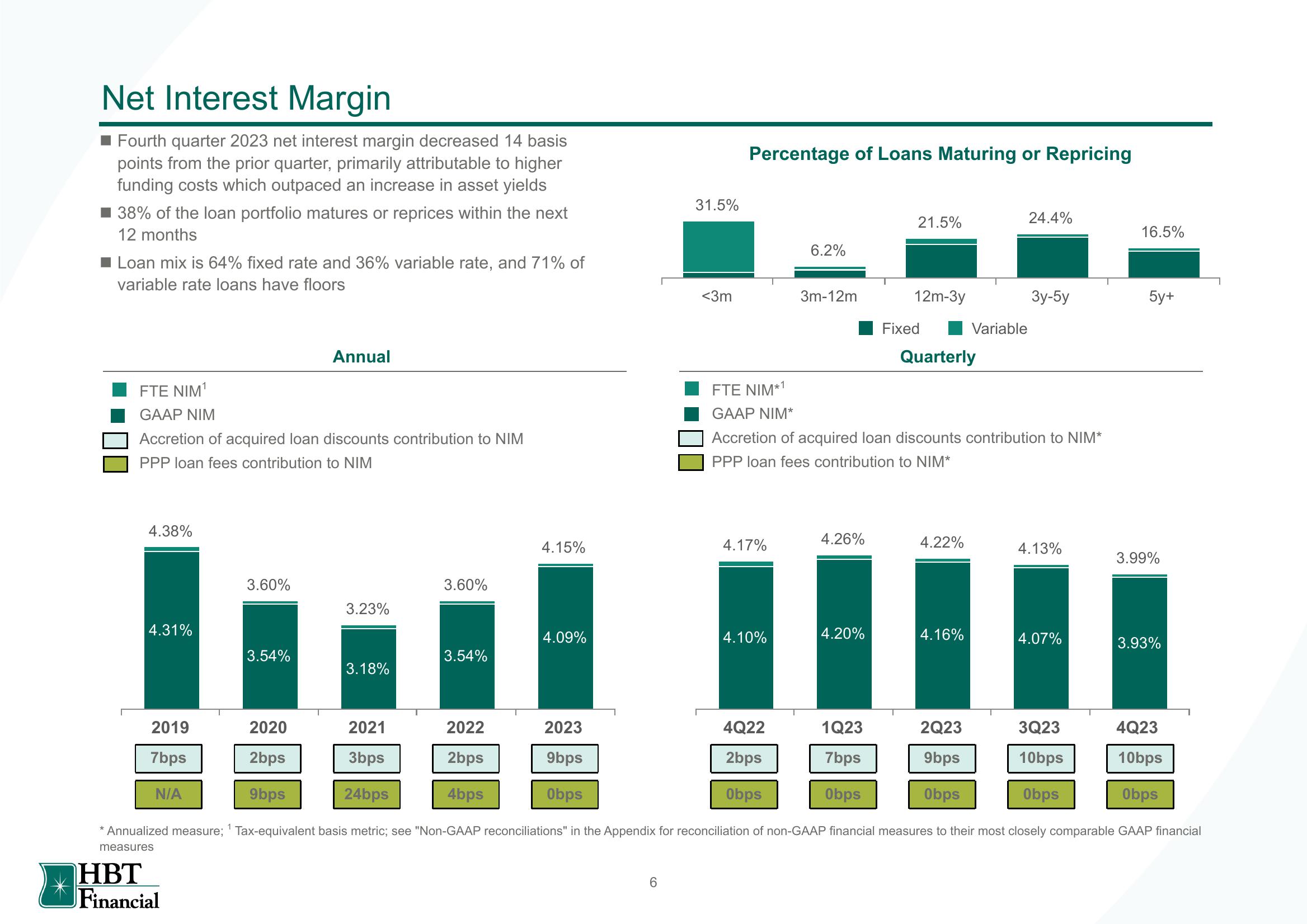

■ Fourth quarter 2023 net interest margin decreased 14 basis

points from the prior quarter, primarily attributable to higher

funding costs which outpaced an increase in asset yields

38% of the loan portfolio matures or reprices within the next

12 months

Loan mix is 64% fixed rate and 36% variable rate, and 71% of

variable rate loans have floors

FTE NIM¹

GAAP NIM

Accretion of acquired loan discounts contribution to NIM

PPP loan fees contribution to NIM

4.38%

4.31%

2019

7bps

N/A

3.60%

HBT

Financial

Annual

3.54%

3.23%

3.18%

3.60%

3.54%

4.15%

2022

2bps

4bps

4.09%

2023

9bps

Obps

31.5%

6

<3m

Percentage of Loans Maturing or Repricing

FTE NIM*1

GAAP NIM*

4.17%

4.10%

6.2%

3m-12m

4Q22

2bps

Obps

4.26%

21.5%

4.20%

12m-3y

Fixed

Accretion of acquired loan discounts contribution to NIM*

PPP loan fees contribution to NIM*

Quarterly

Variable

4.22%

4.16%

24.4%

3y-5y

4.13%

2020

2021

1Q23

2Q23

4Q23

2bps

3bps

7bps

9bps

10bps

9bps

24bps

Obps

Obps

Obps

* Annualized measure; ¹ Tax-equivalent basis metric; see "Non-GAAP reconciliations" in the Appendix for reconciliation of non-GAAP financial measures to their most closely comparable GAAP financial

measures

4.07%

16.5%

3Q23

10bps

Obps

5y+

3.99%

3.93%View entire presentation