GMS Investor Conference Presentation Deck

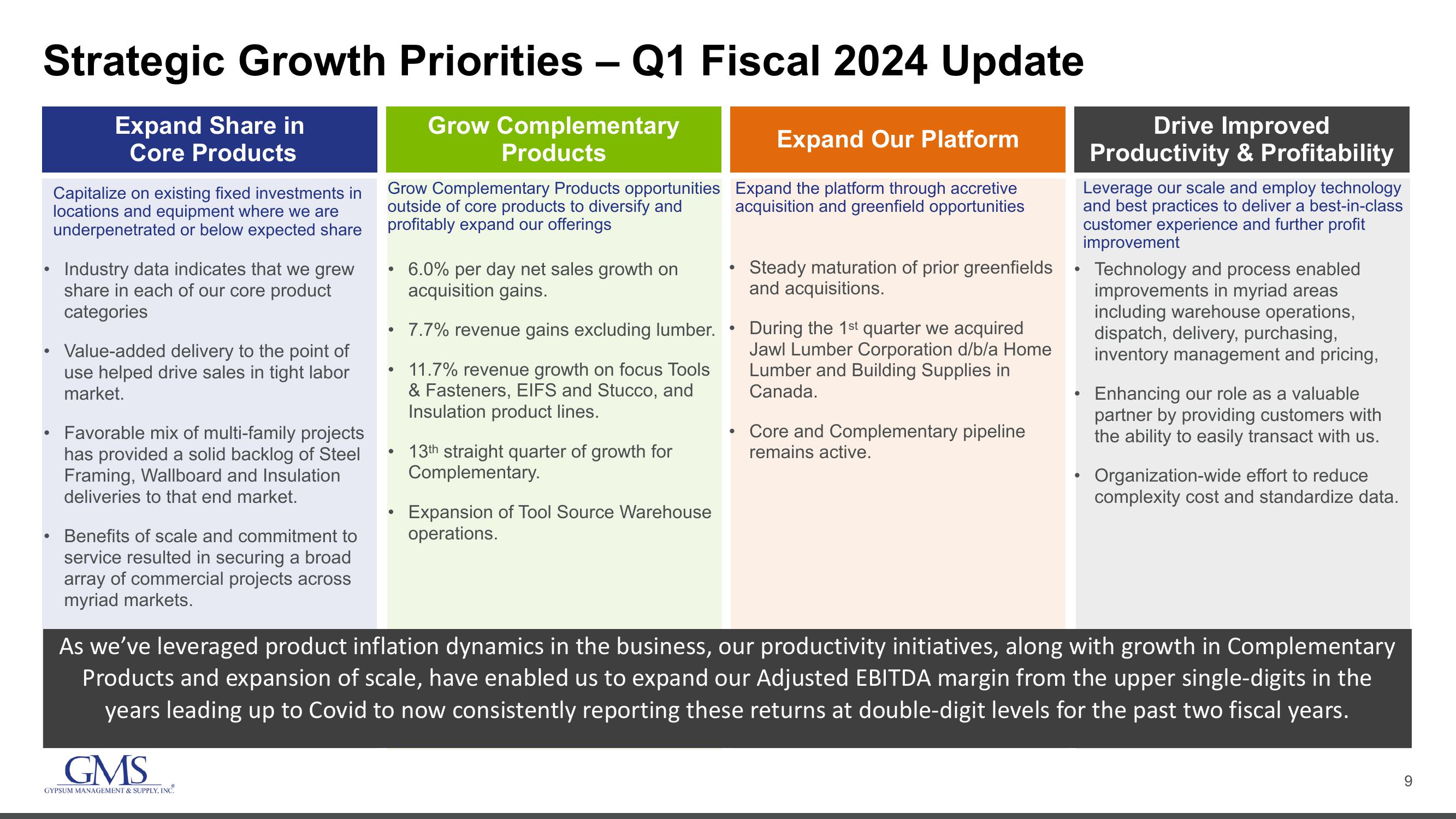

Strategic Growth Priorities - Q1 Fiscal 2024 Update

Expand Share in

Core Products

Grow Complementary

Products

●

●

Capitalize on existing fixed investments in

locations and equipment where we are

underpenetrated or below expected share

Industry data indicates that we grew

share in each of our core product

categories

Value-added delivery to the point of

use helped drive sales in tight labor

market.

Favorable mix of multi-family projects

has provided a solid backlog of Steel

Framing, Wallboard and Insulation

deliveries to that end market.

Benefits of scale and commitment to

service resulted in securing a broad

array of commercial projects across

myriad markets.

Grow Complementary Products opportunities

outside of core products to diversify and

profitably expand our offerings

GMS

GYPSUM MANAGEMENT & SUPPLY, INC.

6.0% per day net sales growth on

acquisition gains.

7.7% revenue gains excluding lumber.

11.7% revenue growth on focus Tools

& Fasteners, EIFS and Stucco, and

Insulation product lines.

13th straight quarter of growth for

Complementary.

Expansion of Tool Source Warehouse

operations.

Expand Our Platform

Expand the platform through accretive

acquisition and greenfield opportunities

Steady maturation of prior greenfields

and acquisitions.

During the 1st quarter we acquired

Jawl Lumber Corporation d/b/a Home

Lumber and Building Supplies in

Canada.

Core and Complementary pipeline

remains active.

Drive Improved

Productivity & Profitability

Leverage our scale and employ technology

and best practices to deliver a best-in-class

customer experience and further profit

improvement

Technology and process enabled

improvements in myriad areas

including warehouse operations,

dispatch, delivery, purchasing,

inventory management and pricing,

Enhancing our role as a valuable

partner by providing customers with

the ability to easily transact with us.

Organization-wide effort to reduce

complexity cost and standardize data.

As we've leveraged product inflation dynamics in the business, our productivity initiatives, along with growth in Complementary

Products and expansion of scale, have enabled us to expand our Adjusted EBITDA margin from the upper single-digits in the

years leading up to Covid to now consistently reporting these returns at double-digit levels for the past two fiscal years.

9View entire presentation