Payoneer SPAC Presentation Deck

Transaction Summary

Valuation

Capital Structure

Earnout Shares

4.

5.

6.

7.

12

.

10.

.

Key Highlights

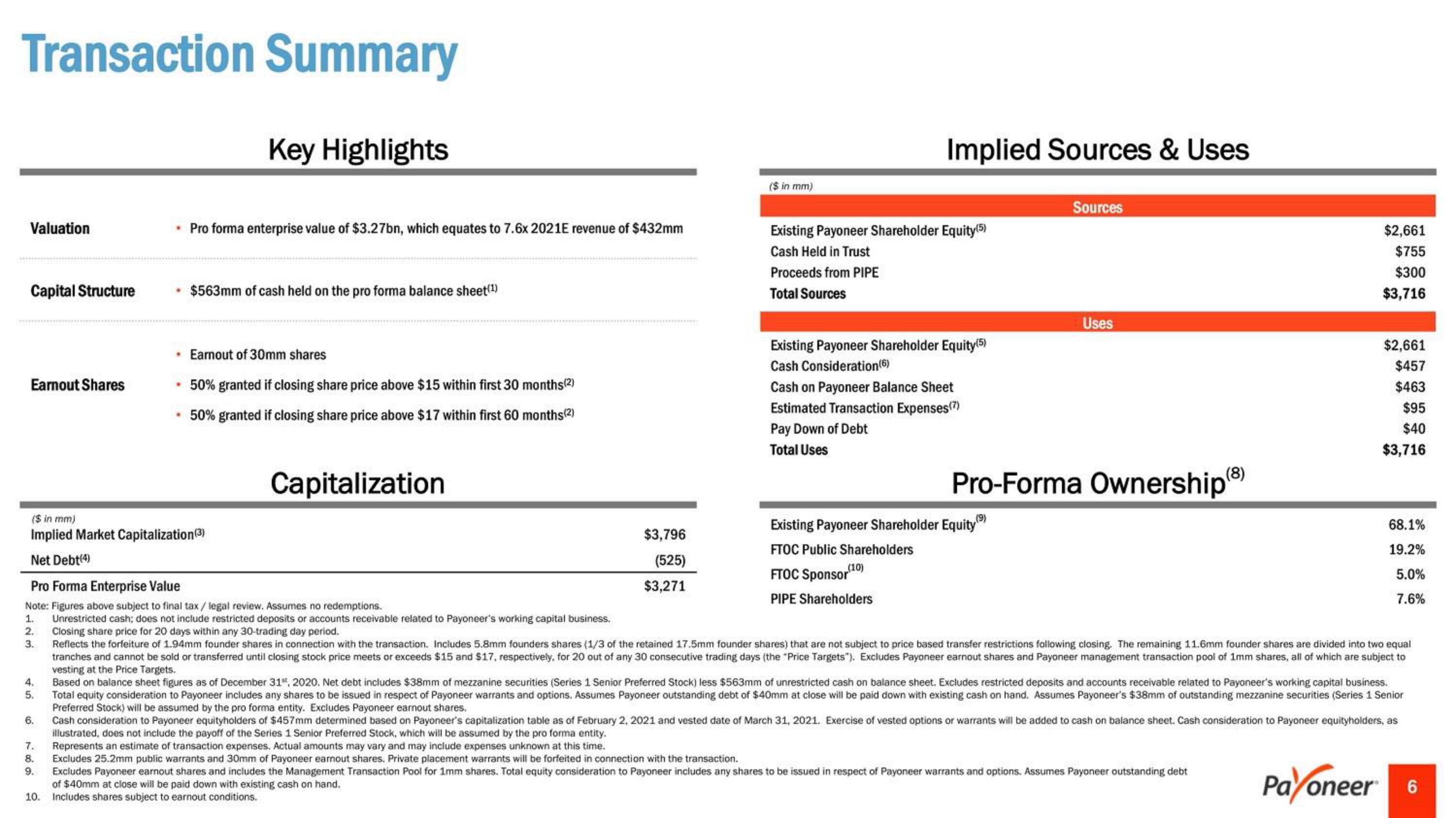

Pro forma enterprise value of $3.27bn, which equates to 7.6x 2021E revenue of $432mm

$563mm of cash held on the pro forma balance sheet(¹)

Earnout of 30mm shares

50% granted if closing share price above $15 within first 30 months(2)

50% granted if closing share price above $17 within first 60 months(2)

Capitalization

($ in mm)

$3,796

(525)

$3,271

Implied Sources & Uses

Existing Payoneer Shareholder Equity (5)

Cash Held in Trust

Proceeds from PIPE

Total Sources

Existing Payoneer Shareholder Equity (5)

Cash Consideration (6)

Cash on Payoneer Balance Sheet

Estimated Transaction Expenses(7)

Pay Down of Debt

Total Uses

($ in mm)

Implied Market Capitalization (3)

Net Debt(4)

Pro Forma Enterprise Value

Note: Figures above subject to final tax/legal review. Assumes no redemptions.

2.

3.

1. Unrestricted cash; does not include restricted deposits or accounts receivable related to Payoneer's working capital business.

Closing share price for 20 days within any 30-trading day period.

Reflects the forfeiture of 1.94mm founder shares in connection with the transaction. Includes 5.8mm founders shares (1/3 of the retained 17.5mm founder shares) that are not subject to price based transfer restrictions following closing. The remaining 11.6mm founder shares are divided into two equal

tranches and cannot be sold or transferred until closing stock price meets or exceeds $15 and $17, respectively, for 20 out of any 30 consecutive trading days (the "Price Targets"). Excludes Payoneer earnout shares and Payoneer management transaction pool of 1mm shares, all of which are subject to

vesting at the Price Targets.

Based on balance sheet figures as of December 31, 2020. Net debt includes $38mm of mezzanine securities (Series 1 Senior Preferred Stock) less $563mm of unrestricted cash on balance sheet. Excludes restricted deposits and accounts receivable related to Payoneer's working capital business.

Total equity consideration to Payoneer includes any shares to be issued in respect of Payoneer warrants and options. Assumes Payoneer outstanding debt of $40mm at close will be paid down with existing cash on hand. Assumes Payoneer's $38mm of outstanding mezzanine securities (Series 1 Senior

Preferred Stock) will be assumed by the pro forma entity. Excludes Payoneer earnout shares.

Cash consideration to Payoneer equityholders of $457mm determined based on Payoneer's capitalization table as of February 2, 2021 and vested date of March 31, 2021. Exercise of vested options or warrants will be added to cash on balance sheet. Cash consideration to Payoneer equityholders, as

illustrated, does not include the payoff of the Series 1 Senior Preferred Stock, which will be assumed by the pro forma entity.

Represents an estimate of transaction expenses. Actual amounts may vary and may include expenses unknown at this time.

8. Excludes 25.2mm public warrants and 30mm of Payoneer earnout shares. Private placement warrants will be forfeited in connection with the transaction.

9. Excludes Payoneer earnout shares and includes the Management Transaction Pool for 1mm shares. Total equity consideration to Payoneer includes any shares to be issued in respect of Payoneer warrants and options. Assumes Payoneer outstanding debt

of $40mm at close will be paid down with existing cash on hand.

Payoneer

Includes shares subject to earnout conditions.

(10)

Sources

Existing Payoneer Shareholder Equity

FTOC Public Shareholders

FTOC Sponsor

PIPE Shareholders

Uses

Pro-Forma Ownership(8)

$2,661

$755

$300

$3,716

$2,661

$457

$463

$95

$40

$3,716

68.1%

19.2%

5.0%

7.6%

6View entire presentation